Technological Innovations

Technological advancements play a pivotal role in shaping the Polymer Emulsions Market. Innovations in formulation technologies, such as the development of advanced surfactants and stabilizers, have led to improved performance characteristics of polymer emulsions. These innovations enable manufacturers to produce emulsions with enhanced stability, durability, and application versatility. In 2025, the market is expected to witness a surge in demand for high-performance emulsions, particularly in sectors like construction and automotive, where superior adhesion and weather resistance are critical. Furthermore, the integration of digital technologies in production processes is likely to streamline operations, reduce costs, and improve product quality, thereby fostering market expansion. Companies that embrace these technological advancements may find themselves at the forefront of the industry, capitalizing on new opportunities and meeting evolving customer needs.

Sustainability Initiatives

The Polymer Emulsions Market is increasingly influenced by sustainability initiatives, as manufacturers and consumers alike prioritize eco-friendly products. The demand for low-VOC (volatile organic compounds) and water-based emulsions is on the rise, driven by stringent environmental regulations and a growing awareness of health impacts associated with traditional solvents. In 2025, it is estimated that the market for sustainable polymer emulsions will account for a substantial portion of the overall market, reflecting a shift towards greener alternatives. This trend not only aligns with regulatory frameworks but also caters to consumer preferences for sustainable products, thereby enhancing market growth. Companies that invest in sustainable practices are likely to gain a competitive edge, as they can appeal to environmentally conscious consumers and meet regulatory requirements more effectively.

Customization and Flexibility

Customization and flexibility are becoming increasingly vital in the Polymer Emulsions Market, as diverse applications require tailored solutions. Manufacturers are responding to this demand by offering a wide range of customizable polymer emulsions that cater to specific industry needs, such as adhesives, paints, and coatings. This trend is particularly pronounced in the construction and automotive sectors, where unique performance characteristics are essential. In 2025, the market is projected to grow as companies leverage customization to differentiate their products and enhance customer satisfaction. The ability to modify properties such as viscosity, drying time, and adhesion strength allows manufacturers to meet the precise requirements of their clients, thereby fostering loyalty and repeat business. As competition intensifies, those who can provide flexible and customized solutions are likely to thrive in the evolving market landscape.

Regulatory Compliance and Standards

Regulatory compliance and standards are critical drivers in the Polymer Emulsions Market, as manufacturers must adhere to increasingly stringent regulations regarding product safety and environmental impact. In 2025, the market is expected to be shaped by the need for compliance with international standards, such as REACH and TSCA, which govern the use of chemicals in products. This regulatory landscape compels manufacturers to innovate and reformulate their products to meet safety and environmental criteria, thereby influencing market dynamics. Companies that proactively engage in compliance efforts are likely to enhance their market reputation and gain consumer trust. Furthermore, adherence to these regulations can open up new market opportunities, as products that meet stringent standards are often favored by consumers and businesses alike, leading to increased sales and market share.

Rising Demand in Emerging Economies

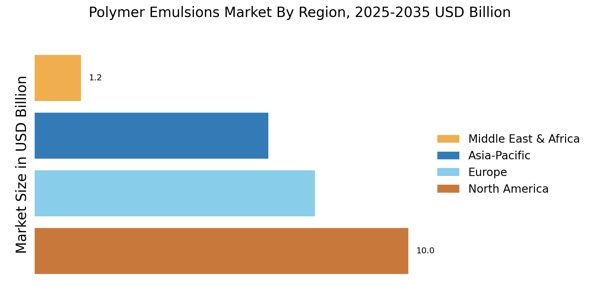

The Polymer Emulsions Market is experiencing a notable increase in demand from emerging economies, where rapid industrialization and urbanization are driving growth. Countries in Asia-Pacific and Latin America are witnessing a surge in construction activities, leading to heightened demand for polymer emulsions in paints, coatings, and adhesives. In 2025, it is anticipated that these regions will contribute significantly to the overall market expansion, as infrastructure development projects gain momentum. Additionally, the growing middle-class population in these regions is likely to boost consumer spending on construction and renovation, further propelling the demand for polymer emulsions. Companies that strategically position themselves in these emerging markets may benefit from lucrative opportunities, as they cater to the evolving needs of a burgeoning consumer base.