Power Monitoring System Market Summary

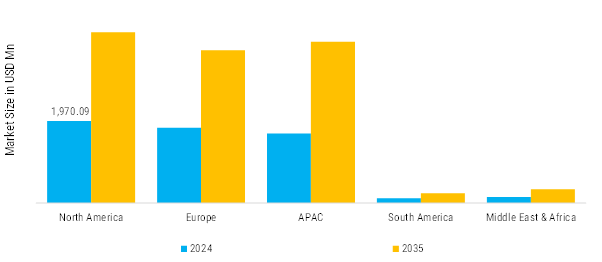

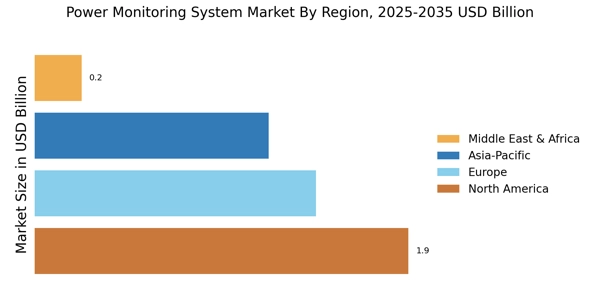

As per Market Research Future analysis, the Power Monitoring System Market Size was estimated at 5,715.38 USD Million in 2024. The Power Monitoring System industry is projected to grow from 6,092.60 USD Million in 2025 to 12,200.22 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 7.2 % during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Power Monitoring System Market is experiencing strong growth driven by expanding demand for energy efficiency, grid reliability, digital technologies, and renewable integration across utilities, industrial, commercial, and residential sectors.

- Rising adoption of solar PV, wind power, energy storage systems, and distributed energy resources (DERs) is increasing the need for power monitoring to manage variability, balance supply and demand, and enable stable grid operation. This drives demand for advanced monitoring systems that support real time tracking of generation and load across diverse sources.

- Utilities and enterprises are increasingly deploying IoT‑enabled sensors, cloud platforms, and AI/analytics tools to enable predictive maintenance, optimize energy usage, and improve fault detection. Projects leveraging digital twins and cloud‑based monitoring enhance operational efficiency and reduce downtime.

- Growing regulatory emphasis on energy efficiency, carbon reduction, and sustainable infrastructure is prompting investments in sophisticated power monitoring solutions. These systems help stakeholders achieve energy optimization goals, reduce losses, and maintain compliance with evolving environmental standards.

Market Size & Forecast

| 2024 Market Size | 21,975.3 (USD Million) |

| 2035 Market Size | 46,364.1 (USD Million) |

| CAGR (2025 - 2035) | 7.2 % |

Major Players

GE Vernova, Siemens, Hitachi, Eaton, Schneider Electric, Honeywell, Mitsubishi Electric, Fuji Electric FA, Emerson, Rockwell Automation, Rishabh Instruments, Megger, Fluke, Yokogawa, OMRON