Top Industry Leaders in the Organic Juices Market

Strategies Adopted by Organic Juices Key Players

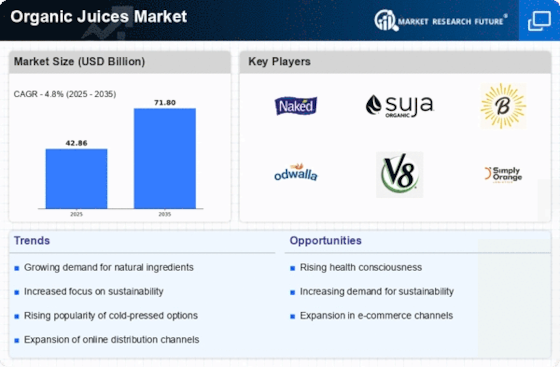

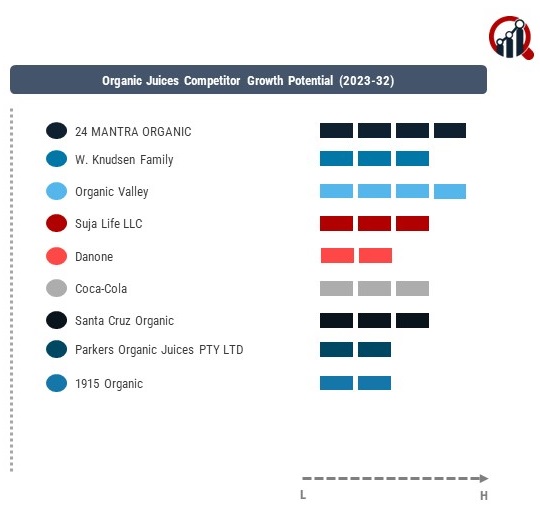

The competitive landscape of the organic juices market is characterized by a mix of established players and emerging companies striving to capitalize on the increasing consumer preference for organic and healthier beverage options. As demand for organic juices continues to rise, companies within this sector are deploying various strategies to secure market share, emphasizing factors such as brand recognition, product quality, and sustainable sourcing.

Key Players:

24 MANTRA ORGANIC

- Knudsen Family

Organic Valley

Suja Life LLC

Danone

Coca-Cola

Santa Cruz Organic

Parkers Organic Juices PTY LTD

1915 Organic

Lakewood Juice Company

Hain Celestial Group

James White Drinks

Evolution Fresh

Purity Organic

Uncle Matt's

In the competitive realm of organic juices, companies adopt strategies centered around product differentiation and sustainable practices. Established players invest in research and development to introduce new flavors and blends that cater to evolving consumer tastes. Additionally, marketing efforts focus on promoting the organic and natural attributes of the products, emphasizing the absence of synthetic additives and preservatives.

Sustainable sourcing and eco-friendly packaging are key components of the strategies employed by major players. Companies are increasingly aligning their operations with environmentally conscious practices to resonate with the growing consumer awareness of sustainability issues. Partnerships with organic farmers and certification programs play a crucial role in ensuring the authenticity of the organic claim.

Market Share Analysis:

Market share analysis in the organic juices sector is influenced by various factors, with brand reputation and consumer trust ranking high. Established brands often enjoy a competitive advantage as consumers associate their names with quality and reliability. Pricing strategies are also pivotal, as companies need to strike a balance between offering premium organic products and ensuring affordability to appeal to a broad customer base.

Distribution channels and accessibility play a crucial role in market share, with companies striving to secure prominent shelf space in retail outlets and expanding their presence in online platforms. Companies that can effectively navigate these factors are better positioned to capture a larger share of the organic juices market.

New and Emerging Companies:

While major players dominate, new and emerging companies are making strides in the organic juices market, often targeting niche segments with specialized offerings. Brands such as Suja Life, known for its cold-pressed organic juices, and small-scale regional players focusing on unique flavor profiles contribute to the market's diversity.

These emerging companies often emphasize transparency in their sourcing and production processes, aiming to appeal to consumers seeking authentic organic options. The agility of these smaller players allows them to quickly respond to changing consumer preferences, introducing innovative blends and packaging formats.

Industry Trends:

The organic juices market has experienced notable trends and industry news that reflect the evolving landscape. A significant trend is the increasing consumer demand for functional organic juices with added health benefits. Companies are investing in incorporating superfoods, vitamins, and other natural ingredients to enhance the nutritional profile of their products.

Moreover, there is a growing emphasis on digital marketing and e-commerce channels. Companies are capitalizing on the online shopping trend, investing in robust e-commerce platforms and digital advertising to reach a broader audience. Social media campaigns and influencer collaborations are becoming standard practices to engage with consumers and build brand awareness.

Competitive Scenario:

The overall competitive scenario in the organic juices market is marked by intense competition among both established players and new entrants. Consumer preference for organic and natural products acts as a driving force, compelling companies to continually innovate and adapt their strategies. Sustainability and transparent sourcing have become integral components of maintaining a competitive edge in this market.

Recent Development

Suja Life:

- Attracting customers who value ethics, the company introduced its "Drink to a Cause" range of cold-pressed juice blends that benefit environmental and social causes.

- created a traceability system using blockchain technology to follow the path of its components from farm to bottle, guaranteeing authenticity and transparency.