Rising Pet Ownership Rates

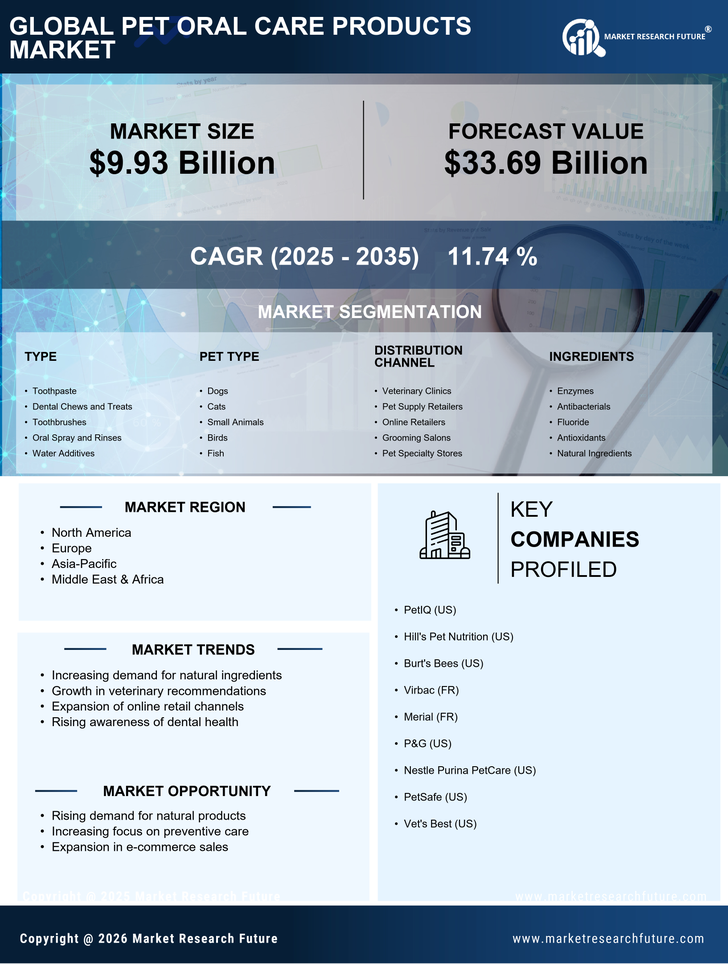

The Pet oral care Products Market appears to be significantly influenced by the increasing rates of pet ownership. As more households adopt pets, the demand for various pet care products, including oral care items, is likely to rise. Recent statistics indicate that pet ownership has surged, with approximately 70% of households owning at least one pet. This trend suggests a growing market for pet oral care products, as pet owners become more aware of the importance of maintaining their pets' dental health. Consequently, the Pet Oral Care Products Market is expected to expand, driven by the need for effective solutions to prevent dental diseases in pets, which can lead to more serious health issues if left untreated.

Expansion of Retail Channels

The expansion of retail channels is a significant driver for the Pet Oral Care Products Market. With the rise of e-commerce and the proliferation of pet specialty stores, consumers now have greater access to a wide range of oral care products for their pets. This increased availability is likely to enhance consumer convenience and encourage more frequent purchases. Market data suggests that online sales of pet care products have grown by over 20% in the past year, reflecting a shift in shopping habits. As retailers continue to diversify their offerings and improve distribution strategies, the Pet Oral Care Products Market is poised for further growth, as consumers are more likely to explore and purchase oral care solutions for their pets.

Growing Awareness of Pet Health

There is a notable increase in awareness regarding pet health, which is positively impacting the Pet Oral Care Products Market. Pet owners are becoming more educated about the significance of oral hygiene in pets, recognizing that poor dental health can lead to various health complications. This heightened awareness is prompting owners to invest in oral care products, such as dental chews, toothpaste, and mouth rinses. Market data suggests that the demand for these products has risen by approximately 15% over the past year, indicating a shift in consumer behavior towards prioritizing pet health. As this trend continues, the Pet Oral Care Products Market is likely to see sustained growth, driven by informed pet owners seeking to enhance their pets' overall well-being.

Innovation in Product Offerings

Innovation plays a crucial role in the Pet Oral Care Products Market, as manufacturers continuously develop new and improved products to meet the evolving needs of pet owners. The introduction of advanced formulations, such as enzymatic toothpaste and dental gels, has garnered attention from consumers seeking effective solutions for their pets' oral health. Additionally, the incorporation of natural ingredients in product formulations aligns with the growing trend towards holistic pet care. Market analysis indicates that innovative products are driving a significant portion of sales within the industry, with a projected growth rate of 10% annually. This focus on innovation not only enhances the Pet Oral Care Products Market but also encourages pet owners to adopt regular oral care routines for their pets.

Increase in Veterinary Recommendations

The Pet Oral Care Products Market is experiencing growth due to an increase in veterinary recommendations for oral care products. Veterinarians are increasingly emphasizing the importance of dental health during routine check-ups, advising pet owners on the necessity of using oral care products to prevent dental diseases. This professional endorsement is likely to influence consumer purchasing decisions, as pet owners trust their veterinarians' expertise. Recent surveys indicate that approximately 60% of pet owners are more inclined to purchase oral care products when recommended by their veterinarians. As this trend continues, the Pet Oral Care Products Market is expected to benefit from the heightened credibility and trust associated with veterinary endorsements, leading to increased sales and market penetration.