Market Growth Projections

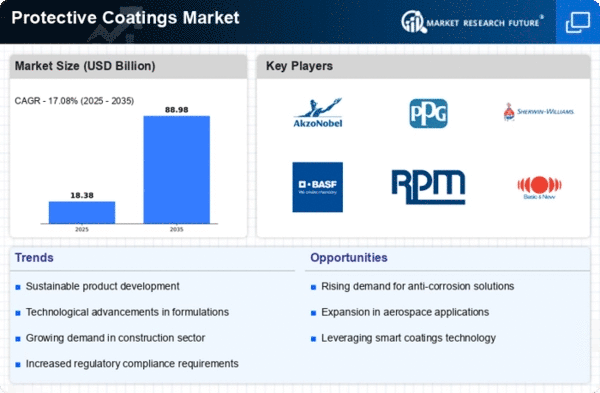

The Global Protective Coatings Market Industry is poised for substantial growth, with projections indicating a market value of 235.94 USD Billion in 2024 and an anticipated increase to 541.32 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.84% from 2025 to 2035. Various factors contribute to this optimistic outlook, including rising demand from key sectors such as construction, automotive, and aerospace, alongside technological advancements and regulatory compliance. The market's expansion reflects the increasing recognition of the importance of protective coatings in enhancing durability and performance across diverse applications.

Emerging Markets and Economic Growth

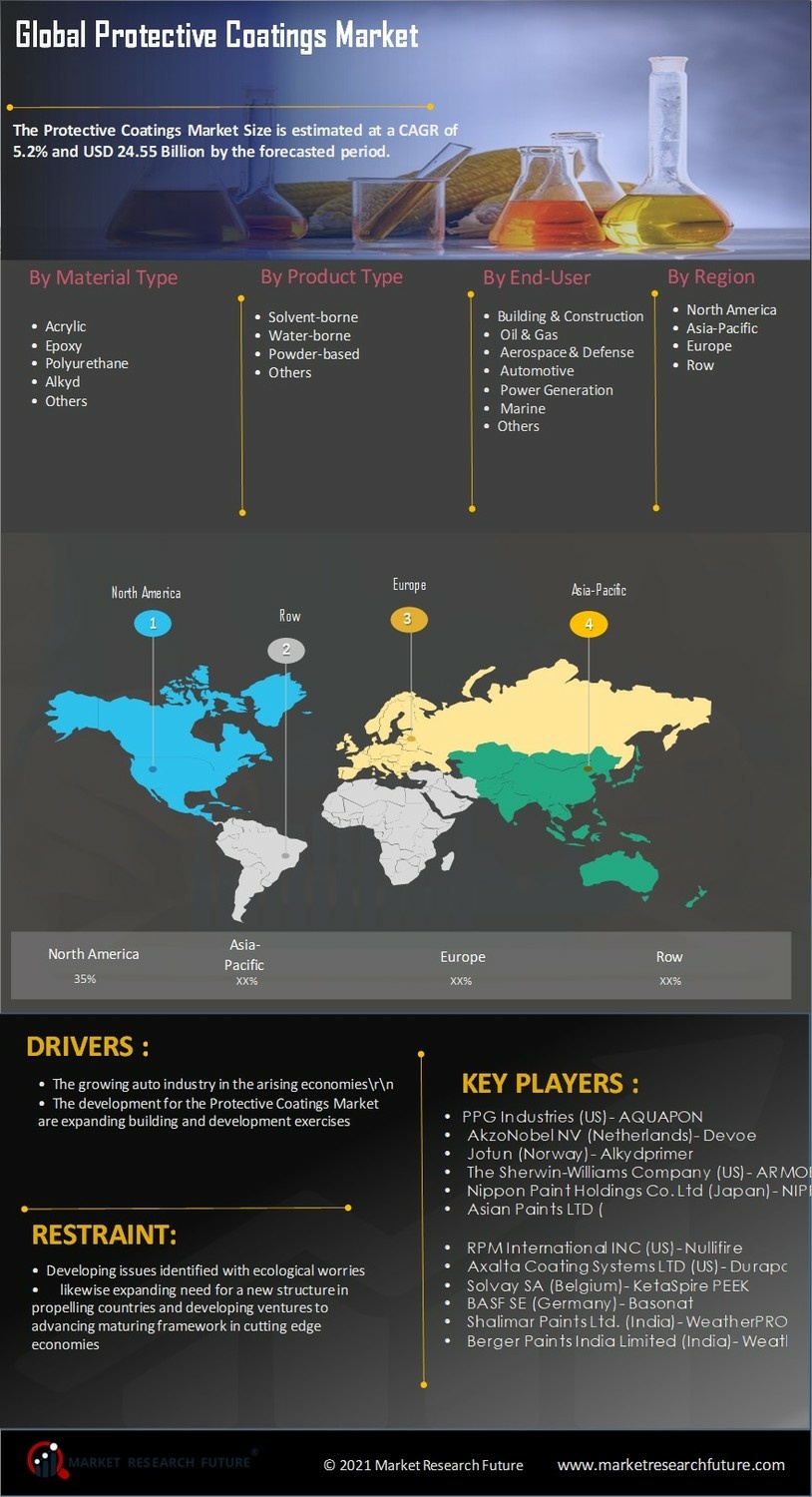

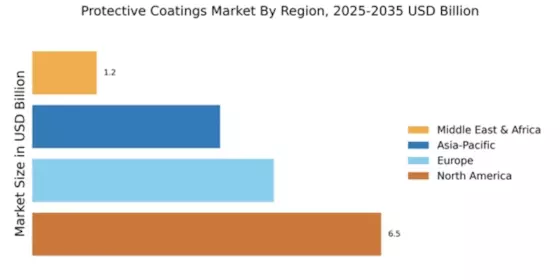

Emerging markets are becoming increasingly influential in the Global Protective Coatings Market Industry. Rapid economic growth in regions such as Asia-Pacific and Latin America is driving infrastructure development and industrialization, leading to heightened demand for protective coatings. As these economies expand, investments in construction, automotive, and manufacturing sectors are surging, thereby increasing the need for protective solutions. For instance, countries like India and Brazil are witnessing significant infrastructure projects that require robust protective coatings. This trend suggests that as emerging markets continue to develop, they will likely play a crucial role in shaping the future landscape of the protective coatings market.

Rising Demand from Construction Sector

The Global Protective Coatings Market Industry experiences substantial growth driven by the increasing demand from the construction sector. As urbanization accelerates globally, the need for durable and protective coatings in residential, commercial, and infrastructure projects intensifies. For instance, protective coatings are essential for safeguarding structures against environmental degradation, which is particularly relevant in regions with harsh climates. The market is projected to reach approximately 235.94 USD Billion in 2024, reflecting the construction industry's pivotal role in driving protective coatings adoption. This trend suggests that as construction activities expand, the demand for protective coatings will likely follow suit, bolstering market growth.

Growth in Automotive and Aerospace Industries

The automotive and aerospace industries are pivotal drivers of the Global Protective Coatings Market Industry. As these sectors expand, the demand for protective coatings that enhance durability and performance is on the rise. Coatings are essential for protecting vehicles and aircraft from corrosion, wear, and environmental factors. For example, advancements in aerospace coatings have led to products that withstand extreme temperatures and pressures. This growth trajectory is expected to contribute significantly to the market, with projections indicating that the industry could reach 541.32 USD Billion by 2035. The increasing focus on lightweight materials and fuel efficiency further underscores the importance of protective coatings in these industries.

Technological Advancements in Coating Solutions

Technological advancements play a crucial role in shaping the Global Protective Coatings Market Industry. Innovations in coating formulations, such as the development of eco-friendly and high-performance coatings, are increasingly appealing to manufacturers and consumers alike. These advancements not only enhance the durability and effectiveness of coatings but also align with global sustainability initiatives. For example, the introduction of waterborne coatings has gained traction due to their lower volatile organic compound emissions. As these technologies evolve, they are expected to drive market growth, with projections indicating a compound annual growth rate of 7.84% from 2025 to 2035, further solidifying the industry's position.

Regulatory Compliance and Environmental Standards

The Global Protective Coatings Market Industry is significantly influenced by stringent regulatory compliance and environmental standards. Governments worldwide are implementing regulations to minimize environmental impact, particularly concerning volatile organic compounds in coatings. This regulatory landscape compels manufacturers to innovate and adapt their products to meet these standards. For instance, the adoption of low-VOC and zero-VOC coatings is becoming increasingly prevalent as companies strive to comply with environmental regulations. This shift not only enhances product appeal but also drives market growth, as consumers and industries prioritize environmentally friendly solutions. Consequently, adherence to these regulations is likely to shape the future of the protective coatings market.