Regulatory Compliance

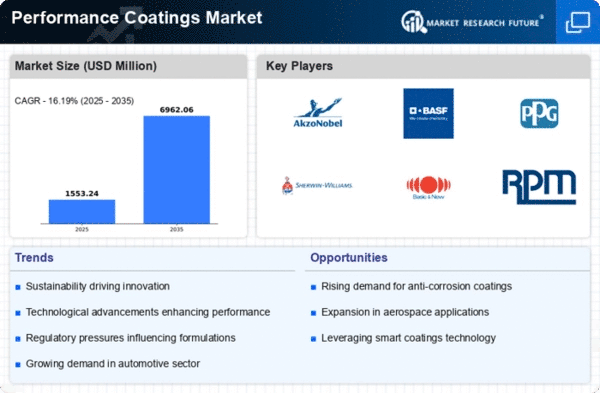

Stringent environmental regulations are shaping the Global Performance Coatings Market Industry, as manufacturers are compelled to develop low-VOC and eco-friendly coatings. Compliance with these regulations not only ensures environmental protection but also enhances product appeal in a market increasingly focused on sustainability. Companies that adapt to these regulations may gain a competitive edge, as consumers and industries alike prioritize environmentally responsible products. This trend is likely to drive innovation and investment in sustainable coating technologies, further influencing market dynamics.

Automotive Industry Demand

The automotive sector is a significant contributor to the Global Performance Coatings Market Industry, driven by the need for high-performance coatings that offer protection and aesthetic appeal. As vehicle production ramps up globally, the demand for coatings that can withstand harsh conditions and provide a visually appealing finish increases. Coatings play a crucial role in enhancing vehicle longevity and performance, which is vital in a competitive market. The automotive industry's growth is expected to positively impact the performance coatings market, as manufacturers seek innovative solutions to meet consumer expectations.

Technological Advancements

Innovations in coating technologies are pivotal to the growth of the Global Performance Coatings Market Industry. The introduction of advanced formulations, such as waterborne and high-solids coatings, enhances performance characteristics, including durability, adhesion, and resistance to corrosion. These advancements not only meet stringent environmental regulations but also cater to the increasing demand for sustainable solutions. As manufacturers invest in research and development, the market is likely to witness a surge in the adoption of eco-friendly coatings. This shift aligns with global sustainability goals, further propelling the industry forward.

Growing Construction Sector

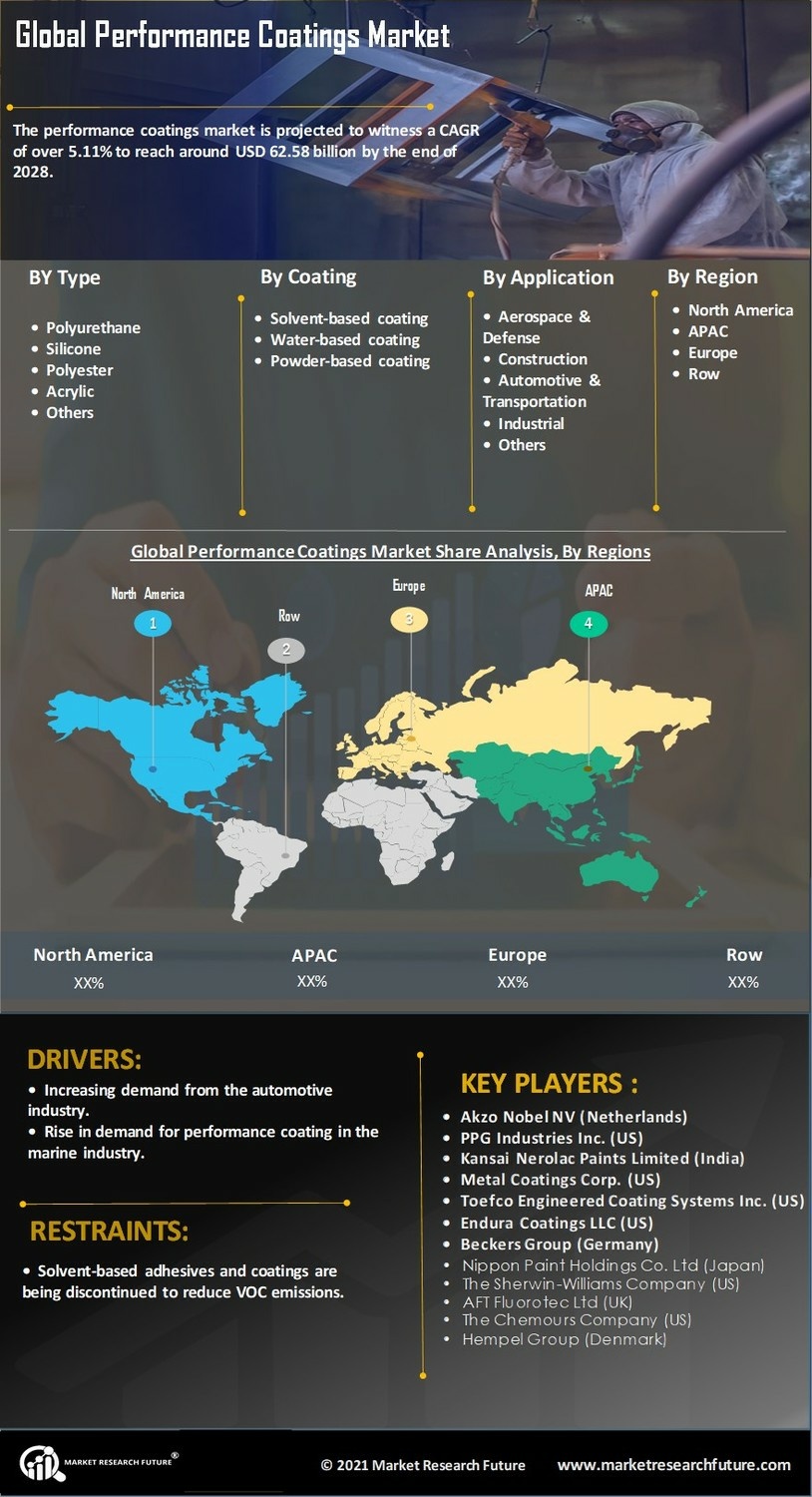

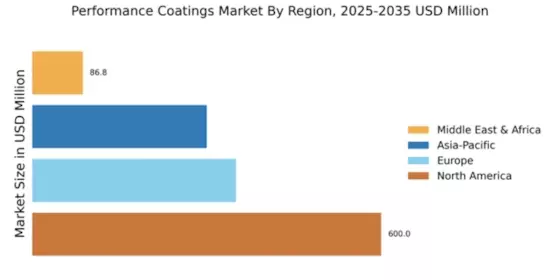

The expansion of the global construction sector significantly drives the Global Performance Coatings Market Industry. As urbanization accelerates, the demand for durable and aesthetically pleasing coatings in residential, commercial, and industrial buildings increases. In 2024, the market is valued at approximately 51.1 USD Billion, reflecting the rising investments in infrastructure development. Coatings are essential for protecting structures from environmental factors, thereby enhancing their longevity. This trend is expected to continue, with projections indicating a market growth to 80.3 USD Billion by 2035, suggesting a robust compound annual growth rate of 4.19% from 2025 to 2035.

Rising Demand in Industrial Applications

The Global Performance Coatings Market Industry is experiencing heightened demand from various industrial applications, including oil and gas, marine, and manufacturing sectors. These industries require specialized coatings that can withstand extreme conditions, such as high temperatures and corrosive environments. As industrial activities expand globally, the need for protective coatings that enhance equipment longevity and performance becomes paramount. This trend is expected to sustain market growth, as industries increasingly recognize the value of investing in high-quality performance coatings.