Research Methodology on Speciality Papers Market

The research methodology used in preparing this report on the Specialty Papers Market is based on critical and sound primary and secondary research sources. The research methods are designed to provide our clients with thorough, up-to-date data and analysis that helps them make informed decisions.

The primary sources used in this research are industry experts and professionals, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), Sales Managers, Directors, and Market Intelligence Professionals. Secondary sources consist of trade magazines, press releases, company brochures, and the Internet.

Data Triangulation

Two types of data triangulation are used for this research report. The first is industrial triangulation, and the second is geographical triangulation. Industrial triangulation involves collecting data from different data sources and merging it with the primary survey data. Geographical triangulation involves collecting data from different geographical locations, i.e., North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Combining data collected from various sources can provide a more comprehensive view of the market.

Research Methodology

Research Strategy:

in-depth analysis of the speciality papers market is conducted by constructing market estimations for the important segments between 2023 and 2030. To do so, international and domestic statistical sources were studied, and their findings were used to estimate the complete global market. Market estimations were cross-validated with the aid of top-down and bottom-up approaches. The top-down approach is used to assess the overall market size of the Global Specialty Papers, and the bottom-up approach is performed to calculate the market shares for each segment and sub-segment.

Data Sources and Tools Used:

The primary sources used for this research include industry experts, such as CEOs, VPs, directors, market intelligence professionals, and product managers. Secondary sources included trade magazines, market reports, press releases, product brochures, and the Internet.

A comprehensive analysis of the global market is conducted using analytical tools such as SWOT Analysis and Porter’s Five Forces. The market dynamics such as drivers, restraints, and opportunities were studied in detail using specific sources. Financial reports of the leading companies in speciality papers were sourced from the Bloomberg database. The data collected was validated by running various sensitivity tests.

Major Stakeholders:

- Customers

- Manufacturers

- Suppliers

- Technology providers

- Investors

- Research organizations

- Government bodies

- Environment protection agencies

- Distributors

- End-users

Research Scope

The market research report on Specialty Papers Market is based on an in-depth analysis of the market, technology, and foremost participants in the market. The report offers an in-depth and comprehensive analysis based on multiple aspects. It is a comprehensive study of the current state of the global speciality papers market, with a primary emphasis on the business opportunities distributed across the different regions of the world.

Segmentation

The Specialty Papers Market is segmented into type, end-use industry, raw material, and region.

Uncoated Specialty Papers

Coated Specialty Papers

Tissue

Packaging

Graphic papers

Others

Wood

Non-Wood

North America

Europe

Asia-Pacific

South America

Middle East & Africa

Regional Analysis

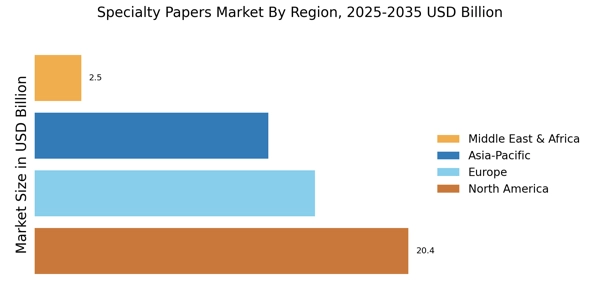

The global market is divided into four broad geographic regions, namely Europe, North America, Asia-Pacific, and the Rest of the World (ROW). These regions were further subdivided into key countries, which are studied in detail in the report. Market estimates were calculated based on the weighted average prices of speciality paper products in the different regions. The market share of each region was calculated using the bottom-up approach, which is based on the market share of each region. The market size of each region was further validated using macro and micro-economic indicators.

The regional analysis sheds light on a variety of aspects, such as the size and structure of the market, overall industry developments, as well as the growth opportunities for leading players in each region.

Competitive Landscape

The Specialty Papers Market report covers the competitive landscape, which highlights the positioning of the key players operating in the global market. The level of competition among the leading players in the market has increased significantly in the past few years. The report also includes information such as company overview, financial overview, products & services, key developments, and strategic initiatives taken by the players to increase their market share in the global Specialty Papers Market.

Key Players

Some of the key players in the global Specialty Papers Market are Nippon Paper Industries Co., Ltd. (Japan), International Paper Company (US), Georgia-Pacific LLC (US), Oji Holdings Corporation (Japan), UPM-Kymmene Oyj (Finland), APP. Sinar Mas (Indonesia), KapStone Paper and Packaging Corporation (US), Cascades Inc. (Canada), Stora Enso Oyj (Finland), Mondi Group (South Africa), and Koehler Paper Group (Germany).

Some of the strategies adopted by these key players to increase their market share are strategic acquisitions and mergers, product launches and innovations, and investments in R&D activities.

Conclusion

The report on Specialty Papers Market provides an in-depth analysis of the industry. The comprehensive research undertakings have descended into the intricate details of the market structure, potential opportunities, and threats that may arise in the future. An understanding of the dynamics and regulatory framework of the market provides a significant outline for the report with fair market estimates for the years ahead. The segmentation component of the report reveals the individual growth prospects of the leading product sub-segments, catering to the specialized requirements of different customers.