Regulatory Compliance

Regulatory compliance regarding product safety and environmental impact is becoming more stringent across various regions. This trend is influencing the formulation and use of dry strength agents in the paper industry. The Paper Dry Strength Agent Market Industry must adapt to these regulations, which often promote the use of safer and more environmentally friendly additives. Compliance with these regulations not only ensures market access but also enhances brand reputation. Companies that proactively align their products with regulatory standards may gain a competitive edge. As regulations evolve, the demand for compliant dry strength agents is likely to increase, creating opportunities for manufacturers to innovate and differentiate their offerings in a crowded marketplace.

Technological Innovations

Technological advancements in the formulation and application of dry strength agents are likely to enhance their effectiveness and efficiency. Innovations such as nanotechnology and advanced polymer chemistry are being integrated into the production processes, leading to the development of superior products. The Paper Dry Strength Agent Market is experiencing a surge in research and development activities aimed at creating agents that offer improved performance characteristics, such as higher strength and lower dosage requirements. This could lead to cost savings for manufacturers and a reduction in waste. As technology continues to evolve, the market may see the introduction of multifunctional agents that not only improve dry strength but also enhance other properties, such as water resistance and printability, thereby broadening their application scope.

Sustainability Initiatives

The increasing emphasis on sustainability within the paper industry appears to drive the demand for dry strength agents. As manufacturers seek to reduce their environmental footprint, the adoption of eco-friendly additives becomes paramount. The Global Paper Dry Strength Agent is witnessing a shift towards bio-based and biodegradable agents, which align with the sustainability goals of many companies. This trend is further supported by regulatory frameworks that encourage the use of sustainable materials. In 2025, the market for sustainable paper products is projected to grow significantly, indicating a robust opportunity for dry strength agents that meet these criteria. Companies that invest in sustainable practices may not only enhance their market position but also appeal to environmentally conscious consumers, thereby potentially increasing their market share.

Rising Demand for Packaging Solutions

The escalating demand for packaging solutions, particularly in the e-commerce sector, is driving growth in the paper industry. As online shopping continues to expand, the need for durable and reliable packaging materials becomes increasingly critical. The Paper Dry Strength Agent Industry is poised to benefit from this trend, as dry strength agents play a crucial role in enhancing the strength and durability of paper products used in packaging. In 2025, the packaging segment is expected to account for a substantial share of the overall paper market, indicating a robust demand for dry strength agents. Manufacturers that can provide high-performance agents tailored for packaging applications may find lucrative opportunities in this growing market segment.

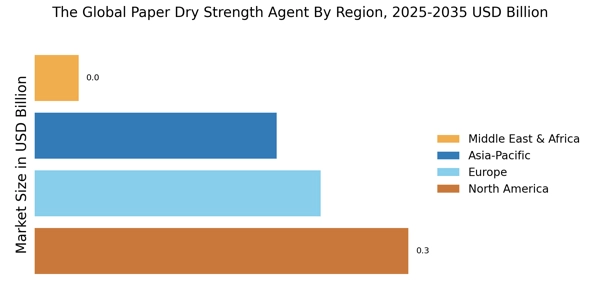

Market Expansion in Emerging Economies

Emerging economies are witnessing rapid industrialization and urbanization, leading to increased demand for paper products. This trend is expected to drive the growth of The Global Paper Dry Strength Agent Industry as manufacturers in these regions seek to enhance the quality and performance of their products. The rising middle class and changing consumer preferences are contributing to a surge in paper consumption, particularly in packaging and hygiene products. As these markets expand, the demand for effective dry strength agents is likely to rise, presenting opportunities for both local and international players. Companies that strategically position themselves in these emerging markets may benefit from the growing demand and establish a strong foothold in the industry.