Growth in Aluminum Production

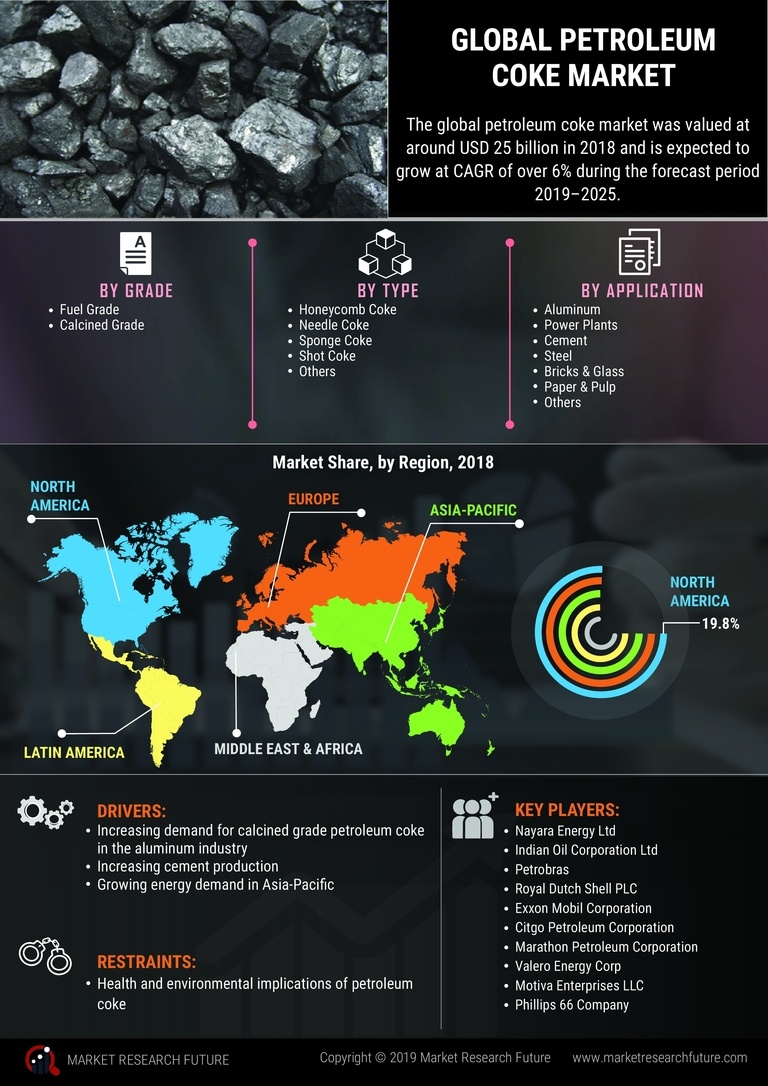

The Petroleum Coke Market is closely linked to the aluminum production sector, which is witnessing robust growth. Petroleum coke is a critical raw material in the production of anodes used in aluminum smelting. As the demand for aluminum rises, driven by its applications in automotive, aerospace, and construction industries, the need for petroleum coke is expected to increase correspondingly. In 2025, the aluminum industry is anticipated to consume a substantial share of petroleum coke, further solidifying its importance in the market. This relationship underscores the interconnectedness of the petroleum coke market with industrial growth, suggesting that fluctuations in aluminum demand could significantly impact petroleum coke consumption.

Expansion of the Cement Industry

The Petroleum Coke Market is benefiting from the expansion of the cement industry, which increasingly utilizes petroleum coke as a fuel source. The cement sector is known for its energy-intensive processes, and petroleum coke offers a cost-effective alternative to traditional fuels. In 2025, the cement industry is projected to account for a considerable portion of petroleum coke consumption, driven by infrastructure development and urbanization trends. This shift towards petroleum coke not only enhances the energy efficiency of cement production but also aligns with sustainability goals, as it reduces reliance on more polluting fuels. Consequently, the growth of the cement industry is likely to serve as a significant driver for the petroleum coke market.

Rising Demand in the Steel Industry

The Petroleum Coke Market is also influenced by the rising demand in the steel industry, where petroleum coke is utilized as a carbon source in the production of steel. As global steel production continues to grow, driven by infrastructure projects and industrialization, the need for petroleum coke is expected to rise. In 2025, the steel sector is projected to consume a notable share of petroleum coke, highlighting its role in enhancing the quality and efficiency of steel manufacturing. This demand is further supported by the industry's shift towards more sustainable practices, as petroleum coke can provide a cleaner alternative to traditional carbon sources, thereby positively impacting the petroleum coke market.

Increasing Demand for Energy Production

The Petroleum Coke Market is experiencing a notable surge in demand due to the increasing need for energy production. As countries strive to meet their energy requirements, petroleum coke serves as a vital feedstock for power generation. In 2025, the energy sector is projected to consume a significant portion of petroleum coke, driven by its high calorific value and cost-effectiveness compared to other fuels. This trend is particularly evident in regions where coal usage is declining, and cleaner alternatives are sought. The transition towards more efficient energy sources is likely to bolster the petroleum coke market, as it is increasingly utilized in power plants and industrial boilers, thereby enhancing its role in the energy landscape.

Technological Advancements in Refining Processes

The Petroleum Coke Market is poised for growth due to technological advancements in refining processes. Innovations in refining technology are enabling more efficient production of petroleum coke, enhancing its quality and reducing production costs. In 2025, these advancements are likely to lead to an increase in the availability of high-quality petroleum coke, which is essential for various industrial applications. As refineries adopt new technologies, the market may witness a shift towards more specialized grades of petroleum coke, catering to specific industry needs. This evolution in refining processes not only supports the growth of the petroleum coke market but also aligns with the broader trends of efficiency and sustainability in the petroleum industry.