Increasing Demand for Energy

The Pipeline and Process Services Market is experiencing a notable surge in demand for energy, driven by the growing global population and industrialization. As countries strive to meet energy needs, investments in pipeline infrastructure are escalating. According to recent data, the energy sector is projected to require an additional 30% in pipeline capacity by 2030. This demand is not only for oil and gas but also for renewable energy sources, which necessitate advanced pipeline solutions. Consequently, service providers in the Pipeline and Process Services Market are likely to expand their offerings to accommodate this increasing demand, ensuring efficient and safe transportation of energy resources.

Focus on Environmental Sustainability

The Pipeline and Process Services Market is witnessing a growing emphasis on environmental sustainability. Companies are increasingly adopting practices that minimize environmental impact, driven by both regulatory pressures and consumer demand for greener solutions. The market for sustainable pipeline services is projected to expand as organizations seek to reduce their carbon footprint. This shift is likely to result in the development of eco-friendly materials and processes, which could reshape service offerings within the Pipeline and Process Services Market. As sustainability becomes a core focus, service providers may need to innovate to align with these environmental goals.

Regulatory Compliance and Safety Standards

The Pipeline and Process Services Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are implementing more rigorous safety protocols to mitigate risks associated with pipeline operations. This trend is evident in the rise of safety audits and inspections, which have increased by approximately 25% in recent years. Companies are compelled to invest in advanced technologies and services that ensure adherence to these regulations. As a result, the Pipeline and Process Services Market is likely to see a boost in demand for specialized services that focus on compliance and safety, thereby enhancing operational reliability.

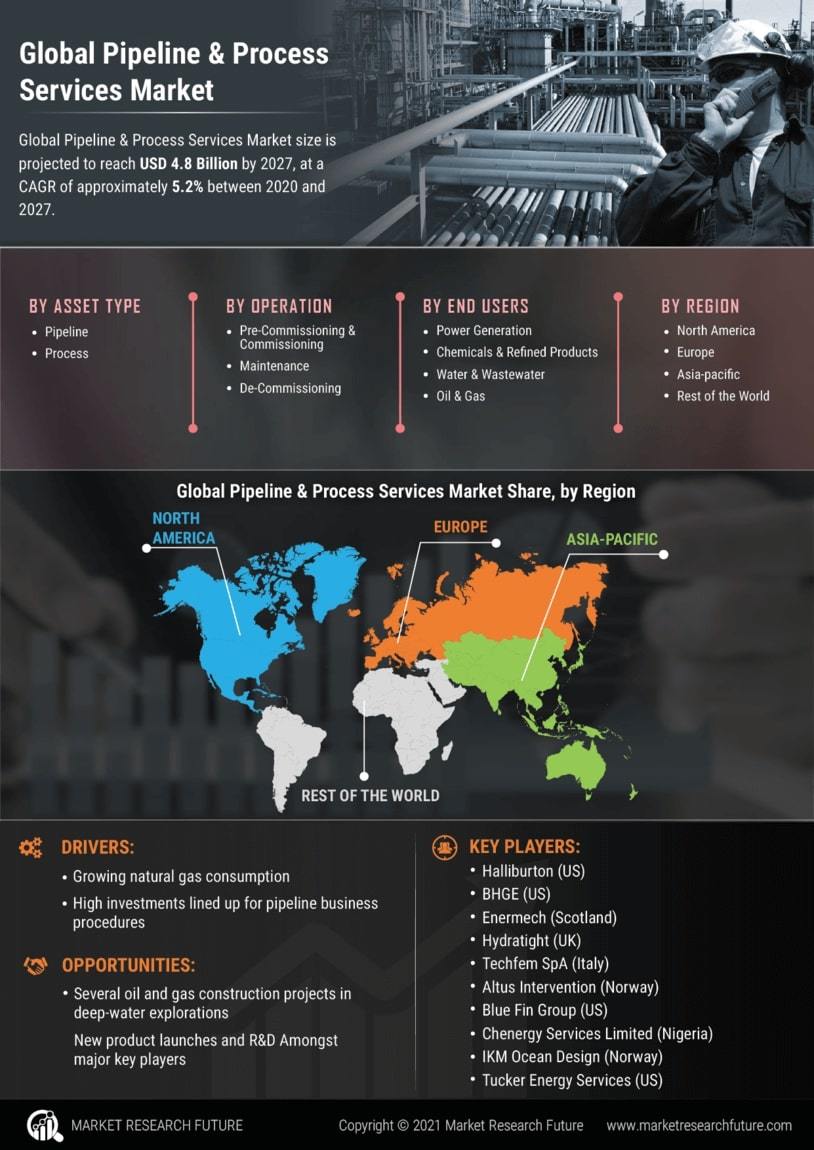

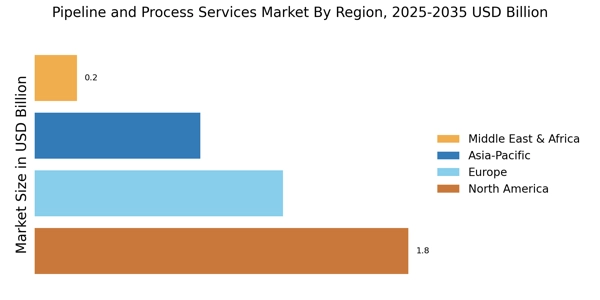

Expansion of Oil and Gas Exploration Activities

The Pipeline and Process Services Market is poised for growth due to the expansion of oil and gas exploration activities. As new reserves are discovered, there is an increasing need for efficient pipeline solutions to transport these resources. Recent estimates indicate that exploration activities could increase by 20% in the next five years, necessitating enhanced pipeline infrastructure. This trend suggests that service providers will need to scale their operations and invest in advanced technologies to support the burgeoning exploration sector. Consequently, the Pipeline and Process Services Market is likely to benefit from this expansion, as demand for related services rises.

Technological Advancements in Pipeline Monitoring

Technological advancements are reshaping the Pipeline and Process Services Market, particularly in the realm of pipeline monitoring and maintenance. Innovations such as smart sensors and data analytics are enabling real-time monitoring of pipeline conditions, which enhances operational efficiency and reduces downtime. The market for pipeline monitoring technologies is expected to grow by over 15% annually, reflecting the increasing reliance on technology for maintenance and safety. This trend suggests that service providers in the Pipeline and Process Services Market will need to adopt these technologies to remain competitive and meet the evolving needs of their clients.