Market Trends

Key Emerging Trends in the Personal Services Robotics Market

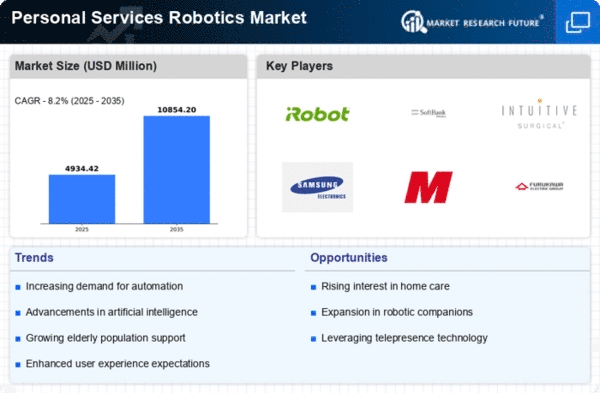

The growing incorporation of machine learning and artificial intelligence (AI) into personal service robots is one such development. These robots are programmed with capabilities that allow them to converse, identify emotions, and provide company, meeting the emotional and social requirements of their users. In response, businesses in the industry are providing modular designs that let users add or update features in accordance with their needs. This pattern indicates a move toward customized robotics solutions, in which consumers can design own robots to perform a range of functions, from housework to medical support. The creation of environmentally friendly robots is a growing phenomenon in the personal service robotics market, in response to the international push for sustainability. In order to develop robots with a less environmental impact, manufacturers place a strong emphasis on employing energy-efficient components and sustainable materials. Redefining the market is the decentralization of personal service robots, which is another noteworthy trend. Personal service robots have become more widely available and reasonably priced, meaning that their use is no longer restricted to niche niches. These robots are now accessible to a wider range of customers, including small businesses and individual consumers, thanks to the democratization movement. Because of its accessibility, the market is made more inclusive and a wider spectrum of users can take use of personal service robots' capabilities. Furthermore, there is a growing emphasis in the industry on human-robot collaboration, wherein robots are engineered to operate in harmony with humans. Cobots, or collaborative robots, are being researched to help with a variety of activities without endangering human safety. This tendency is especially noticeable in sectors like healthcare, where robots work beside medical professionals to improve patient care and optimize processes. To guarantee the appropriate use of data, manufacturers and programmers are proactively addressing these issues by putting in place comprehensive safety and privacy protocols. From the introduction of machine learning and AI to the creation of socially supportive robots, the industry is going through a revolutionary time. Customization, ecological responsibility, and democratization are highlighted, highlighting a market that is both technologically sophisticated and sensitive to the varied requirements and tastes of its customers.

Leave a Comment