Aluminum Market Summary

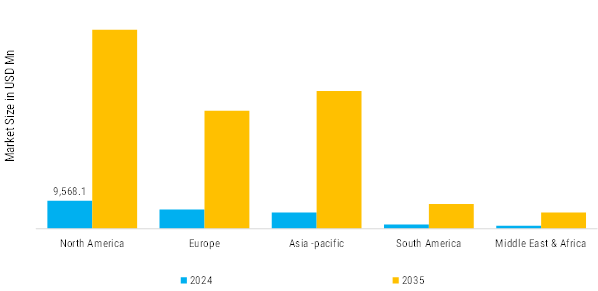

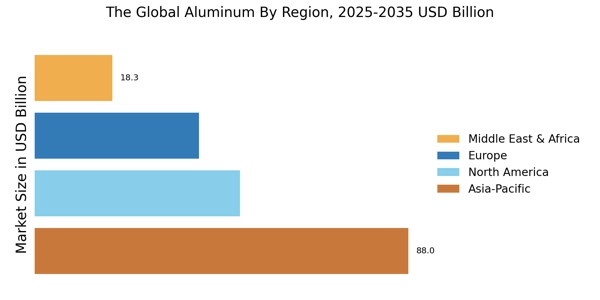

As per Market Research Future analysis, The Aluminum Market Size was valued at USD 1,95,126.7 million in 2024. The Aluminum Market Industry is projected to grow from USD 2,05,592.1 million in 2025 to USD 3,47,442.9 million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.385% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The Aluminum Market is experiencing robust structural trends driven by electrification, sustainability mandates, and supply constraints.

- Electric vehicles (EVs) propel aluminium use, with EVs requiring 30-50% more aluminium than internal combustion models for batteries, chassis, and structures. Renewable energy, especially solar panels.

- Global inventories hit multi-year lows, with LME stocks down 20% year-on-year, signaling physical tightness. China's production caps, energy shortages, and stalled expansions limit output growth, fostering deficits projected at 365,000 tonnes in 2026.

- Bauxite shortages loom as Guinea's exports falter amid political unrest, hiking alumina costs 25% year-on-year. Water scarcity curtails Middle East smelters, idling 300,000 tonnes capacity. Cybersecurity threats target automated casting lines, prompting USD 2 billion in industry-wide defenses.

- Additive manufacturing integrates aluminium alloys for complex aerospace and automotive parts, cutting weight by 20-30% while enhancing strength. Nano-aluminizing improves corrosion resistance in marine and EV applications, extending lifespans by 40%.

Market Size & Forecast

| 2024 Market Size | 1,95,126.7 (USD Million) |

| 2035 Market Size | 3,47,442.9 (USD Million) |

| CAGR (2025 - 2035) | 5.385% |

Major Players

Blue Diamond growers, Treehouse California Almonds LLC, Barry Callebaut, Royal Nut Company, Olam Group Limited, Harris Woolf Almonds, Almondco Australia, Borges Agricultural & Industrial Nuts, Select Harvest Limited, and Mariani Nut Company.