Market Analysis

In-depth Analysis of Plant-Based Beverages Market Industry Landscape

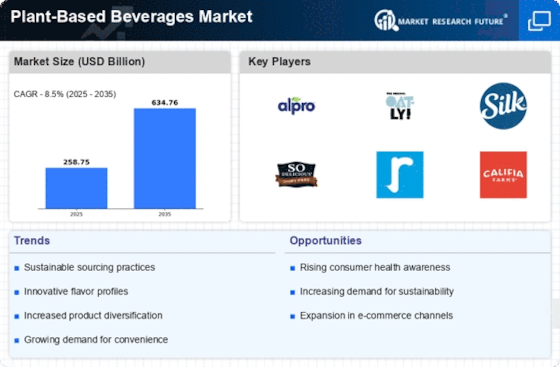

Because they are healthier, better for the environment, and less harmful than cheese, plant-based drinks are growing increasingly popular. More individuals being vegan or flexitarian, health and environmental concerns, and innovative plant-based technology influence the plant-based drink industry. More individuals preferring non-dairy products and no animal testing will harm the sector. Eating differently is a growing ethical and environmental trend. The rising frequency of chronic illnesses worldwide will also increase demand for healthful drinks. Health-conscious consumers desire healthy drinks, expanding the industry. Non-dairy beverage sales will rise as more individuals prioritize health and ethics. People are leading healthier lives as plant-based alternatives become more widespread. The relationship between food choices and animal welfare concerns reveals that various factors influence shopping. As chronic illnesses rise, more people prefer healthful drinks. These drinks are essential nowadays. Because of this, these overlapping trends will likely advance the market throughout the review period, changing how consumers drink.

Plant-based drinks are growing as health-conscious consumers purchase more dairy substitutes. Low-fat plant-based drinks like almond, soy, and oat milk may be healthier. Plant-based meals are helping people eat healthier and more evenly.

Environmentalism affects costs too. Due to their environmental friendliness, plant-based drinks satisfy green requirements. Plant-based choices are preferred by those worried about greenhouse gas emissions and animal farm land usage. This boosted the market.

Veganism and flexitarianism are driving plant-based beverage sales. Plant-based drinks are in high demand as more individuals become vegan for moral reasons or to cut less on meat and dairy. This cultural shift is influencing what consumers purchase and forcing corporations to provide more plant-based items to attract customers.

New plant-based technologies are transforming the market. New methods of handling and preparing plant-based drinks improve their flavor, texture, and nutritional content. With superior flavor and feel, early plant-based choices are more attractive to more individuals.

Plant-based drinks are heavily impacted by the economy. As manufacturing has increased and economies of scale have set in, they are now simpler to procure and cheaper. More consumers can purchase plant-based goods, expanding the market.

People not understanding about plant-based drinks' health advantages, rivalry amongst plant sources, and allergy concerns are commercial issues. Food firms are promoting the health advantages of plant-based meals, analyzing their nutritional worth, and offering a range of plant-based drinks to address these issues.

Leave a Comment