Regulatory Compliance

Regulatory compliance is increasingly influencing the Cement and Concrete Additives Market. Governments worldwide are implementing stringent regulations to ensure the safety and environmental sustainability of construction materials. Compliance with these regulations often necessitates the use of specific additives that enhance the performance and longevity of concrete. In 2025, the market is expected to see a rise in demand for additives that meet these regulatory standards, as construction companies seek to avoid penalties and enhance their reputations. This trend underscores the importance of innovation in developing compliant products that align with evolving regulations.

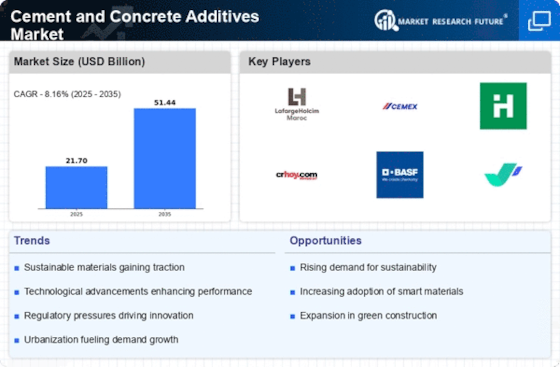

Sustainability Initiatives

The Cement and Concrete Additives Market is increasingly influenced by sustainability initiatives. As environmental concerns rise, there is a growing demand for eco-friendly construction materials. This shift is evident in the adoption of alternative binders and recycled aggregates, which reduce carbon footprints. In 2025, the market for sustainable concrete additives is projected to reach approximately USD 10 billion, reflecting a compound annual growth rate of around 8%. Companies are investing in research and development to create innovative products that meet stringent environmental regulations. This trend not only addresses ecological issues but also enhances the market's appeal to environmentally conscious consumers and builders.

Technological Advancements

Technological advancements play a pivotal role in shaping the Cement and Concrete Additives Market. Innovations in material science and engineering have led to the development of high-performance additives that improve the properties of concrete. For instance, the introduction of superplasticizers and fiber-reinforced additives has revolutionized concrete formulations, enhancing workability and strength. In 2025, the market for advanced concrete additives is anticipated to grow significantly, driven by the construction industry's need for more efficient and durable materials. These advancements not only optimize production processes but also contribute to the overall sustainability of construction practices.

Rising Construction Activities

The Cement and Concrete Additives Market is experiencing a surge in demand due to rising construction activities across various sectors. With increasing investments in residential, commercial, and industrial projects, the need for high-quality cement industry and concrete additives is becoming more pronounced. In 2025, the construction sector is projected to grow at a rate of 5% annually, driving the demand for additives that improve concrete performance. This growth is further fueled by the need for durable and sustainable construction solutions, prompting manufacturers to innovate and expand their product offerings to meet the evolving needs of the market.

Urbanization and Infrastructure Development

Rapid urbanization is a key driver for the Cement and Concrete Additives Market. As populations migrate to urban areas, the demand for housing, roads, and infrastructure escalates. In 2025, it is estimated that urban areas will house over 60% of the global population, necessitating significant investments in construction. This surge in infrastructure projects is likely to increase the consumption of cement and concrete additives, which enhance the durability and performance of concrete. The market is expected to witness a robust growth trajectory, with a projected increase in demand for high-performance concrete additives that cater to the needs of modern construction.