Advancements in Drug Formulations

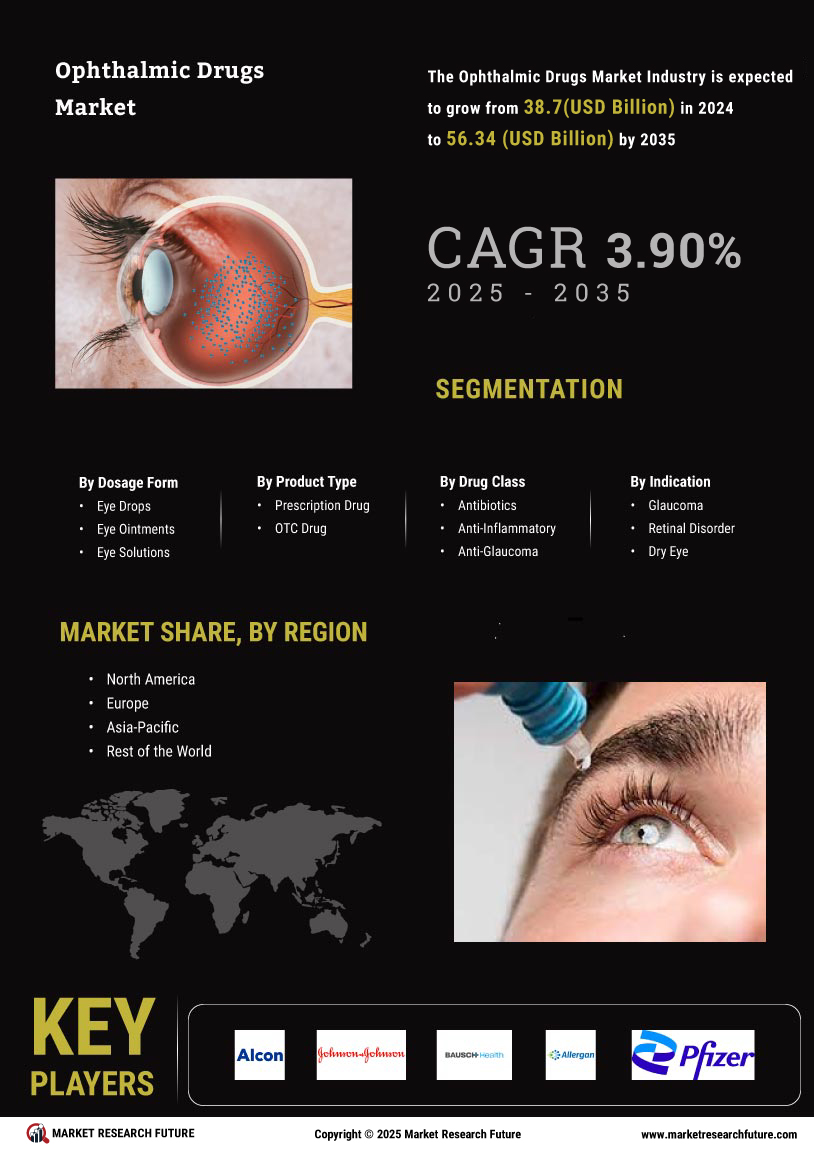

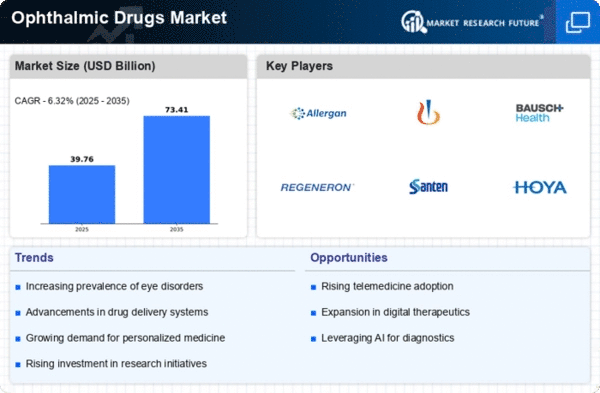

Innovations in drug formulations are significantly influencing the Global Ophthalmic Drugs Market Industry. The development of novel drug delivery systems, such as sustained-release formulations and nanotechnology-based products, enhances the efficacy and safety of ophthalmic treatments. These advancements not only improve patient compliance but also expand the therapeutic options available for various eye conditions. As a result, the market is poised for growth, with projections indicating an increase to 56.3 USD Billion by 2035. The continuous evolution of drug formulations is likely to attract investment and research, fostering a competitive landscape in the ophthalmic drugs sector.

Increasing Healthcare Expenditure

The Global Ophthalmic Drugs Market Industry is benefiting from rising healthcare expenditure across various regions. Governments and private sectors are allocating more resources to healthcare, which includes funding for ophthalmic treatments. This trend is particularly evident in developed nations, where healthcare budgets are expanding to accommodate advanced medical technologies and therapies. As a result, patients have better access to ophthalmic drugs, which is expected to contribute to a compound annual growth rate of 3.47% from 2025 to 2035. Enhanced healthcare spending is likely to facilitate the introduction of innovative ophthalmic solutions, thereby driving market growth.

Rising Prevalence of Eye Disorders

The Global Ophthalmic Drugs Market Industry is experiencing growth due to the increasing prevalence of eye disorders such as glaucoma, cataracts, and age-related macular degeneration. According to health statistics, millions of individuals worldwide are affected by these conditions, necessitating effective treatment options. This rising incidence is likely to drive demand for ophthalmic drugs, contributing to the market's projected value of 38.7 USD Billion in 2024. As the global population ages, the burden of eye diseases is expected to escalate, further propelling the need for innovative therapies and medications in the ophthalmic sector.

Emerging Markets and Demographic Shifts

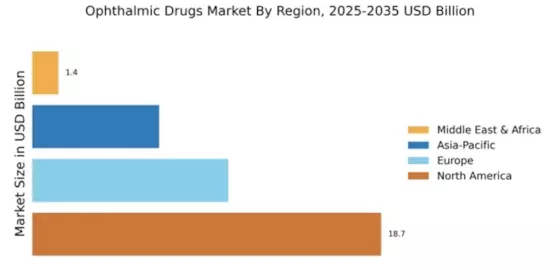

The Global Ophthalmic Drugs Market Industry is witnessing growth driven by emerging markets and demographic shifts. Countries in Asia-Pacific and Latin America are experiencing rapid urbanization and an increase in disposable income, leading to greater access to healthcare services. Additionally, demographic changes, such as an aging population, are contributing to a higher prevalence of eye disorders. These factors are expected to create lucrative opportunities for pharmaceutical companies, as they seek to expand their presence in these regions. The market's expansion in emerging economies could significantly influence global trends and drive innovation in ophthalmic drug development.

Growing Awareness and Screening Programs

Increased awareness regarding eye health and the importance of regular eye examinations is propelling the Global Ophthalmic Drugs Market Industry. Public health initiatives and screening programs are being implemented globally to educate individuals about eye disorders and promote early detection. Such initiatives are crucial in reducing the burden of preventable blindness and vision impairment. As more people become aware of the need for timely treatment, the demand for ophthalmic drugs is expected to rise. This heightened awareness is likely to play a pivotal role in shaping the market dynamics, ensuring a steady influx of patients seeking ophthalmic care.