North America : Market Leader in Dental Care

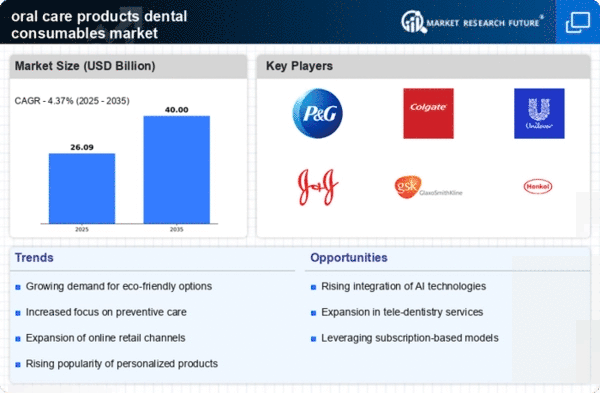

North America continues to lead the oral care products dental consumables market, holding a significant share of 10.0 in 2025. The growth is driven by increasing consumer awareness regarding oral hygiene, coupled with innovative product launches and advancements in dental technology. Regulatory support for dental health initiatives further propels market demand, making it a robust sector for investment and development. The competitive landscape is characterized by major players such as Procter & Gamble, Colgate-Palmolive, and Johnson & Johnson, which dominate the market with their extensive product portfolios. The U.S. remains the largest market, supported by high disposable incomes and a strong focus on preventive dental care. This region's commitment to quality and innovation positions it as a benchmark for global standards in oral care.

Europe : Emerging Trends in Oral Care

Europe's oral care products dental consumables market is valued at 8.0 in 2025, reflecting a growing trend towards premium products and sustainability. The demand is fueled by increasing health consciousness among consumers and stringent regulations promoting oral health. The European Union's initiatives to enhance dental care accessibility and quality standards are pivotal in shaping market dynamics, encouraging innovation and competition. Leading countries like Germany, France, and the UK are at the forefront, with a competitive landscape featuring key players such as Unilever and GlaxoSmithKline. The market is witnessing a shift towards eco-friendly products, aligning with consumer preferences for sustainable options. This trend is expected to drive growth, as companies adapt to meet evolving consumer demands and regulatory requirements.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region, with a market size of 5.0 in 2025, is experiencing rapid growth in the oral care products dental consumables sector. This growth is driven by rising disposable incomes, urbanization, and increasing awareness of dental hygiene. Regulatory frameworks are evolving to support better oral health practices, which is crucial for market expansion in countries like China and India, where demand is surging. China and India are leading the charge, with a competitive landscape that includes both local and international players. Companies like Colgate-Palmolive and Procter & Gamble are investing heavily in marketing and distribution to capture the growing consumer base. The region's diverse demographics and varying consumer preferences present both challenges and opportunities for market players aiming to establish a strong foothold in this dynamic environment.

Middle East and Africa : Untapped Potential in Oral Care

The Middle East and Africa region, with a market size of 2.0 in 2025, presents significant untapped potential in the oral care products dental consumables market. The growth is driven by increasing urbanization, rising disposable incomes, and a growing awareness of oral hygiene. Regulatory bodies are beginning to implement standards that promote better dental health, which is expected to catalyze market growth in the coming years. Countries like South Africa and the UAE are leading the market, with a competitive landscape that includes both local and international brands. Key players are focusing on expanding their product offerings to cater to diverse consumer needs. The region's unique challenges, such as varying access to dental care, create opportunities for innovative solutions and partnerships to enhance market penetration.