North America : Market Leader in Services

North America is poised to maintain its leadership in the Oil and Gas Pipeline Repair and Maintenance Services Market, holding a significant market share of 10.75 in 2024. The region's growth is driven by increasing investments in infrastructure, stringent safety regulations, and a rising demand for efficient energy transportation. Regulatory bodies are emphasizing the need for regular maintenance to prevent leaks and ensure environmental safety, further propelling market growth.

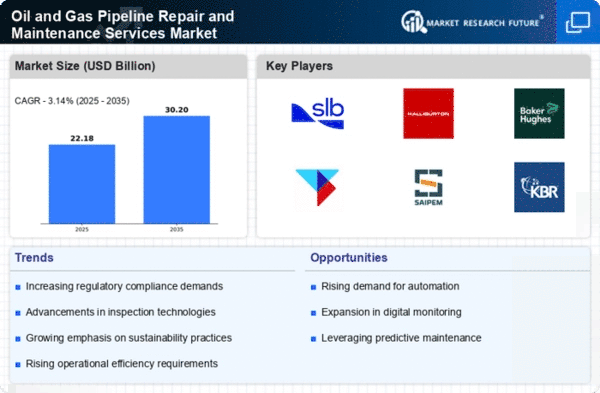

The competitive landscape in North America is robust, featuring key players such as Schlumberger, Halliburton, and Baker Hughes. These companies are leveraging advanced technologies and innovative solutions to enhance service delivery. The U.S. remains the largest market, supported by extensive pipeline networks and a focus on modernization. As the region continues to invest in pipeline integrity management, the demand for repair and maintenance services is expected to grow significantly.

Europe : Emerging Market Dynamics

Europe's Oil and Gas Pipeline Repair and Maintenance Services Market is evolving, with a market size of 5.5 in 2024. The region is experiencing growth due to increasing regulatory pressures for environmental compliance and the need for infrastructure upgrades. European countries are focusing on sustainability, which is driving investments in pipeline maintenance to reduce emissions and enhance safety standards. The European Union's regulations are pivotal in shaping market dynamics, encouraging companies to adopt advanced technologies for pipeline integrity.

Leading countries in this region include Germany, the UK, and France, where major players like TechnipFMC and Saipem are actively involved. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing service offerings. As Europe transitions towards greener energy solutions, the demand for efficient pipeline repair and maintenance services is expected to rise, ensuring compliance with stringent regulations.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific region, with a market size of 4.0 in 2024, is rapidly emerging as a significant player in the Oil and Gas Pipeline Repair and Maintenance Services Market. The growth is fueled by increasing energy demands, urbanization, and investments in pipeline infrastructure. Countries like China and India are leading the charge, driven by their expanding economies and the need for efficient energy distribution. Regulatory frameworks are evolving to support infrastructure development, further enhancing market prospects.

In this competitive landscape, key players such as KBR and Aker Solutions are establishing a strong presence. The region is witnessing a surge in partnerships and collaborations aimed at leveraging technological advancements. As the demand for reliable pipeline services grows, the Asia-Pacific market is expected to see substantial investments, positioning it as a future powerhouse in the global market.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region, with a market size of 1.25 in 2024, presents unique opportunities in the Oil and Gas Pipeline Repair and Maintenance Services Market. The region's growth is driven by the need for efficient energy transportation and the management of aging infrastructure. As oil and gas remain critical to the economies of many countries, there is an increasing focus on maintaining pipeline integrity to prevent environmental hazards and ensure operational efficiency. Regulatory bodies are beginning to implement stricter guidelines to enhance safety and reliability.

Leading countries in this region include Saudi Arabia and South Africa, where companies like McDermott International and Subsea 7 are making significant inroads. The competitive landscape is characterized by a mix of local and international players, all vying for market share. As investments in pipeline maintenance grow, the region is expected to see a rise in demand for specialized services, driven by both regulatory requirements and the need for operational excellence.