Market Trends

Key Emerging Trends in the Plant-Based Beverages Market

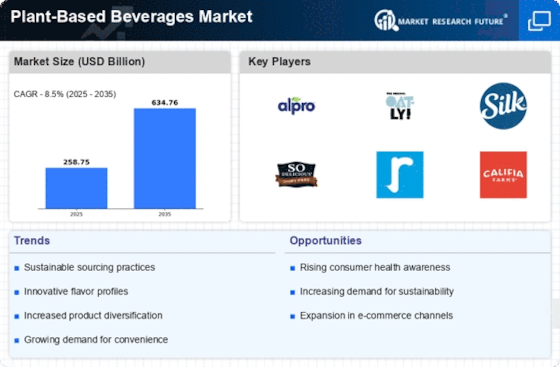

Changes in the plant-based drink business reveal that consumers worldwide are selecting healthier, environmentally friendly drinks. Recent years have seen more consumers choose plant-based drinks over sugary and dairy-based ones. People are learning about plant-based diets' health advantages, the environment, and preferring non-dairy products because they can't tolerate lactose or think it's moral.

The expanding global population and demand in healthy non-dairy drinks will generate a major market growth opportunity. Since more people seek non-dairy drinks, healthier choices benefit the industry. As individuals realize the importance of health and fitness, they seek dairy-free alternatives.

The market will benefit from more plant-based, nutritionally superior drinks. Due to lactose sensitivity, personal preference, and environmental concerns, non-dairy choices are growing in popularity. This trend demonstrates that preferences are changing and society is growing healthier and more informed.

New technology and more products may help beverage companies capitalize on expanding non-dairy demand. As the global population expands and more people become health-conscious, market participants may enhance their positions and adapt to fulfill the wants of consumers who desire healthy, eco-friendly drinks.

More plant-based drinks are available. Many milks are now available besides almond and soy. These include oat, chocolate, rice, and pea protein drinks. This diversity suits many preferences and health demands, thus plant-based solutions are growing increasingly popular. Plant-based sources are growing in the market because consumers want better options.

The market for plant-based functional drinks is also doing very well. They're good for you in a lot of ways. Growing numbers of people are drinking plant-based drinks that are good for them and full of minerals, vitamins, and other nutrients. Health is important to people, so they want to eat foods that have beneficial properties. Healthy beverages like plant-based protein shakes and sweetened nut milks enable new products.

Another benefit of plant-based beverages is their longevity. People constantly search for methods to help the environment because they realize how vital it is. Cheese has the same effect on the earth as drinks made from plants. Because of this trend, companies can make money by promoting ecologically friendly packing, healthy shopping, and clear supply lines. People are buying things more and more because they care about morals and the environment. This method to sustainability appeals to people who want to buy.

There are also more partnerships between food service and beverage companies and plant-based beverage companies. More consumers demand plant-based choices, so fast food, coffee, and restaurants are offering them. This arrangement makes plant-based beverages more accessible by increasing their popularity.

In regions with increasing finances, plant-based beverages are becoming more popular. People are reconsidering their unhealthy and ecologically destructive diets as plant-based diets become increasingly popular. Globalization lets huge corporations enter new markets. They may also promote plant-based solutions and adapt to community demands.

Leave a Comment