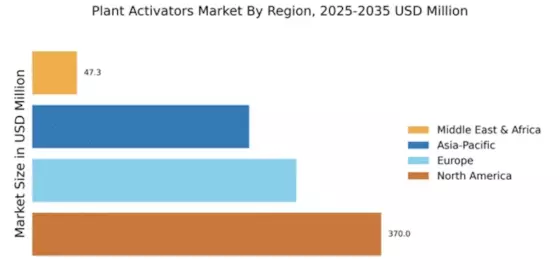

North America : Market Leader in Plant Activators

North America is poised to maintain its leadership in the Plant Activators Market, holding a significant market share of $370.0M in 2025. The region's growth is driven by increasing demand for sustainable agricultural practices and the adoption of innovative farming technologies. Regulatory support for eco-friendly products further catalyzes market expansion, as farmers seek effective solutions to enhance crop resilience and yield.

The competitive landscape in North America is robust, featuring key players such as BASF SE, Bayer AG, and Corteva Agriscience. The U.S. stands out as the leading country, with substantial investments in agricultural research and development. This focus on innovation, combined with a strong distribution network, positions North America as a critical hub for plant activators, ensuring a steady supply of advanced solutions to meet growing agricultural demands.

Europe : Emerging Market with Growth Potential

Europe's Plant Activators Market is projected to reach $280.0M by 2025, driven by increasing consumer demand for organic produce and stringent regulations promoting sustainable farming practices. The European Union's Green Deal emphasizes reducing chemical pesticide use, which propels the adoption of plant activators as viable alternatives. This regulatory framework is a key catalyst for market growth, encouraging innovation and investment in eco-friendly solutions.

Leading countries in this region include Germany, France, and the Netherlands, where agricultural technology is rapidly evolving. Major players like Syngenta AG and BASF SE are actively investing in research to develop effective plant activators. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing product offerings, ensuring that Europe remains a significant player in the global market.

Asia-Pacific : Rapid Growth in Agricultural Innovation

The Asia-Pacific region is witnessing a surge in the Plant Activators Market, projected to reach $230.0M by 2025. This growth is fueled by rising agricultural productivity demands and increasing awareness of sustainable farming practices. Countries like India and China are investing heavily in agricultural technology, supported by government initiatives aimed at enhancing food security and environmental sustainability. The regulatory environment is becoming more favorable for plant activators, further driving market expansion.

In this competitive landscape, key players such as UPL Limited and Nufarm Limited are making significant strides. India is emerging as a leader in adopting innovative agricultural solutions, while China is focusing on modernizing its agricultural practices. The presence of these major companies, along with a growing emphasis on research and development, positions Asia-Pacific as a vital region for the future of plant activators.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa (MEA) region is gradually developing its Plant Activators Market, projected to reach $47.3M by 2025. The growth is primarily driven by increasing agricultural activities and the need for improved crop yields in arid climates. Governments are recognizing the importance of sustainable agriculture, leading to supportive policies that encourage the use of plant activators. However, challenges such as limited access to advanced agricultural technologies and infrastructure remain.

Countries like South Africa and Kenya are at the forefront of this market, with local players and international companies working to introduce innovative solutions. The competitive landscape is evolving, with a focus on partnerships to enhance product availability. As the region continues to develop its agricultural sector, the demand for effective plant activators is expected to rise, presenting opportunities for growth.