North America : Innovation and Leadership Hub

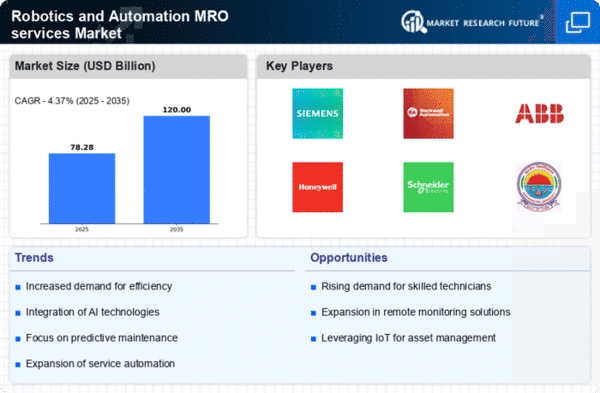

North America leads the Robotics and Automation MRO services market with a commanding 40.0% share. The region's growth is driven by rapid technological advancements, increased automation in manufacturing, and supportive government policies promoting innovation. The demand for efficient maintenance solutions is rising as industries seek to enhance productivity and reduce downtime. Regulatory frameworks are also evolving to support automation initiatives, further fueling market expansion. The competitive landscape in North America is robust, featuring key players like Siemens, Rockwell Automation, and Honeywell. The U.S. stands out as a leader, with significant investments in robotics and automation technologies. Companies are focusing on integrating AI and IoT into their MRO services, enhancing operational efficiency. The presence of established firms and a strong startup ecosystem fosters innovation, making North America a pivotal region in the global market.

Europe : Emerging Robotics Powerhouse

Europe holds a significant 20.0% share of the Robotics and Automation MRO services market, driven by increasing demand for automation across various sectors. The region benefits from stringent regulations aimed at enhancing workplace safety and efficiency, which catalyze the adoption of advanced robotics solutions. Countries like Germany and France are at the forefront, investing heavily in R&D to boost automation capabilities and improve service delivery. Germany is a key player in the European market, with companies like ABB and KUKA leading the charge in robotics innovation. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. The European Union's commitment to digital transformation and sustainability initiatives further supports the growth of MRO services, positioning Europe as a vital player in the global robotics landscape.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific accounts for a 10.0% share of the Robotics and Automation MRO services market, with countries like Japan and China leading the way in automation adoption. The region's growth is fueled by increasing labor costs and a strong push towards modernization in manufacturing processes. Governments are implementing policies to support technological advancements, which is driving demand for MRO services in robotics and automation sectors. Japan is home to major players like Fanuc and Yaskawa Electric, which are pivotal in shaping the market landscape. The competitive environment is intensifying as more companies enter the space, focusing on innovative solutions to meet the growing demand. The region's emphasis on smart manufacturing and Industry 4.0 initiatives is expected to further accelerate the adoption of robotics and automation services, making Asia-Pacific a key area for future growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region holds a modest 5.0% share of the Robotics and Automation MRO services market, but it presents significant growth opportunities. The demand for automation is rising as industries seek to improve efficiency and reduce operational costs. Government initiatives aimed at diversifying economies and investing in technology are driving the adoption of robotics solutions across various sectors, including manufacturing and logistics. Countries like South Africa and the UAE are emerging as key players in the market, with investments in smart technologies and automation solutions. The competitive landscape is evolving, with both local and international firms vying for market presence. As the region continues to embrace digital transformation, the potential for growth in MRO services is substantial, positioning the Middle East and Africa as a future hub for robotics and automation.