Innovation in Product Offerings

Innovation plays a crucial role in shaping the Organic Milk Protein Market, as manufacturers continuously seek to develop new and diverse product offerings. The introduction of flavored organic milk protein powders, ready-to-drink protein shakes, and fortified products has expanded the market's appeal to a broader audience. This trend is supported by market data showing that innovative product launches have contributed to a significant increase in consumer interest and sales. For instance, the introduction of plant-based blends that combine organic milk protein with other protein sources has attracted consumers looking for versatile dietary options. Furthermore, advancements in processing technologies have enabled manufacturers to enhance the nutritional profile of organic milk protein products, making them more appealing to health-conscious consumers. As a result, innovation remains a key driver of growth in the Organic Milk Protein Market.

Rising Demand for Nutritional Products

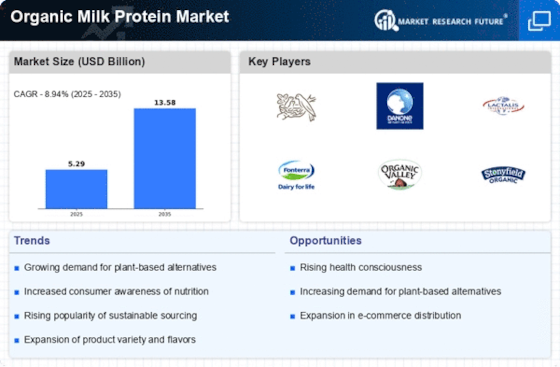

The Organic Milk Protein Market is experiencing a notable increase in demand for nutritional products, driven by a growing awareness of health and wellness among consumers. As individuals become more health-conscious, they are seeking high-quality protein sources that align with their dietary preferences. This trend is reflected in the rising sales of organic milk protein products, which are perceived as healthier alternatives to conventional protein sources. According to recent data, the organic milk protein segment has seen a compound annual growth rate of approximately 8% over the past few years, indicating a robust market potential. This demand is further fueled by the increasing popularity of fitness and wellness regimes, where organic milk protein is often incorporated into dietary plans. Consequently, manufacturers are expanding their product lines to cater to this evolving consumer preference.

Increased Awareness of Dietary Proteins

The Organic Milk Protein Market is benefiting from a heightened awareness of the importance of dietary proteins in maintaining overall health. As consumers become more educated about nutrition, they are increasingly recognizing the role of protein in muscle development, weight management, and overall well-being. This awareness is reflected in the growing popularity of high-protein diets, which often incorporate organic milk protein as a primary source. Market Research Future indicates that the demand for protein-rich products has surged, with organic milk protein being favored for its high biological value and digestibility. Additionally, the rise of social media and health influencers has further amplified this awareness, leading to increased consumer interest in organic milk protein products. Consequently, this trend is likely to continue driving growth in the Organic Milk Protein Market.

Regulatory Support for Organic Products

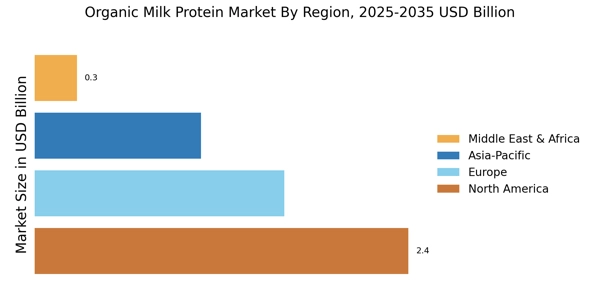

Regulatory support for organic products is a significant driver in the Organic Milk Protein Market, as governments worldwide implement policies that promote organic farming and production. These regulations often include certification processes that ensure the integrity of organic products, thereby enhancing consumer trust. As consumers become more discerning about their food choices, the presence of regulatory frameworks that support organic standards is likely to bolster the market. Data suggests that regions with strong organic certification programs have seen a corresponding increase in organic product sales, including organic milk protein. This regulatory backing not only encourages farmers to adopt organic practices but also reassures consumers about the quality and safety of the products they purchase. As such, the ongoing development of supportive regulations is expected to positively influence the growth trajectory of the Organic Milk Protein Market.

Sustainability and Environmental Concerns

Sustainability has emerged as a pivotal driver within the Organic Milk Protein Market, as consumers increasingly prioritize environmentally friendly products. The organic farming practices associated with organic milk protein production are perceived as more sustainable compared to conventional methods. This perception is supported by data indicating that organic dairy farming can lead to reduced greenhouse gas emissions and improved soil health. As consumers become more aware of the environmental impact of their food choices, they are more likely to opt for organic milk protein products. This shift is not only beneficial for the environment but also aligns with the values of a growing segment of the population that seeks to support ethical and sustainable agricultural practices. Consequently, brands that emphasize their commitment to sustainability are likely to gain a competitive edge in the Organic Milk Protein Market.