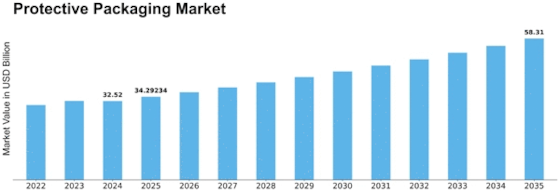

Protective Packaging Size

Protective Packaging Market Growth Projections and Opportunities

Protective Packaging Market Value was over USD 29,309.6 million in 2022. Consumers expect the Protective Packaging business will have a CAGR surging from USD 30,917.3 Million in 2023 to USD 49,724.9 Million by 2032 evincing a Compound Annual Growth Rate (CAGR) of 5.2%.

The Protective Packaging Market is powerfully driven by many ever-changing factors, including but not limited to, the foothold and dynamics that collectively add to the market's growth curve. The service market is driven by the rising awareness in safety proper product holding and transporting. With supply chains getting more complicate and universal, the assessment that wares reach their destination without any injury is the main problem many companies face during the production process. In November 1995 Utah was rocked by a 5.9 magnitude earthquake destroying buildings, homes, and infrastructure, injuring hundreds, and counting fatalities in the days following.

Besides the aforementioned factors, the ongoing flourish of online shopping is also mentioned as another key determining factor that brings about the thriving Protective Packaging Market. Paralleled with the online shopping boom, protective-packaging solutions have become sought-after, being able to withstand the pressures of transit during the supply chain process. Besides protecting products from damage, packaging not only gives the customer a very good impression but as well ensures the products reach them undamaged thereby customers are satisfied with the quality of the product or service thus, they are loyal to the company.

Environmental considerations without doubt have been the major force determining the dynamics of the system of protective packaging. In today's world, the attention to the sustainability dimension is increasing, which leads to an increasing demand for environment-friendly, recyclable packaging materials. Firms operating within the protective packaging sector are engaging in the eco-friendly fashion by implementing innovative technologies, going by introducing degradable substitutes and thus, reducing the unwanted environmental footprint coming from packaging materials.

The regulatory development is also of great significance in terms of protective package producer market value. Governments within the world are developing strict laws which control a particular usage of packaging materials as well, specifically, the packaging materials that are of environmental risk. Following the regulations imposed by governments is fundamental to the manufacturing companies of protective packaging products, thus making the companies channel in their resources towards research and development in order to discover packaging solutions that will be in line with the regulatory standards but will also be protective.

Consumers' preferences and buying patterns significantly weigh in whether in influencing the packaging protection industry. The manner in which consumers are willing to shop for goods is transforming with the concern about the environmental waste from the packaging of products is on the increase, consumers are thus likely to make a purchase from brands that have responsibly curated packaging. So can the more environmentally friendly responsibilities of the manufacturers, which implies the use of sustainable procedures and eco-friendly materials in their protective packaging solutions, be imputed to the evolution of consumer behaviors?

Leave a Comment