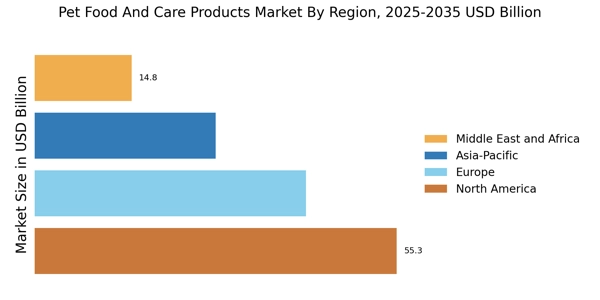

North America : Market Leader in Pet Care

North America is the largest market for pet food and care products, accounting for approximately 40% of the global market share. The region's growth is driven by increasing pet ownership, a trend towards premium pet food, and rising health consciousness among pet owners. Regulatory support for pet food safety and quality standards further catalyzes market expansion. The U.S. leads this market, followed by Canada, which holds around 10% of the share.

The competitive landscape is characterized by major players such as Nestle Purina PetCare, Mars Petcare, and Hill's Pet Nutrition, which dominate the market with innovative product offerings. The presence of these key players fosters a dynamic environment, encouraging continuous product development and marketing strategies aimed at enhancing pet health and wellness. The focus on natural and organic ingredients is also gaining traction among consumers, shaping future trends.

Europe : Emerging Trends in Pet Care

Europe is witnessing significant growth in the pet food and care products market, holding approximately 30% of the global share. The increasing trend of pet humanization, where pets are treated as family members, drives demand for premium and specialized products. Regulatory frameworks, such as the European Food Safety Authority guidelines, ensure high safety and quality standards, further boosting consumer confidence in pet food products. The UK and Germany are the largest markets, contributing significantly to the region's growth.

Leading countries in Europe include the UK, Germany, and France, with a competitive landscape featuring key players like Unicharm and various local brands. The market is characterized by a mix of established companies and innovative startups focusing on niche segments, such as organic and grain-free pet foods. This diversity fosters a vibrant market environment, encouraging continuous innovation and adaptation to consumer preferences.

Asia-Pacific : Rapid Growth in Pet Ownership

Asia-Pacific is rapidly emerging as a significant market for pet food and care products, accounting for about 20% of the global market share. The region's growth is fueled by rising disposable incomes, urbanization, and a growing trend of pet ownership, particularly in countries like China and India. Regulatory improvements in food safety standards are also enhancing consumer trust in pet food products. China is the largest market in the region, followed by Japan, which holds a substantial share as well.

The competitive landscape in Asia-Pacific is diverse, with both international and local players vying for market share. Key companies like Unicharm and local brands are innovating to cater to the unique preferences of pet owners in the region. The focus on premiumization and health-oriented products is becoming increasingly prominent, as consumers seek high-quality options for their pets. This trend is expected to continue driving market growth in the coming years.

Middle East and Africa : Untapped Potential in Pet Care

The Middle East and Africa region is witnessing a gradual increase in the pet food and care products market, currently holding about 10% of the global share. The growth is driven by rising disposable incomes, urbanization, and a growing interest in pet ownership, particularly in urban areas. Regulatory frameworks are evolving to ensure better safety and quality standards in pet food, which is crucial for building consumer trust. South Africa and the UAE are the leading markets in this region, contributing significantly to its growth.

The competitive landscape is characterized by a mix of local and international players, with companies focusing on expanding their product offerings to meet the diverse needs of pet owners. The presence of key players is increasing, and there is a growing trend towards premium and specialized pet food products. As awareness of pet care continues to rise, the market is expected to expand further, tapping into the potential of this emerging market.