Regulatory Compliance

Regulatory compliance is an essential driver influencing the Release Liners Market. As governments worldwide implement stricter regulations regarding materials used in packaging and labeling, manufacturers are compelled to adapt their products accordingly. Compliance with these regulations not only ensures product safety but also enhances brand reputation. The demand for release liners that meet specific regulatory standards is increasing, particularly in industries such as food and pharmaceuticals, where safety and quality are paramount. Market data suggests that companies investing in compliance-driven innovations are likely to gain a competitive edge. This focus on regulatory adherence is expected to drive the development of new release liner products that align with evolving standards, thereby fostering growth within the Release Liners Market.

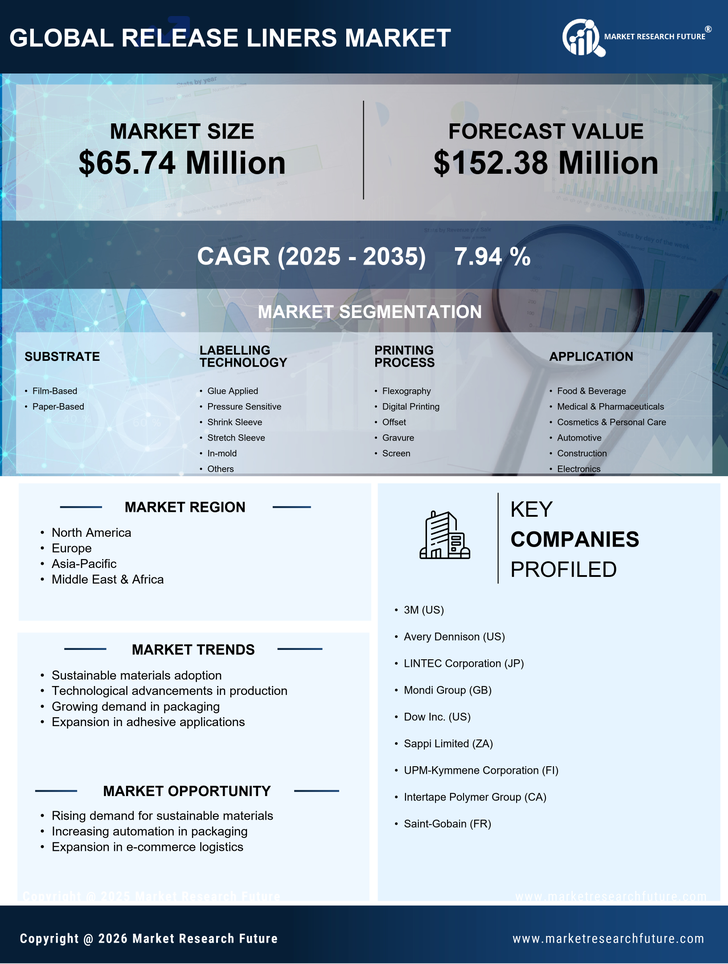

Sustainability Initiatives

The increasing emphasis on sustainability initiatives is a pivotal driver for the Release Liners Market. As consumers and businesses alike become more environmentally conscious, there is a growing demand for eco-friendly materials. This trend is reflected in the rising adoption of biodegradable and recyclable release liners, which are designed to minimize environmental impact. According to recent data, the market for sustainable packaging solutions is projected to grow significantly, with a notable portion attributed to the release liners segment. Companies are investing in research and development to create innovative products that align with sustainability goals, thereby enhancing their market position. This shift not only meets consumer expectations but also complies with stringent regulations aimed at reducing waste and promoting sustainable practices. Consequently, the focus on sustainability is likely to drive growth and innovation within the Release Liners Market.

Technological Advancements

Technological advancements play a crucial role in shaping the Release Liners Market. Innovations in material science and manufacturing processes have led to the development of high-performance release liners that offer enhanced functionality. For instance, advancements in silicone coating technologies have improved the release properties of liners, making them more efficient for various applications. The integration of automation and digital technologies in production processes has also resulted in increased efficiency and reduced costs. Market data indicates that the demand for technologically advanced release liners is on the rise, particularly in sectors such as automotive, electronics, and healthcare. These advancements not only improve product performance but also enable manufacturers to meet the evolving needs of their customers. As a result, the continuous pursuit of technological innovation is expected to drive growth and competitiveness in the Release Liners Market.

Growing Demand in Packaging

The growing demand in packaging is a significant driver for the Release Liners Market. As e-commerce continues to expand, the need for efficient and reliable packaging solutions has surged. Release liners are integral to various packaging applications, including pressure-sensitive adhesives and labels. Market analysis reveals that the packaging sector is one of the largest consumers of release liners, accounting for a substantial share of the overall market. This trend is further fueled by the increasing preference for convenient and user-friendly packaging solutions among consumers. Additionally, the rise of sustainable packaging options is prompting manufacturers to explore innovative release liner solutions that align with eco-friendly practices. Consequently, the packaging industry's growth is likely to propel the demand for release liners, thereby enhancing the overall market landscape.

Rising Applications in Healthcare

The rising applications in healthcare represent a notable driver for the Release Liners Market. With the increasing demand for medical devices, diagnostics, and packaging solutions, the need for specialized release liners has grown. These liners are essential in applications such as wound care, surgical tapes, and medical packaging, where reliability and performance are critical. Industry expert's indicate that the healthcare sector is experiencing robust growth, leading to heightened demand for high-quality release liners that ensure product integrity and safety. Furthermore, the ongoing advancements in healthcare technology are likely to create new opportunities for innovative release liner solutions. As a result, the expanding applications in healthcare are expected to significantly contribute to the growth trajectory of the Release Liners Market.