North America : Leading Market Innovators

North America is poised to maintain its leadership in the Factory Robotics Repair and Maintenance Services Market, holding a significant market share of $2.6B in 2025. The region's growth is driven by rapid technological advancements, increased automation in manufacturing, and a strong focus on operational efficiency. Regulatory support for automation and robotics further fuels demand, as industries seek to enhance productivity and reduce downtime.

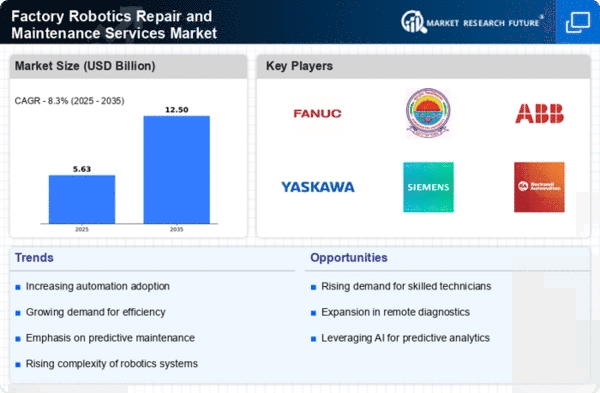

The competitive landscape is robust, with key players like Rockwell Automation, Siemens, and ABB leading the charge. The U.S. stands out as a major contributor, leveraging its technological prowess and innovation. The presence of established companies and a growing number of startups in robotics services ensures a dynamic market environment, fostering continuous improvement and service diversification.

Europe : Emerging Robotics Hub

Europe is witnessing a significant rise in the Factory Robotics Repair and Maintenance Services Market, projected at $1.5B by 2025. The region benefits from strong regulatory frameworks promoting automation and sustainability, driving demand for advanced robotics solutions. Countries like Germany and France are at the forefront, investing heavily in Industry 4.0 initiatives, which enhance operational efficiency and competitiveness in manufacturing.

The competitive landscape features major players such as KUKA and ABB, alongside a growing number of local firms specializing in robotics services. Germany, as a manufacturing powerhouse, leads the charge, supported by favorable government policies and funding for innovation. This environment fosters collaboration between industry and academia, ensuring a steady pipeline of skilled professionals and cutting-edge technologies.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a key player in the Factory Robotics Repair and Maintenance Services Market, with a projected size of $1.0B by 2025. The region's growth is driven by increasing industrial automation, particularly in countries like China and Japan, where manufacturing sectors are rapidly adopting robotics to improve efficiency and reduce labor costs. Government initiatives supporting smart manufacturing further catalyze this trend, creating a favorable environment for robotics services.

China leads the region in robotics adoption, with significant investments in automation technologies. Key players like Fanuc and Yaskawa are pivotal in shaping the market landscape, offering innovative solutions tailored to local needs. The competitive environment is characterized by a mix of established firms and emerging startups, fostering innovation and service diversification in the robotics sector.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is at the nascent stage of the Factory Robotics Repair and Maintenance Services Market, with a size of $0.1B projected for 2025. The growth potential is significant, driven by increasing investments in industrial automation and a shift towards smart manufacturing practices. Countries like the UAE and South Africa are beginning to embrace robotics, supported by government initiatives aimed at diversifying economies and enhancing productivity.

The competitive landscape is still developing, with a few key players starting to establish a presence. Local firms are beginning to explore partnerships with international companies to leverage expertise and technology. As the region continues to invest in infrastructure and technology, the demand for robotics services is expected to grow, presenting opportunities for both local and global players.