The Audio Equipment Market in Europe is characterized by a dynamic competitive landscape, driven by innovation, consumer demand for high-quality sound, and the increasing integration of smart technologies. Major players such as Sony (JP), Bose (US), and Sennheiser (DE) are at the forefront, each adopting distinct strategies to enhance their market presence. Sony (JP) focuses on technological advancements, particularly in wireless audio solutions, while Bose (US) emphasizes premium sound quality and user experience. Sennheiser (DE), on the other hand, is known for its commitment to professional audio equipment, catering to both consumers and industry professionals. Collectively, these strategies contribute to a competitive environment that is both fragmented and concentrated, with a mix of established brands and emerging players vying for market share.

Key business tactics within the market include localizing manufacturing to reduce costs and optimize supply chains, which appears to be a common approach among leading companies. The competitive structure is moderately fragmented, with a few dominant players holding substantial market shares while numerous smaller firms cater to niche segments. This structure allows for a diverse range of products and innovations, fostering a competitive atmosphere that encourages continuous improvement and adaptation.

In November 2025, Bose (US) announced a strategic partnership with a leading tech firm to integrate AI capabilities into its audio products. This move is likely to enhance user personalization and improve sound quality through adaptive audio technology, positioning Bose as a frontrunner in the smart audio segment. Such partnerships may prove crucial in maintaining competitive advantage in an increasingly tech-driven market.

In December 2025, Sennheiser (DE) launched a new line of eco-friendly headphones, reflecting a growing trend towards sustainability in consumer electronics. This initiative not only aligns with global environmental goals but also caters to a consumer base that is increasingly conscious of sustainability issues. By prioritizing eco-friendly materials and production processes, Sennheiser is likely to attract environmentally aware consumers, thereby enhancing its brand reputation and market share.

In January 2026, Sony (JP) unveiled its latest wireless speaker series, which incorporates advanced sound technology and smart home integration features. This launch signifies Sony's commitment to innovation and its strategy to capture the growing demand for connected audio solutions. By continuously evolving its product offerings, Sony is well-positioned to maintain its competitive edge in a rapidly changing market.

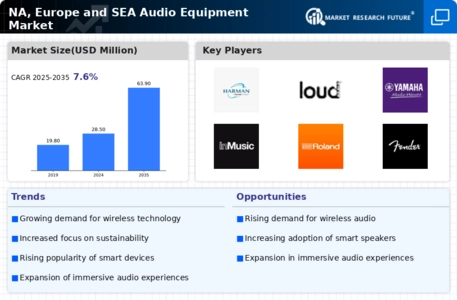

As of January 2026, current trends in the Audio Equipment Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to leverage each other's strengths and enhance their product offerings. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future differentiation will hinge on the ability to deliver unique, high-quality audio experiences that resonate with consumers.

.png)