E-Commerce Expansion

The rapid expansion of e-commerce platforms has transformed the way consumers purchase pet treats, significantly impacting the Pet Treat Market. With the convenience of online shopping, pet owners are increasingly turning to digital channels to find a wider variety of products, often at competitive prices. Recent statistics suggest that online sales of pet treats have surged, accounting for nearly 30% of total sales in the industry. This shift not only provides consumers with greater access to niche and premium products but also allows brands to reach a broader audience. As e-commerce continues to grow, the Pet Treat Market is expected to adapt, enhancing online presence and marketing strategies to capture this expanding consumer base.

Humanization of Pets

The trend of pet humanization is significantly influencing the Pet Treat Market, as pet owners increasingly view their pets as family members. This shift in perception has led to a greater willingness to invest in high-quality treats that mirror human food trends, such as gourmet flavors and artisanal options. Data suggests that the premium segment of the pet treat market is expanding rapidly, with consumers seeking out products that offer unique experiences for their pets. This humanization trend not only drives sales but also encourages brands to create more sophisticated marketing strategies that resonate with pet owners' emotional connections to their pets. As this trend continues, the Pet Treat Market is likely to evolve, reflecting the changing dynamics of pet ownership.

Health and Wellness Trends

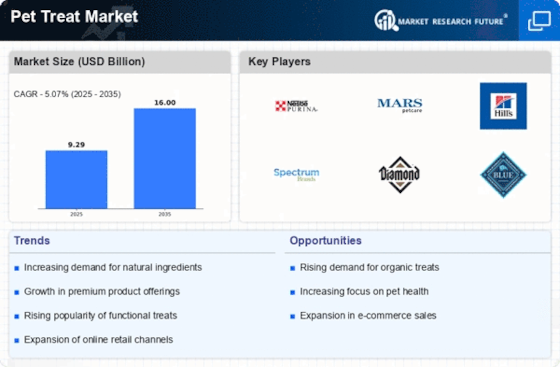

The increasing focus on health and wellness among pet owners appears to be a driving force in the Pet Treat Market. Consumers are increasingly seeking treats that are not only palatable but also beneficial for their pets' health. This trend is reflected in the rising demand for organic, natural, and functional treats that promote specific health benefits, such as dental care or joint support. According to recent data, the market for health-oriented pet treats has seen a growth rate of approximately 10% annually, indicating a robust shift towards healthier options. As pet owners become more educated about pet nutrition, the Pet Treat Market is likely to continue evolving to meet these health-conscious demands.

Innovative Product Development

Innovation in product development is a key driver in the Pet Treat Market, as brands strive to differentiate themselves in a competitive landscape. The introduction of unique flavors, textures, and formats caters to the diverse preferences of pets and their owners. Additionally, the incorporation of functional ingredients, such as probiotics or superfoods, is becoming increasingly common, appealing to health-conscious consumers. Market analysis indicates that innovative products are gaining traction, with a notable increase in sales for treats that offer added health benefits. As companies continue to invest in research and development, the Pet Treat Market is poised for ongoing growth, driven by the demand for novel and beneficial products.

Sustainability and Ethical Sourcing

Sustainability has emerged as a crucial consideration for consumers in the Pet Treat Market. Pet owners are increasingly concerned about the environmental impact of their purchases, leading to a demand for sustainably sourced and eco-friendly products. This trend is evident in the rise of brands that prioritize ethical sourcing, biodegradable packaging, and transparency in ingredient sourcing. Recent surveys indicate that a significant portion of consumers is willing to pay a premium for treats that align with their values regarding sustainability. As awareness of environmental issues continues to grow, the Pet Treat Market is likely to see an increase in the availability and popularity of sustainable options, reflecting a broader shift towards responsible consumerism.