Increasing Protein Demand

The growing awareness of the health benefits associated with protein consumption is driving the milk protein market in Thailand. Consumers are increasingly seeking high-protein diets, which has led to a surge in demand for protein-rich dairy products. According to recent data, the protein intake in Thailand has risen by approximately 15% over the past five years, reflecting a shift towards healthier eating habits. This trend is particularly evident among fitness enthusiasts and health-conscious individuals who prioritize protein for muscle recovery and overall wellness. As a result, manufacturers are innovating and expanding their product lines to include milk protein supplements, fortified dairy products, and ready-to-drink protein beverages. The milk protein market is thus positioned to benefit from this increasing demand, as consumers continue to prioritize protein as a key component of their diets.

Growth of Functional Foods

The rise of functional foods in Thailand is significantly impacting the milk protein market. Functional foods, which offer health benefits beyond basic nutrition, are becoming increasingly popular among Thai consumers. This trend is driven by a desire for products that support health and wellness, such as those that enhance immunity, improve digestion, and promote muscle health. The milk protein market is adapting to this demand by developing products that incorporate milk protein as a key ingredient in functional food formulations. For instance, the introduction of yogurt enriched with milk protein and probiotics has gained traction, appealing to health-conscious consumers. Market data indicates that the functional food sector in Thailand is expected to grow at a CAGR of 8% over the next five years, further bolstering the milk protein market as manufacturers seek to capitalize on this trend.

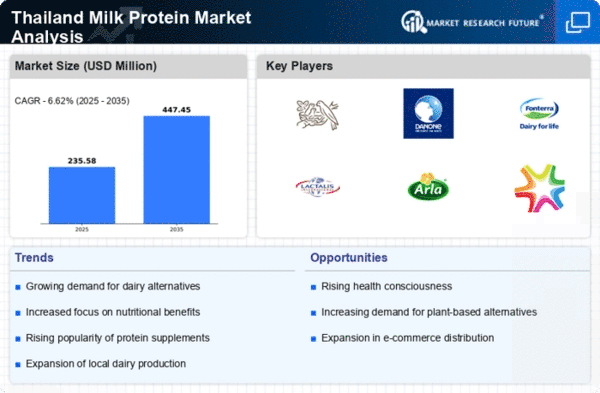

Expansion of E-commerce Channels

The expansion of e-commerce channels in Thailand is significantly impacting the milk protein market. With the increasing penetration of the internet and mobile devices, consumers are increasingly turning to online platforms for their grocery shopping, including dairy products. This shift towards e-commerce presents a unique opportunity for the milk protein market to reach a wider audience and enhance product accessibility. Online retailers are offering a diverse range of milk protein products, from protein powders to fortified dairy items, catering to the growing demand for convenience and variety. Market data indicates that online grocery sales in Thailand are expected to grow by 30% over the next few years, suggesting that the milk protein market must adapt to this trend by optimizing online marketing strategies and distribution channels to capture the evolving consumer preferences.

Rising Popularity of Dairy Alternatives

The increasing popularity of dairy alternatives in Thailand is influencing the milk protein market. As more consumers adopt plant-based diets or reduce their dairy intake for various reasons, including lactose intolerance and ethical concerns, the demand for milk protein is evolving. While this may seem counterintuitive, the milk protein market is responding by innovating and creating hybrid products that combine dairy and plant-based proteins. This approach allows manufacturers to cater to a broader audience, including those seeking the nutritional benefits of milk protein while also appealing to the growing segment of consumers interested in plant-based options. Market analysis suggests that the dairy alternative segment is projected to grow by 20% in the next few years, indicating a shift in consumer preferences that the milk protein market must navigate.

Technological Advancements in Dairy Processing

Technological advancements in dairy processing are playing a crucial role in shaping the milk protein market in Thailand. Innovations in processing techniques, such as microfiltration and ultrafiltration, enable manufacturers to produce high-quality milk protein with enhanced nutritional profiles. These technologies not only improve the efficiency of protein extraction but also enhance the functional properties of milk protein, making it more appealing for various applications in food and beverage products. The milk protein market is likely to benefit from these advancements, as they allow for the development of new products that meet consumer demands for quality and functionality. Furthermore, the integration of automation and smart technologies in dairy processing is expected to streamline production processes, reduce costs, and improve product consistency, thereby fostering growth in the milk protein market.