North America : Market Leader in Services

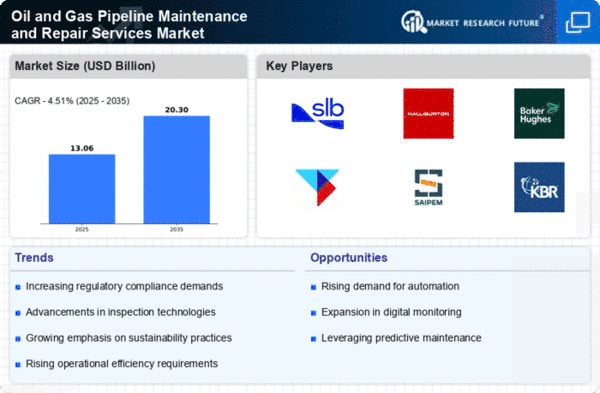

North America continues to lead the Oil and Gas Pipeline Maintenance and Repair Services market, holding a significant share of 6.25 in 2024. The region's growth is driven by increasing investments in infrastructure, stringent safety regulations, and a rising demand for efficient energy transportation. Regulatory bodies are emphasizing the need for regular maintenance to prevent leaks and ensure safety, further propelling market growth. The United States is the primary contributor, with major players like Schlumberger, Halliburton, and Baker Hughes dominating the landscape. The competitive environment is characterized by technological advancements and strategic partnerships aimed at enhancing service delivery. As the market evolves, companies are focusing on innovative solutions to meet the growing demand for pipeline integrity and reliability.

Europe : Emerging Market Dynamics

Europe's Oil and Gas Pipeline Maintenance and Repair Services market is projected to grow, with a market size of 3.5 in 2024. The region is witnessing increased regulatory scrutiny and a shift towards sustainable practices, driving demand for maintenance services. Governments are implementing stricter regulations to ensure pipeline safety and environmental protection, which is expected to boost market growth significantly. Leading countries such as Germany, the UK, and France are at the forefront, with key players like TechnipFMC and Saipem actively participating in the market. The competitive landscape is marked by collaborations and technological innovations aimed at enhancing service efficiency. As Europe transitions to greener energy solutions, the demand for reliable pipeline maintenance services will continue to rise.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region is emerging as a significant player in the Oil and Gas Pipeline Maintenance and Repair Services market, with a size of 2.75 in 2024. The growth is fueled by increasing energy demands, urbanization, and investments in pipeline infrastructure. Governments are recognizing the need for robust maintenance services to ensure operational efficiency and safety, which is driving market expansion. Countries like China and India are leading the charge, with a growing presence of key players such as KBR and Aker Solutions. The competitive landscape is evolving, with companies focusing on innovative technologies and service offerings to capture market share. As the region continues to develop its energy infrastructure, the demand for pipeline maintenance services is expected to surge.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa region is gradually developing its Oil and Gas Pipeline Maintenance and Repair Services market, currently valued at 0.75 in 2024. The growth is driven by increasing investments in oil and gas infrastructure and a rising focus on safety and environmental regulations. Governments are beginning to implement policies that mandate regular maintenance checks, which is expected to enhance market growth in the coming years. Countries like Saudi Arabia and South Africa are key players in this market, with a growing number of local and international companies entering the landscape. The competitive environment is characterized by partnerships and collaborations aimed at improving service delivery. As the region's energy sector evolves, the demand for reliable pipeline maintenance services will likely increase.