Technological Innovations

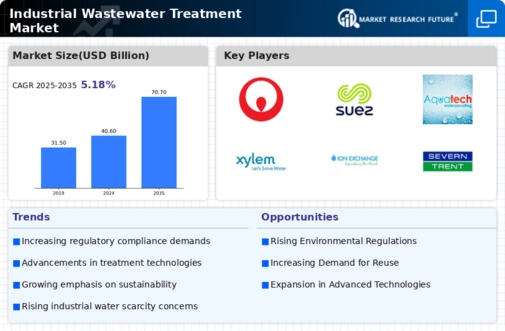

Technological innovations in wastewater treatment processes are transforming the Industrial Wastewater Treatment Market. The advent of advanced treatment technologies, such as membrane bioreactors, advanced oxidation processes, and zero-liquid discharge systems, is enhancing the efficiency and effectiveness of wastewater treatment. These innovations not only improve the quality of treated water but also enable industries to recover valuable resources from wastewater, such as energy and nutrients. Market analysis indicates that the adoption of these technologies is increasing, with a projected CAGR of 7% over the next five years. This growth is indicative of the industry's shift towards more sustainable practices, as companies seek to minimize their environmental footprint while optimizing operational efficiency. Thus, technological advancements are likely to play a crucial role in shaping the future of the Industrial Wastewater Treatment Market.

Increasing Industrialization

The rapid pace of industrialization across various sectors appears to be a primary driver for the Industrial Wastewater Treatment Market. As industries expand, the volume of wastewater generated increases significantly, necessitating effective treatment solutions. For instance, the manufacturing sector, which includes textiles, chemicals, and food processing, contributes substantially to wastewater generation. Reports indicate that the industrial sector accounts for approximately 70% of total water usage, leading to heightened demand for advanced treatment technologies. This trend suggests that companies are increasingly investing in wastewater treatment facilities to comply with environmental regulations and to mitigate the impact of their operations on local water bodies. Consequently, the Industrial Wastewater Treatment Market is likely to experience robust growth as industries seek to enhance their wastewater management practices.

Corporate Sustainability Goals

The integration of corporate sustainability goals into business strategies is significantly influencing the Industrial Wastewater Treatment Market. Many companies are now prioritizing environmental responsibility as part of their operational ethos, which includes effective wastewater management. This shift is driven by consumer demand for sustainable practices and the need to enhance brand reputation. Market data suggests that organizations with robust sustainability initiatives are more likely to invest in advanced wastewater treatment technologies. As a result, the Industrial Wastewater Treatment Market is witnessing an increase in partnerships between technology providers and industries aiming to achieve their sustainability targets. This trend indicates a growing recognition of the importance of wastewater treatment in achieving broader environmental objectives, thereby fostering market growth.

Rising Awareness of Water Scarcity

The growing awareness of water scarcity issues is emerging as a critical driver for the Industrial Wastewater Treatment Market. As populations expand and water resources become increasingly strained, industries are recognizing the importance of sustainable water management practices. This awareness is prompting companies to invest in wastewater treatment solutions that not only treat but also recycle and reuse water. Reports indicate that industries could potentially reduce their freshwater consumption by up to 50% through effective wastewater treatment and reuse strategies. This trend is likely to accelerate the demand for innovative treatment technologies, as businesses aim to secure their water supply and reduce operational costs. Consequently, the Industrial Wastewater Treatment Market is expected to benefit from this heightened focus on water conservation and sustainability.

Stringent Environmental Regulations

The enforcement of stringent environmental regulations is a significant driver influencing the Industrial Wastewater Treatment Market. Governments and regulatory bodies are increasingly implementing laws aimed at reducing pollution and protecting water resources. For example, regulations such as the Clean Water Act in various regions mandate that industries treat their wastewater before discharge. This regulatory landscape compels companies to invest in advanced treatment technologies to ensure compliance. The market data suggests that The Industrial Wastewater Treatment Market is projected to reach USD 100 billion by 2026, driven largely by these regulatory pressures. As industries strive to meet compliance standards, the demand for innovative treatment solutions is expected to rise, thereby propelling the growth of the Industrial Wastewater Treatment Market.