Rising Energy Costs

The increasing costs of energy in the US are driving the demand for the power monitoring-system market. As utility rates continue to rise, businesses and consumers are seeking ways to optimize their energy consumption. This trend is particularly evident in commercial sectors, where energy expenses can account for a significant portion of operational costs. By implementing power monitoring systems, organizations can identify inefficiencies and reduce waste, potentially saving up to 20% on energy bills. The power monitoring-system market is thus positioned to benefit from this economic pressure, as stakeholders look for solutions that provide real-time insights into energy usage and facilitate cost-effective management.

Enhanced Data Security Concerns

As the power monitoring-system market expands, concerns regarding data security are becoming increasingly prominent. With the integration of IoT devices and cloud-based solutions, the potential for cyber threats has risen. Organizations are now more aware of the need to protect sensitive energy consumption data from breaches. This awareness is driving demand for power monitoring systems that incorporate robust security features. According to industry reports, nearly 60% of businesses in the energy sector have experienced cyber incidents in the past year. Consequently, the market is likely to see a surge in solutions that prioritize data integrity and security, ensuring that users can monitor their energy usage without compromising their information.

Growing Focus on Renewable Energy

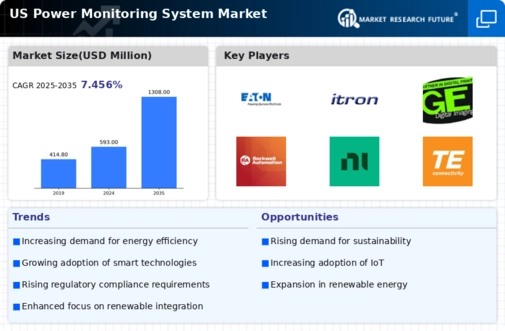

The transition towards renewable energy sources in the US is influencing the power monitoring-system market. As more organizations adopt solar, wind, and other renewable technologies, the need for effective monitoring systems becomes paramount. These systems enable users to track energy production and consumption, ensuring that renewable sources are utilized efficiently. According to recent data, the share of renewables in the US energy mix is projected to reach 50% by 2030. This shift not only supports sustainability goals but also creates a robust market for power monitoring solutions that can integrate with diverse energy sources, enhancing overall energy management.

Increased Demand for Energy Efficiency

The push for energy efficiency in the US is significantly impacting the power monitoring-system market. With rising awareness of climate change and energy conservation, both consumers and businesses are prioritizing energy-efficient practices. The US Department of Energy has set ambitious targets to reduce energy consumption by 30% by 2030. Power monitoring systems play a crucial role in achieving these goals by providing insights that help users optimize their energy use. This growing emphasis on efficiency not only drives market demand but also encourages innovation in monitoring technologies, as stakeholders seek advanced solutions to meet regulatory and environmental standards.

Technological Advancements in Smart Grids

The evolution of smart grid technology is a key driver for the power monitoring-system market. Smart grids facilitate two-way communication between utilities and consumers, allowing for enhanced monitoring and management of energy resources. This technology enables real-time data collection and analysis, which is crucial for optimizing energy distribution and consumption. The US government has invested heavily in smart grid initiatives, with funding exceeding $4 billion in recent years. As smart grids become more prevalent, the demand for sophisticated power monitoring systems that can interface with these networks is likely to increase, presenting significant opportunities for market growth.