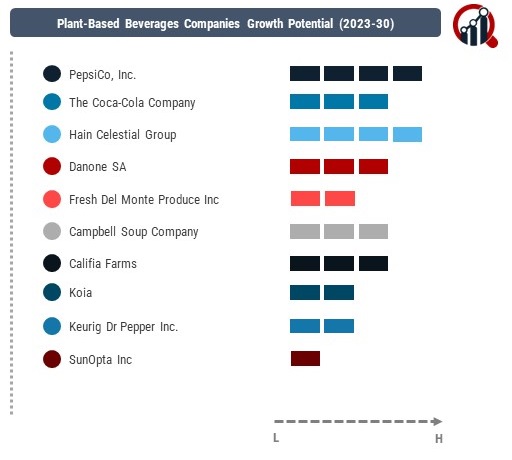

Top Industry Leaders in the Plant-Based Beverages Market

The Plant-Based Beverages market is heavily influenced by key players shaping the industry. Prominent brands and companies in this sector include Coca-Cola Company, PepsiCo Inc., Hain Celestial Group, Danone SA, Fresh Del Monte Produce Inc., Campbell Soup Company, Califia Strategies, Koia Keurig Dr Pepper Inc., SunOpta Inc. These established entities have established their positions through extensive distribution networks, brand recognition, and a focus on offering a wide array of plant-based beverages, including almond, soy, oat, coconut, and pea-based options. Their strategies revolve around product diversification, marketing, and catering to the growing consumer demand for dairy-free alternatives.

Factors for Market Share Analysis:

Market share analysis within the Plant-Based Beverages industry entails considering various crucial factors. Brand reputation, product quality, flavor variety, packaging innovations, pricing strategies, and global distribution significantly impact market positioning. Brands offering a diverse range of plant-based milk alternatives with various flavors, fortified options, and environmentally friendly packaging secure a competitive edge. Additionally, factors like consumer perception, nutritional value, and adapting to changing dietary preferences influence market share.

New and Emerging Companies:

New and emerging companies in the Plant-Based Beverages market often focus on niche aspects such as novel ingredients, functional beverages, or sustainability initiatives. These emerging players leverage innovation in recipes, introduce unique ingredients like hemp or flaxseed, and emphasize sustainability by using eco-friendly packaging or supporting ethical sourcing practices. Moreover, they often rely on digital marketing, social media presence, and collaborations with health-conscious retailers to gain visibility and compete with established brands.

Industry News:

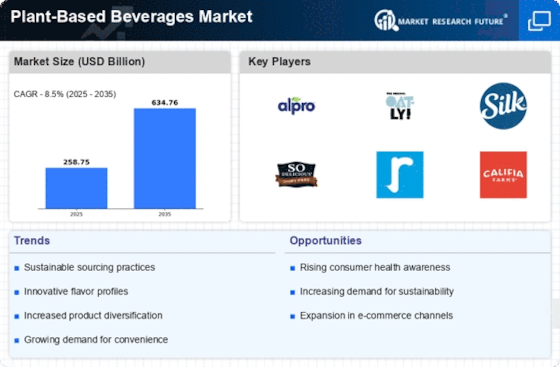

Industry news in the Plant-Based Beverages market revolves around innovation in flavors, sustainability efforts, and the shift towards healthier lifestyles. Brands are investing in research and development to introduce new plant-based beverage varieties, focusing on functional beverages that offer added health benefits, and enhancing taste profiles to appeal to a wider consumer base. Additionally, there's a significant focus on sustainability initiatives, such as reducing carbon footprints, using renewable energy, and supporting fair trade practices throughout the supply chain.

Current Company Investment Trends:

Current investment trends within this market underscore a strong emphasis on sustainability, innovation, and consumer-centric strategies. Companies are investing in sustainable sourcing practices, supporting regenerative agriculture, and adopting eco-friendly packaging to align with consumer preferences for environmentally conscious products. Furthermore, investments in marketing campaigns promoting health benefits, collaborations with cafes and supermarkets, and expanding product portfolios to include innovative beverage options are prevalent among industry players.

Overall Competitive Scenario:

The overall competitive scenario within the Plant-Based Beverages market remains dynamic and consumer-driven. Established players face competition from newer entrants focusing on unique flavors, functional benefits, and sustainability. Differentiation through product quality, innovation, sustainability efforts, pricing strategies, and alignment with changing consumer preferences for natural, healthy, and eco-friendly beverages will determine a company's success and competitive standing in this rapidly evolving market landscape.

Key Companies in the Plant-Based Beverages market includes.

- Coca-Cola Company

- PepsiCo Inc.

- Hain Celestial Group

- Danone SA

- Fresh Del Monte Produce Inc.

- Campbell Soup Company.

- Califia Strategies

- Koia Keurig Dr Pepper Inc.

- SunOpta Inc.