Research Methodology on Frozen Sea-Food Market

Introduction

The published research methodology is designed to provide an understanding of the methodology used to conduct research for the report titled, “Frozen Sea Food Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2023-2030” conducted by Market Research Future (MRFR). It includes detailed information about the primary and secondary research sources, quantitative and qualitative analysis adopted for the research and analytical tools used for the in-depth analysis of the data.

Research Objectives

The primary objective of the research is to provide a comprehensive analysis of the Frozen Sea Food Market on a global level concerning various dynamics such as end-use industry, technology trends, market competition, and regional trends. The research is also designed to analyze market trends and their effect on the Frozen Sea Food Market, analyze market potentials and opportunities and provide a market forecast until the year 2030.

Research Design

The research methodology adopted to analyze and assess the Frozen Sea Food Market consists of a combination of both primary and secondary research. Primary research is conducted using surveys, interviews, and interviews with industry experts, while secondary or desk research is conducted using several sources, including company websites and databases, white papers, industry journals, and expert opinions. The primary objective of the research is to provide accurate and up-to-date information about the market by compiling and discussing various factors such as drivers, challenges, emerging trends, and company profiles.

Research Scope

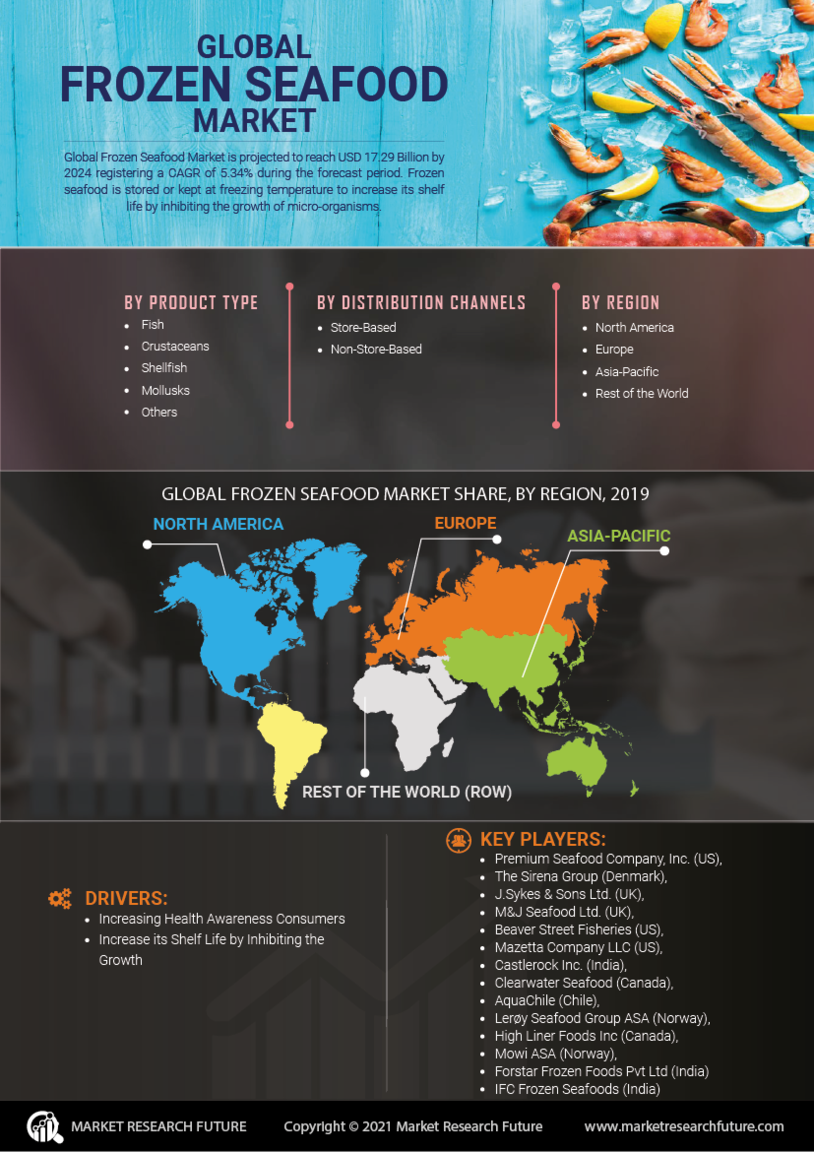

The research scope of the study is to analyze the data from various sources, including interviews, press releases, third-party reports, and industry experts. The research scope also includes the analysis of the Frozen Sea Food Market from different regions, types of frozen seafood, end-use applications, and end-user industries.

Research Sources

The research is conducted using primary and secondary research techniques. Primary research includes surveying industry experts with interviews and surveys, as well as conducting qualitative and quantitative interviews, while secondary research sources include company websites, databases, white papers, and industry journals, among others.

Databases Used

Various databases, such as the Bloomberg database, Categorized Canadian Trade Database, World Bank database, National Bureau of Statistics database, and European Union Trade database are used for the research.

Market Segmentation

The Frozen Sea Food Market is segmented based on type, end-use application, end-user industry, and region.

Finfish

Shellfish

Others

Processed Seafood

Value Added Seafood

Ready-to-Eat Seafood

Foodservice

Retail

Others

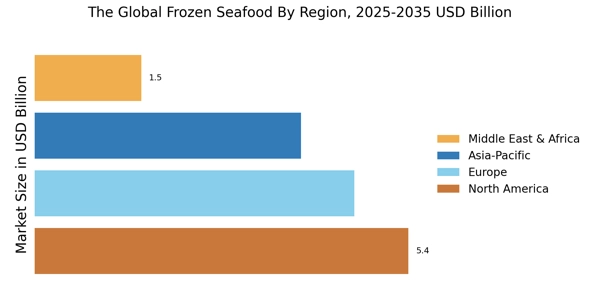

North America

Europe

Asia-Pacific

Rest of the World

Research Assumptions

The research involves making several assumptions on the growing demand for frozen seafood across different regions and industries, increasing health awareness, and increasing disposable incomes. It also assumes that the market is likely to reflect a positive CAGR during the forecast period 2023-2030.

Analytical Tools Used

Porter’s Five Forces Analysis

SWOT Analysis

PEST Analysis

Market Attractiveness Analysis

Quantitative Analysis

The quantitative aspect of the research uses various statistical tools and techniques for data analysis. These tools include an analysis of variance (ANOVA), factor analysis, structural equation modelling (SEM), multiple regression, and other general linear models (GLMs).

Data Interpretation and Visualization

Data interpretation and visualization are used to highlight key market dynamics and trends, as well as analyze the empirical evidence collected from various sources during the study. The data is presented in the form of tables, graphs, and charts.

Conclusion

The research methodology adopted to analyze the Frozen Sea Food Market aspires to gain precise insights into the market, which could be utilized to develop successful business strategies in the near future. The scope of the research involves primary and secondary research techniques, research scope, segmentation, research sources, databases used, analytical tools used, and other corresponding research activities. The research also includes several quantitative and qualitative methodologies to gain useful information from industry experts and third-party sources. MRFR is confident that this research methodology will provide in-depth and accurate insights into the Frozen Sea Food Market for the period 2023-2030.