North America : Innovation and Sustainability Focus

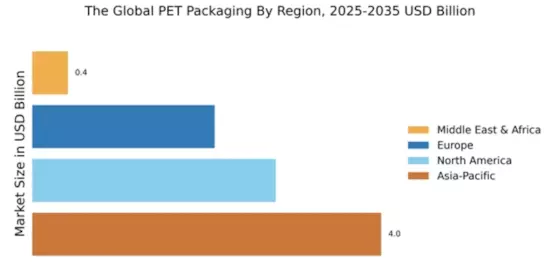

The North American PET packaging market, valued at $2.79B, is driven by increasing demand for sustainable packaging solutions and innovations in recycling technologies. Regulatory initiatives aimed at reducing plastic waste are catalyzing growth, with companies investing in eco-friendly materials and processes. The region's focus on sustainability aligns with consumer preferences, further boosting market potential.

Leading countries like the US and Canada dominate the market, with key players such as Amcor plc and Berry Global Inc. driving competition. The presence of established manufacturers and a robust supply chain enhances market dynamics. As companies innovate and adapt to regulatory changes, the competitive landscape is expected to evolve, fostering further growth in the sector.

Europe : Sustainability and Regulatory Compliance

Europe's PET packaging market, valued at $2.09B, is characterized by stringent regulations promoting sustainability and recycling. The European Union's directives on plastic waste management are significant growth drivers, pushing companies to adopt eco-friendly practices. The region's commitment to reducing plastic pollution is evident in its market dynamics, with a growing emphasis on circular economy principles.

Germany, France, and the UK are leading countries in this market, with major players like Mondi Group plc and Constantia Flexibles Group GmbH at the forefront. The competitive landscape is marked by innovation and collaboration among companies to meet regulatory standards. As the market evolves, the focus on sustainable packaging solutions is expected to strengthen, aligning with consumer demand for environmentally responsible products.

Asia-Pacific : Rapid Growth and Market Leadership

The Asia-Pacific region leads The Global PET Packaging with a valuation of $4.0B, driven by rapid industrialization and urbanization. The increasing demand for packaged food and beverages, coupled with rising disposable incomes, fuels market growth. Regulatory support for sustainable packaging practices is also a key driver, as governments encourage eco-friendly initiatives to combat plastic waste.

Countries like China, India, and Japan are pivotal in this market, with significant contributions from key players such as Alpla Werke Alwin Lehner GmbH and Plastipak Holdings, Inc. The competitive landscape is vibrant, with numerous local and international companies vying for market share. As the region continues to expand, innovation in packaging solutions will play a crucial role in maintaining its market leadership.

Middle East and Africa : Emerging Market with Growth Potential

The Middle East and Africa (MEA) PET packaging market, valued at $0.41B, is an emerging segment with significant growth potential. Factors such as increasing urbanization, population growth, and rising consumer awareness about sustainable packaging are driving demand. Regulatory frameworks are gradually evolving to support eco-friendly practices, which is expected to further enhance market growth in the coming years.

Countries like South Africa and the UAE are leading the market, with a growing presence of key players such as Sealed Air Corporation and SABIC. The competitive landscape is characterized by a mix of local and international companies, focusing on innovation and sustainability. As the region develops, the PET packaging market is poised for substantial growth, driven by changing consumer preferences and regulatory support.