Protective Coatings Size

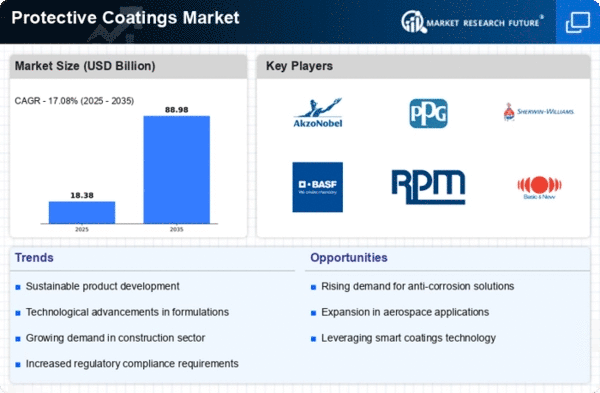

Protective Coatings Market Growth Projections and Opportunities

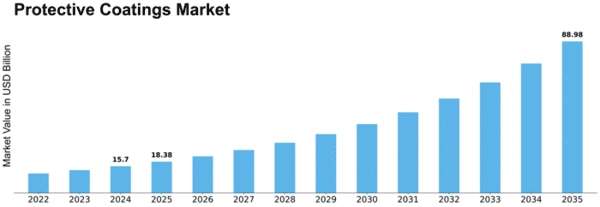

The protective coatings market is expected an increased of USD 24.55 Billion by 2028 with a CAGR of 5.2% during the forecast period (2022 - 2028).

The Protective Coating Market is an impacted area, because of the various factors that, altogether, are determining its growth and development. An upcoming factor is the demand for protective coatings by the range of industries on shielding the surfaces from the corrosion, wear, and environmental degradation. Industries of automotive, construction, oil and gas as well as marine facilities require protective systems to extend the usage time of equipment, building and material properties. Such demands as to cut down time and expenditure on maintenance, to extend the life of the coating and to bear with heat and cold contribute greatly to the development of the market of advanced protective coatings.

Beyond this, it is the construction sector which assumes primary responsibility for the development of the protective coatings market. Construction Materials, bridges, road and infrastructure are widely coated with protecting coatings to gain resistance against weathering, UV radiation, chemical agents. As the size of the infrastructure sector continues to expand (especially in developing economies), more and more protective paints are required not only in new construction projects but also for renovations and maintenance activities, offering remarkable growth for the entire market.

Moreover auto industry also consumes a great amount of protective coatings: these coatings prevent corrosion, reduce scratches, and add a more attractive appearance. As technology is incorporated into motor vehicles and consumers especially require tough and visually appealing coverings, the need for high-tech protective finishing is on the rise in the automotive industry. Electric vehicles and autonomous driving as well as protective coatings are a more important factor in determining the durability and performance of automotive components.

The oil and gas industry besides being another major playing field in the protective coatings market, it is widely applied in offshore and onshore facilities. Shielding constitutes a vital link in the protection of apparatus subject to corrosion and deterioration in a number of harsh environments, for example, pipelines, storage tanks and drilling platforms. Over the world, the oil and gas sector embark on exploration and production, which increase the need for high protective coatings that cannot be destroyed by corrosive fluids, extreme temperatures, and severe weather conditions.

Technical breakthroughs in the field of protective coatings and the continually improving formulations add to the market dynamics. Manufacturers are always fine-tuning coatings with the improved properties of extended adhesion, increased chemical resistance, and better durability. The nano-technology in protective coating has brought new possibilities with ultra-thin high-performance coatings that offer enlarged level of protection yet present an aesthetic aspect. These developments are tailored to specific industries and help to extoll the usage of the modern protective coatings.

Leave a Comment