North America : Market Leader in Services

North America is poised to maintain its leadership in the Pipeline Corrosion Control and Repair Services Market, holding a market size of $1.25B in 2025. Key growth drivers include stringent regulatory frameworks, increasing investments in infrastructure, and a rising focus on environmental sustainability. The demand for advanced corrosion control technologies is also on the rise, driven by aging pipeline infrastructure and the need for efficient maintenance solutions.

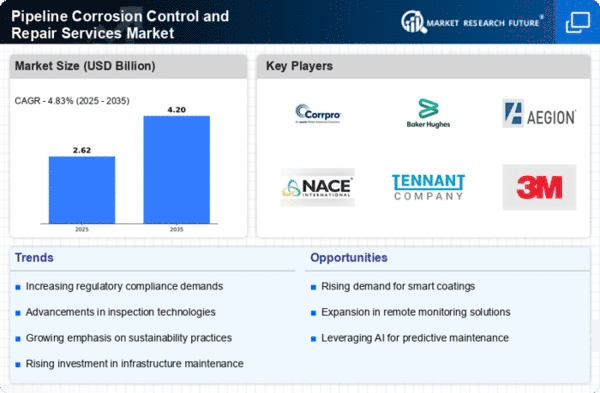

The competitive landscape is robust, with major players like Corrpro Companies Inc, Baker Hughes Company, and Aegion Corporation leading the market. The U.S. is the primary contributor, supported by a strong presence of key players and innovative technologies. The market is characterized by ongoing research and development efforts aimed at enhancing service efficiency and effectiveness, ensuring that North America remains at the forefront of pipeline services.

Europe : Emerging Regulatory Frameworks

Europe is witnessing significant growth in the Pipeline Corrosion Control and Repair Services Market, with a market size of $0.75B projected for 2025. The region's growth is driven by stringent environmental regulations and a commitment to sustainable energy practices. Countries are increasingly investing in pipeline maintenance and repair to comply with EU directives, which emphasize safety and environmental protection, thus boosting demand for corrosion control services.

Leading countries in this market include Germany, France, and the UK, where key players like SUEZ Water Technologies & Solutions are actively engaged. The competitive landscape is evolving, with a focus on innovative solutions and technologies to enhance service delivery. The presence of established companies and a growing emphasis on research and development are expected to further drive market growth in Europe.

Asia-Pacific : Rapid Infrastructure Development

The Asia-Pacific region is emerging as a significant player in the Pipeline Corrosion Control and Repair Services Market, with a market size of $0.4B anticipated by 2025. Rapid industrialization and urbanization are key growth drivers, leading to increased investments in pipeline infrastructure. Additionally, government initiatives aimed at enhancing energy security and environmental sustainability are catalyzing demand for corrosion control services across the region.

Countries like China, India, and Australia are at the forefront of this growth, with a competitive landscape that includes both local and international players. The presence of key companies is growing, and there is a strong focus on adopting advanced technologies to improve service efficiency. As the region continues to develop, the demand for effective pipeline maintenance solutions is expected to rise significantly.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is currently the smallest market for Pipeline Corrosion Control and Repair Services, with a projected size of $0.1B in 2025. However, the region presents untapped opportunities driven by increasing investments in oil and gas infrastructure and a growing awareness of the importance of pipeline maintenance. Regulatory frameworks are gradually evolving, encouraging the adoption of corrosion control technologies to enhance operational efficiency and safety.

Countries like Saudi Arabia and South Africa are leading the way in this market, with a focus on developing their energy sectors. The competitive landscape is still developing, with both local and international players looking to establish a foothold. As the region continues to invest in infrastructure, the demand for corrosion control services is expected to grow, presenting significant opportunities for market players.