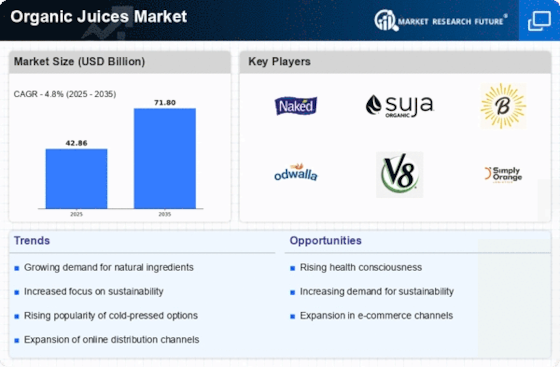

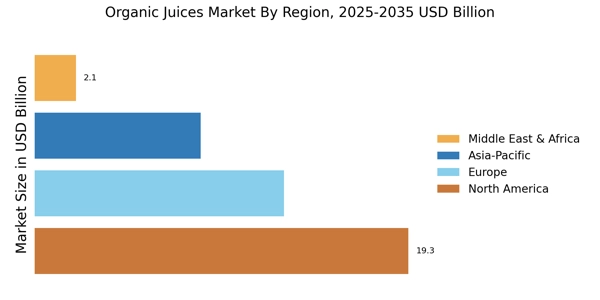

The Organic Juices Market is currently experiencing a notable transformation, driven by a growing consumer preference for health-conscious products. This shift is largely influenced by increasing awareness regarding the benefits of organic ingredients, which are perceived as more nutritious and environmentally friendly. As consumers become more discerning about their dietary choices, the demand for organic juices is likely to rise, reflecting a broader trend towards natural and wholesome food options. Additionally, the market is witnessing innovations in product offerings, with brands exploring unique flavor combinations and functional beverages that cater to specific health needs. This diversification may attract a wider audience, further propelling market growth. Moreover, the Organic Juices Market is also influenced by changing lifestyle patterns, particularly among younger demographics who prioritize convenience and sustainability. The rise of e-commerce platforms has made organic juices more accessible, allowing consumers to purchase these products with ease. As sustainability becomes a focal point for many brands, there is a potential for increased collaboration with local farmers and suppliers, which could enhance the authenticity and appeal of organic juices. Overall, the market appears poised for continued expansion, driven by evolving consumer preferences and innovative approaches to product development.

Health and Wellness Focus

The organic juice market US has been growing rapidly as more consumers choose healthier, natural beverage options free from artificial additives and pesticides, making organic juices a prominent segment within the broader juice industry. Shoppers frequently seek out the best organic juices USA that deliver clean flavor, nutritional value, and ingredient transparency, with popular choices often highlighting 100% fruit and vegetable blends, minimal processing, and no added sugars. One reason for this shift is the increasing awareness of cold pressed juice benefits, which include higher retention of vitamins, enzymes, and antioxidants compared with traditional heat-pasteurized juices, supporting overall wellness, hydration, and detoxification efforts. A number of organic juice brands US have become well-known for their commitment to organic farming and quality, offering a range of products from single-serve bottles to family-size options featuring blends like green juices, citrus mixes, and fruit medleys. With rising health consciousness and demand for functional beverages, the organic juice market growth in the US is expected to continue strong momentum, driven by innovation in flavors, packaging, and distribution channels both in stores and online.

The Organic Juices Market is increasingly aligned with the health and wellness movement, as consumers seek beverages that contribute positively to their overall well-being. This trend indicates a preference for juices that are not only organic but also fortified with vitamins, minerals, and other beneficial ingredients.

Sustainability and Ethical Sourcing

Sustainability is becoming a critical factor in the Organic Juices Market, with consumers showing a preference for products that are ethically sourced and environmentally friendly. Brands that emphasize sustainable practices in their production processes may gain a competitive edge.

Innovative Flavor Profiles

The Organic Juices Market is witnessing a surge in innovative flavor profiles, as manufacturers experiment with unique combinations of fruits, vegetables, and herbs. This trend suggests that consumers are increasingly open to trying new and exotic flavors, which could enhance their overall juice experience.