Increasing Aging Population

The South America Ophthalmic Drugs Market is experiencing growth due to the increasing aging population in the region. As individuals age, they become more susceptible to various eye disorders, including cataracts, glaucoma, and age-related macular degeneration. According to demographic data, the proportion of individuals aged 65 and older is projected to rise significantly in South America, leading to a higher demand for ophthalmic drugs. This demographic shift necessitates the development and distribution of effective treatments tailored to the needs of older patients. Consequently, pharmaceutical companies are likely to invest in research and development to create innovative solutions that address age-related eye conditions, thereby driving the market forward.

Rising Healthcare Expenditure

The South America Ophthalmic Drugs Market is benefiting from the rising healthcare expenditure across several countries in the region. Governments and private sectors are increasingly allocating funds to improve healthcare infrastructure and access to medical services. For instance, Brazil and Argentina have made substantial investments in healthcare, which includes the procurement of ophthalmic medications. This increase in spending is likely to enhance the availability of essential drugs for treating eye conditions, thereby expanding the market. Furthermore, as healthcare systems evolve, there is a growing emphasis on providing comprehensive eye care services, which may further stimulate demand for ophthalmic drugs.

Increased Awareness of Eye Health

The South America Ophthalmic Drugs Market is witnessing growth driven by increased awareness of eye health among the population. Public health campaigns and educational initiatives are effectively informing individuals about the importance of regular eye examinations and early detection of eye disorders. As awareness rises, more people are seeking medical attention for their eye-related issues, leading to a higher demand for ophthalmic drugs. This trend is particularly evident in urban areas where access to healthcare services is improving. Consequently, the increased focus on eye health is likely to contribute positively to the growth of the ophthalmic drugs market in South America.

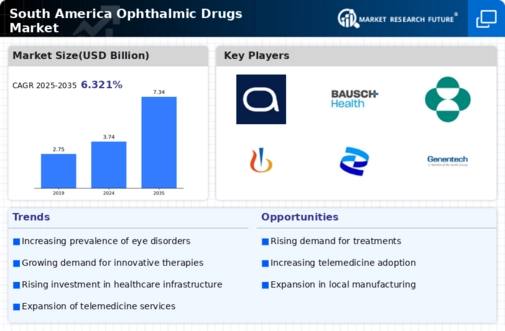

Emergence of Telemedicine in Eye Care

The South America Ophthalmic Drugs Market is being influenced by the emergence of telemedicine in eye care. The adoption of telehealth services allows patients to consult with ophthalmologists remotely, facilitating timely diagnosis and treatment of eye conditions. This trend is particularly relevant in rural areas where access to specialized eye care may be limited. As telemedicine becomes more prevalent, it is expected to drive the demand for ophthalmic drugs, as patients are more likely to receive prescriptions and follow-up care through virtual consultations. This shift towards digital healthcare solutions may enhance the overall efficiency of eye care delivery in South America.

Regulatory Support for Ophthalmic Innovations

The South America Ophthalmic Drugs Market is poised for growth due to regulatory support for innovations in ophthalmic treatments. Regulatory bodies in countries like Brazil and Chile are actively promoting the approval of new drugs and therapies aimed at treating eye diseases. This supportive regulatory environment encourages pharmaceutical companies to invest in research and development, leading to the introduction of novel ophthalmic drugs. Moreover, initiatives aimed at expediting the approval process for critical medications may result in a faster market entry for innovative products, thus enhancing competition and availability in the South American market.