Growing Awareness of Eye Health

There is a notable increase in public awareness regarding eye health, which is positively impacting the UK ophthalmic drugs market. Educational campaigns and initiatives led by organizations such as the Royal National Institute of Blind People (RNIB) have played a crucial role in informing the public about the importance of regular eye examinations and early detection of eye diseases. This heightened awareness is likely to result in more individuals seeking medical advice and treatment for eye conditions, thereby driving demand for ophthalmic drugs. Furthermore, as patients become more informed about available treatment options, they may actively engage with healthcare providers to explore innovative therapies. This trend suggests that the UK ophthalmic drugs market will continue to benefit from an informed patient population, leading to increased utilization of ophthalmic products.

Government Initiatives and Funding

Government initiatives aimed at improving eye health are significantly influencing the UK ophthalmic drugs market. The UK government has recognized the importance of addressing eye health issues and has implemented various programs to enhance access to ophthalmic care. For example, the NHS Long Term Plan emphasizes the need for improved eye care services, which includes increased funding for research and development of new ophthalmic drugs. This commitment to eye health is likely to foster innovation and attract investment in the sector. Additionally, public health campaigns aimed at raising awareness about eye health may lead to earlier diagnosis and treatment of eye disorders, further driving demand for ophthalmic drugs. As a result, the UK ophthalmic drugs market is poised for growth, supported by robust government backing.

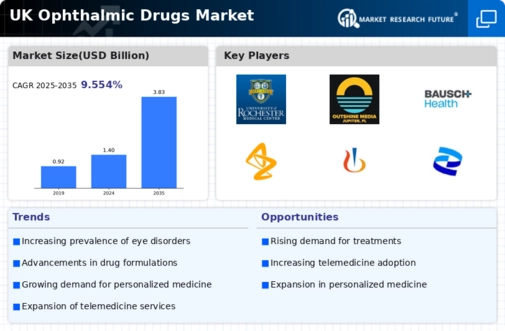

Increasing Prevalence of Eye Disorders

The UK ophthalmic drugs market is experiencing growth due to the rising prevalence of eye disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration. According to the National Health Service (NHS), the number of individuals diagnosed with these conditions has been steadily increasing, leading to a higher demand for effective treatment options. This trend is further supported by an aging population, as older adults are more susceptible to various eye diseases. The increasing burden of these disorders necessitates the development and availability of innovative ophthalmic drugs, thereby driving market expansion. Furthermore, the NHS has allocated significant funding towards eye health initiatives, which may enhance access to necessary treatments and contribute to the overall growth of the UK ophthalmic drugs market.

Rising Demand for Innovative Therapies

The UK ophthalmic drugs market is witnessing a surge in demand for innovative therapies, particularly in the treatment of chronic eye conditions. Patients and healthcare providers are increasingly seeking advanced treatment options that offer improved efficacy and safety profiles. The emergence of biologics and gene therapies has opened new avenues for managing previously untreatable conditions, thereby expanding the market landscape. According to recent reports, the biologics segment within the ophthalmic drugs market is expected to grow significantly, driven by the introduction of new products and the increasing acceptance of these therapies among clinicians. This trend indicates a shift towards more personalized treatment approaches, which may enhance patient outcomes and satisfaction. Consequently, the demand for innovative therapies is likely to propel the growth of the UK ophthalmic drugs market.

Advancements in Ophthalmic Drug Formulations

Innovations in drug formulations are playing a pivotal role in shaping the UK ophthalmic drugs market. Recent advancements in sustained-release technologies and nanotechnology have led to the development of more effective and patient-friendly ophthalmic products. For instance, the introduction of preservative-free formulations has improved patient compliance and reduced the risk of ocular toxicity. The UK market has seen a surge in the approval of novel drug delivery systems, which enhance the bioavailability of therapeutic agents. According to the Medicines and Healthcare products Regulatory Agency (MHRA), the approval rate for new ophthalmic drugs has increased, reflecting the industry's commitment to research and development. These advancements not only improve treatment outcomes but also stimulate competition among pharmaceutical companies, thereby driving growth in the UK ophthalmic drugs market.