Plastic Gear Market Summary

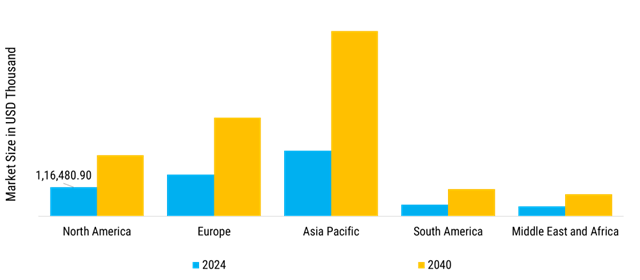

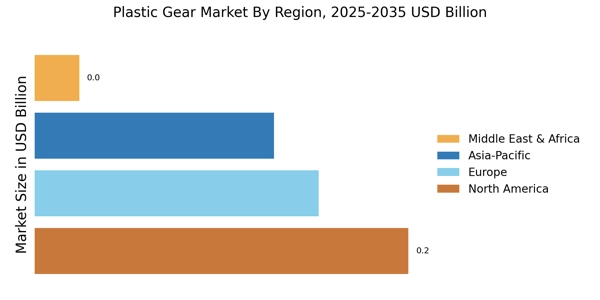

As per Market Research Future analysis, the Plastic Gear Market Size was estimated at 632,123 USD Thousand in 2024. The Plastic Gear industry is projected to grow from 669,432 USD Thousand in 2025 to 1,579,458 USD Thousand by 2035, exhibiting a compound annual growth rate (CAGR) of 5.9% during the forecast period 2025 - 2040.

Key Market Trends & Highlights

The Plastic Gear Market is experiencing robust growth driven by advancement of Automotive Industry & development of Hybrid Materials:

- Advanced Technologies: 3D printing and additive manufacturing allow for rapid prototyping, customization, and production of complex gear designs.

- Sustainable Manufacturing: Companies are focusing on using recycled materials and promoting the circular economy concept.

- EV Integration: Electric vehicles accounted for more than 300 million units of plastic gear consumption in 2023.

Market Size & Forecast

| 2024 Market Size | 632,123 (USD Thousand) |

| 2035 Market Size | 1,579,458 (USD Thousand) |

| CAGR (2025 - 2040) | 19.04% |

Major Players

Gleason Corporation, Miller Plastic Products, Molded Devices Inc., Retlaw Industries, igus GmbH, Guangzhou Engineering Plastics Industries (Group) Co., LTD, Winzeler Gear, Kore Industries, Hangzhou Bright Rubber Plastic Product Co., Ltd, Enplas Corporation, IMS Gear, Others