Research Methodology on Oat Milk Market

Market Research Future (MRFR) has used extensive and incisive primary and secondary research sources for the report. MRFR applied a top-down as well as bottom-up approach to quantify the overall Oat Milk Market and arrive at accurate market estimations.

Primary Research

Primary research consists of accessibility and interviews with industry experts like industry decision-makers, subject matter and product managers, marketing directors, CEOs, and other industry personalities. Primary research further includes material obtained from newsletters, press releases, market surveys, and other related primary sources.

The overall primary research data is consolidated and quickly refined with the following dedicated sources of data:

- Interviews with executives and thought leaders from different industry verticals

- Information from business journals, trade books and others

- Trading data from numerous online databases

- Relevant Government sources

- Detailed analysis and understanding of current market trends

Secondary Research

Secondary research is based on robust sources of information. The information is thoroughly checked and crosschecked for confirmation, biasing or veracity.

The secondary research sources are as follows:

- Periodicals, trade publications and industry publications from industry associations

- Detailed reports related to the industry

- Government and non-government records

- Company websites

- Online paid databases

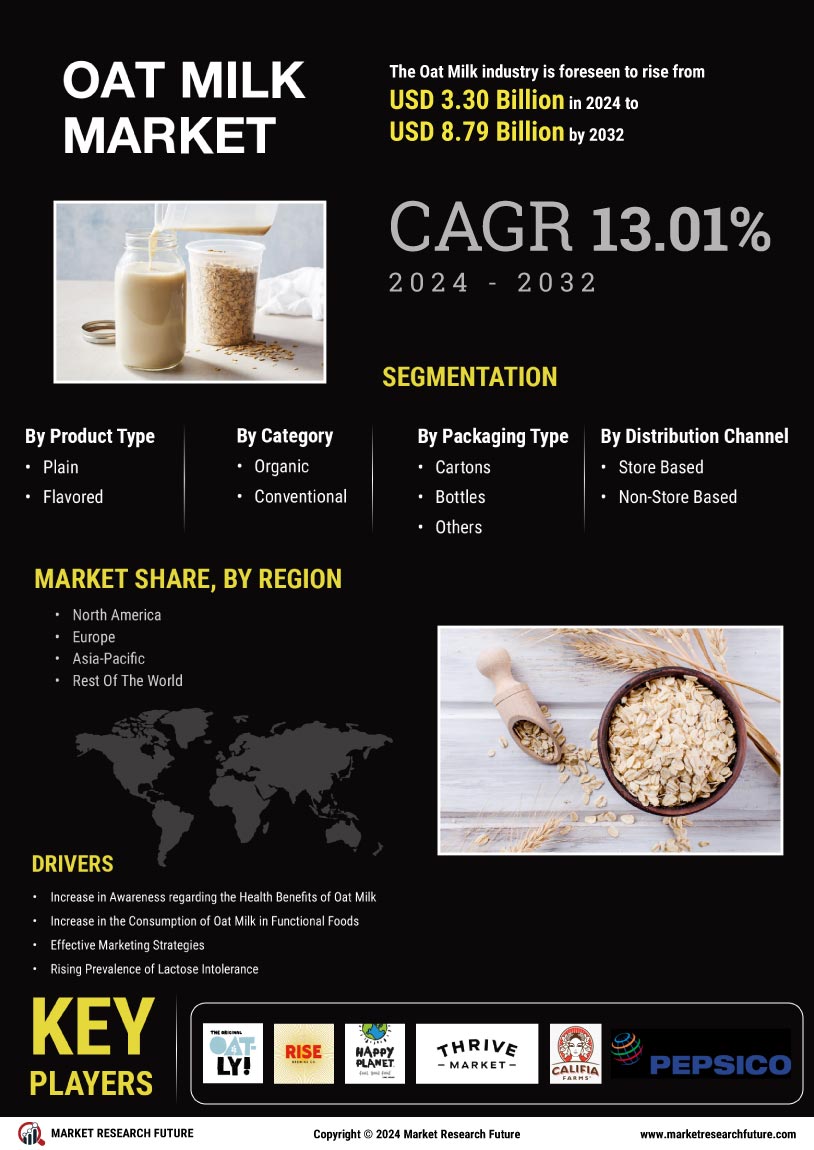

Market Segmentation

The market is segmented in terms of type, form, packaging, and application. The segments are further examined both quantitatively and qualitatively based on market trends, value, volume, and share projections. The market estimations and projections are validated by the analysis of historical data, which also form the basis of the projection of future market values.

Market Size Estimation

MRFR utilized a bottom-up approach to calculating the Oat Milk Market size that took into account the value of the overall Oat Milk Market through the sales of products across different sectors and the related price in each of those sectors. The price is considered at the regional level and the data is cross-referenced with the regional sales. Pertinent data is gathered from market participants, industry associations, and research papers to assess and arrive at market estimations.

Data Triangulation

Data points gathered from extensive primary and secondary research are thoroughly examined and validated by a three-way data triangulation process. Additionally, further data points are collected and the analysis team analyzes any new trends in the Oat Milk Market.

Assumptions

This research study involves intensive data collection and comprehensive analysis of the Oat Milk Market. The assumptions made while carrying out the study and data analysis are listed in detail in the research report.

Companies Covered

- Plant-Based Farms

- Califia Farms

- Hain Celestial Group

- Ripple Foods

- Oatly AB

- Clover Organic Farms

- Pacific Foods

- Earth’s Own Food Company

- Blue Diamond Growers

- MALK

- Nutty Goodness

- The Solidaridad Network

- Organic Valley

- Thrive Market

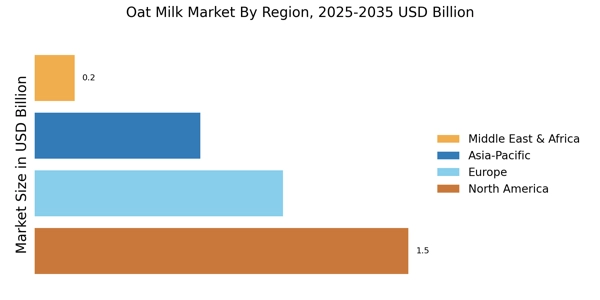

Regional Analysis

The global Oat Milk Market is covered in detail across regions such as Europe, North America, Asia Pacific, and the Rest of the World. Detailed information on the regional trends characterizing the Oat Milk Market growth over the review period 2023 to 2030 are discussed in the report to determine the impact of such trends on the market’s overall trajectory in terms of the current standing and the forecasted value.

Key Players

The report covers aspects related to the key players present in the market. MRFR has profiled the strategic plans of the key players, along with their financial statements, regional presence, product portfolio, and recent developments.

Competitive Analysis

MRFR entrepreneurs carefully analyze the Oat Milk Market key players and their strategies, activities, technology integration, and future prospects. This helps assess their capabilities and performance and analyze the overall competitive landscape of the market. MRFR also conducts a SWOT analysis to identify the strengths and weaknesses of the prominent players and study the opportunities available to them.