Pet Treat Products Market Summary

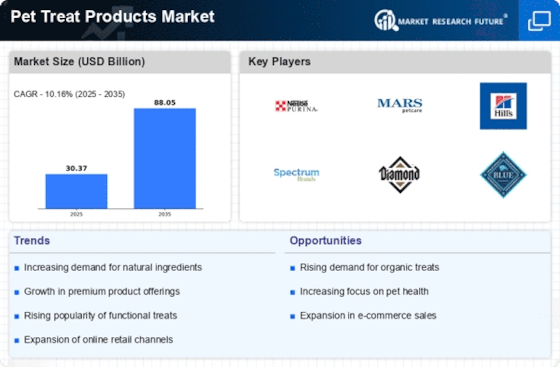

As per Market Research Future analysis, the Pet Treat Products Market Size was estimated at 30.37 USD Billion in 2024. The Pet Treat Products industry is projected to grow from 33.46 USD Billion in 2025 to 88.05 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 10.16% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Pet Treat Products Market is experiencing a dynamic shift towards health-conscious and sustainable offerings.

- Health-conscious treats are gaining traction, reflecting a growing consumer preference for nutritious options.

- Sustainable practices are increasingly prioritized, with brands focusing on ethical sourcing and eco-friendly packaging.

- E-commerce growth is reshaping the market landscape, facilitating easier access to a wider variety of pet treats.

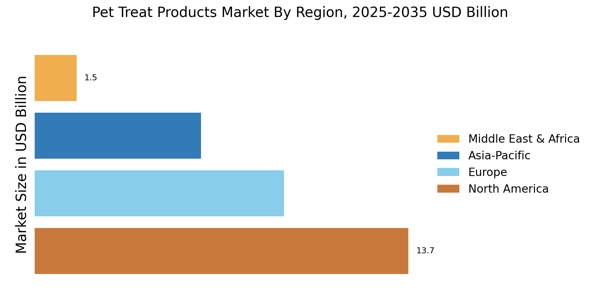

- The humanization of pets and health and wellness trends are major drivers propelling the demand for flavored kibbles and pellets in North America and sticks and wafers in the Asia-Pacific region.

Market Size & Forecast

| 2024 Market Size | 30.37 (USD Billion) |

| 2035 Market Size | 88.05 (USD Billion) |

| CAGR (2025 - 2035) | 10.16% |

Major Players

Nestle Purina PetCare (US), Mars Petcare (US), Hill's Pet Nutrition (US), Spectrum Brands (US), Diamond Pet Foods (US), Blue Buffalo (US), WellPet (US), PetSmart (US), TropiClean (US)