Rising Geriatric Population

The dental consumables market in North America is poised for growth due to the rising geriatric population. As the population ages, there is an increasing prevalence of dental issues, necessitating the use of various dental consumables. By 2030, it is estimated that nearly 20% of the U.S. population will be aged 65 and older, which could lead to a heightened demand for dental products tailored to this demographic. The dental consumables market is adapting to these changes by developing specialized products that address the unique needs of older adults, such as denture adhesives and oral care solutions for sensitive gums. This demographic shift presents a significant opportunity for manufacturers to innovate and expand their product lines, ultimately driving market growth.

Focus on Aesthetic Dental Products

The dental consumables market in North America is increasingly influenced by a growing focus on aesthetic dental products. Consumers are becoming more conscious of their appearance, leading to a rise in demand for cosmetic dental procedures and products. This trend is reflected in the market for whitening agents, veneers, and orthodontic products, which are projected to grow significantly. The dental consumables market is responding to this demand by offering a wider range of aesthetic solutions that cater to consumer preferences. As a result, manufacturers are investing in marketing and product development to capture this lucrative segment. The emphasis on aesthetics not only drives sales but also encourages innovation within the industry, as companies strive to meet the evolving expectations of consumers.

Expansion of Dental Insurance Coverage

The dental consumables market in North America is significantly influenced by the expansion of dental insurance coverage. As more individuals gain access to dental insurance, the frequency of dental visits increases, leading to higher consumption of dental products. Recent statistics indicate that approximately 60% of Americans have some form of dental insurance, which encourages regular check-ups and preventive care. This trend is likely to bolster the dental consumables market, as insured patients are more inclined to purchase necessary dental products. Furthermore, insurance plans increasingly cover preventive services, which may lead to a rise in the use of consumables such as sealants and fluoride treatments. Consequently, the market is expected to benefit from this growing accessibility to dental care, fostering a more health-conscious consumer base.

Increasing Demand for Oral Hygiene Products

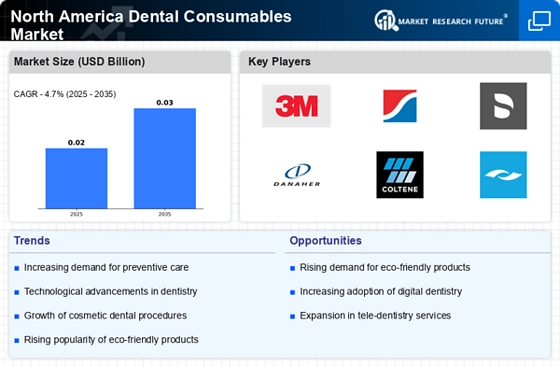

The dental consumables market in North America experiences a notable surge in demand for oral hygiene products. This trend is driven by heightened awareness of dental health among consumers, leading to increased spending on preventive care. According to recent data, the market for oral hygiene products is projected to grow at a CAGR of approximately 5.5% over the next five years. This growth is indicative of a broader shift towards preventive dental care, as consumers prioritize maintaining oral health to avoid costly treatments. The dental consumables market is thus witnessing a transformation, with manufacturers focusing on innovative products that cater to this growing demand. As a result, companies are investing in research and development to create effective and appealing oral hygiene solutions, further propelling market growth.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is reshaping the dental consumables market in North America. Innovations such as digital imaging, 3D printing, and tele-dentistry are enhancing the efficiency and effectiveness of dental care. As dental practices adopt these technologies, there is a corresponding increase in the demand for consumables that complement these advancements. For instance, the use of 3D printing in creating dental prosthetics has led to a rise in the consumption of specific materials and tools. The dental consumables market is likely to benefit from this trend, as practitioners seek high-quality products that align with their technological capabilities. This integration not only improves patient outcomes but also drives the market towards more sophisticated and specialized consumables.