Market Analysis

In-depth Analysis of Protective Coatings Market Industry Landscape

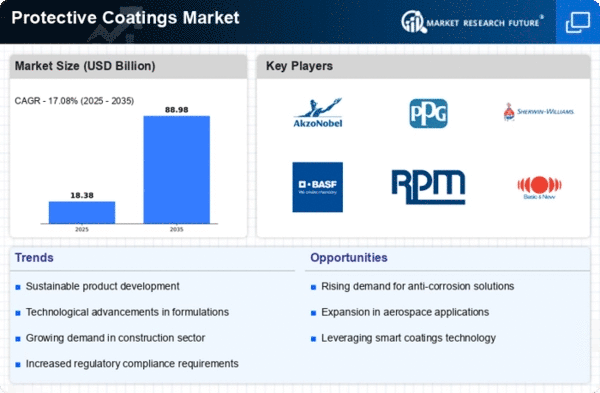

The protective coatings market is undergoing the rapid changes due to the rising significance of corrosion control, stabilization, and appearance in different industries. Protective coatings, which are used to protect surfaces from the harshness of environmental elements, corrosion, and wear, are in fact things that ensure the integrity of structures, equipment, and assets in long term. There are many things that will be shaping the market dynamics, such as that the demand in the construction industry is robust where the protective coatings are vital for the preservation of buildings, bridges, and the infrastructure. With the increase in the amount of infrastructure projects taking place across the globe, there is a constant demand for coatings that offer corrosion resistance, weatherability and long-term protection, thereby fuelling market expansion.

Protection coatings market dynamics are significantly determined by the exploration and production sector where coatings are crucial for the protection of pipelines, storage tanks, and offshore structures from the adverse external environment. The industry's corrosion prevention, chemical resistance, and asset life extension maintain the demands for innovative thermal protection. The oil and gas industry finds itself to be pushing through turbulent times which include among them extreme chemicals exposure and inclement temperatures, protective coatings play an integral role of increasing efficiency in operations and extending the lifespan of the critical assets.

Furthermore, the automotive and transportation of the sector is the main player influencing the market. The protective coatings are broadly utilized in automotive manufacturing for the purpose of corrosion protection, scratches prevention and aesthetic improvement among others. Lightweight materials usage in the automotive industry currently is a trend that creates more demand for the coating that is not only corrosion resistant but fuel efficiency as well. Moreover, corrosion protective coatings are employed by shipbuilding industry to combat corrosion in marine environment and extend the life time of vessels and offshore platforms.

The market dynamics of coatings were also affected by the industry whereby these coatings are essential in protecting the machinery, equipment and manufacturing facilities. The coatings manufacture with customized characteristics as heat resistance, chemical resistance, and anti-corrosion requirements propels the market for protective coatings in various sectors of industries. With the industrial world going ahead in terms of advancement, the role of such types of high-performing coatings will be increasingly expected.

Leave a Comment