Growing Awareness and Education

There is a growing awareness and education regarding eye health among the German population, which is positively impacting the Germany ophthalmic drugs market. Public health campaigns and initiatives by organizations such as the German Ophthalmological Society are promoting regular eye examinations and early detection of eye diseases. This increased awareness is leading to higher rates of diagnosis and treatment, thereby driving demand for ophthalmic drugs. Furthermore, educational programs aimed at healthcare professionals are enhancing their ability to identify and manage eye disorders effectively. As a result, patients are more likely to seek timely treatment, which is expected to contribute to the growth of the market. The emphasis on eye health education is likely to foster a more proactive approach to eye care, ultimately benefiting the Germany ophthalmic drugs market.

Regulatory Support for Innovation

The regulatory landscape in Germany is becoming increasingly supportive of innovation within the ophthalmic drugs market. The Federal Institute for Drugs and Medical Devices (BfArM) has implemented streamlined approval processes for new ophthalmic therapies, which encourages pharmaceutical companies to invest in research and development. This regulatory support is particularly crucial for the introduction of novel therapies that address unmet medical needs in the field of ophthalmology. Additionally, the European Medicines Agency (EMA) has established guidelines that facilitate the development of orphan drugs for rare eye diseases, further stimulating innovation. As a result, the Germany ophthalmic drugs market is likely to witness a surge in new product launches, which could enhance treatment options for patients and improve overall healthcare outcomes. The favorable regulatory environment is expected to play a pivotal role in shaping the future of the market.

Rising Incidence of Eye Disorders

The prevalence of eye disorders in Germany is on the rise, which is significantly influencing the Germany ophthalmic drugs market. Conditions such as age-related macular degeneration, diabetic retinopathy, and glaucoma are becoming increasingly common, particularly among the aging population. According to recent statistics, approximately 6 million people in Germany are affected by some form of visual impairment, which underscores the urgent need for effective therapeutic solutions. This growing patient population is driving demand for innovative ophthalmic drugs, as healthcare providers seek to address these conditions with advanced treatment options. Consequently, pharmaceutical companies are investing heavily in research and development to create new drugs that cater to this expanding market. The increasing burden of eye diseases is expected to contribute to a robust growth trajectory for the Germany ophthalmic drugs market in the coming years.

Aging Population and Demographic Shifts

The demographic shifts in Germany, particularly the aging population, are exerting a significant influence on the Germany ophthalmic drugs market. As the population ages, the incidence of age-related eye conditions is expected to rise, leading to an increased demand for ophthalmic medications. Current projections indicate that by 2030, nearly 25% of the German population will be over the age of 65, a demographic that is particularly susceptible to eye disorders. This trend is prompting pharmaceutical companies to focus on developing targeted therapies for age-related conditions, thereby expanding their product portfolios. Additionally, the healthcare system is adapting to accommodate the needs of this aging demographic, which may include increased funding for ophthalmic treatments. The implications of these demographic changes are likely to shape the future landscape of the Germany ophthalmic drugs market.

Technological Advancements in Drug Delivery

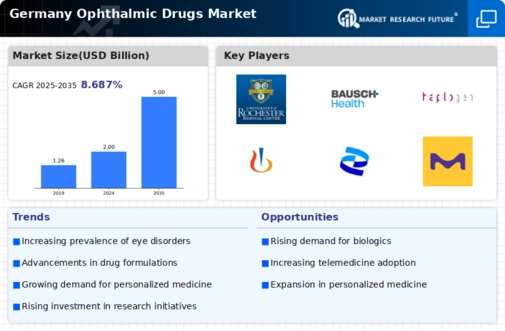

The Germany ophthalmic drugs market is experiencing a notable transformation due to technological advancements in drug delivery systems. Innovations such as sustained-release formulations and targeted delivery mechanisms are enhancing the efficacy of ophthalmic medications. For instance, the introduction of nanotechnology in drug formulation has shown promise in improving bioavailability and reducing systemic side effects. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% over the next five years. This growth is driven by the increasing demand for more effective and patient-friendly treatment options, which are becoming essential in managing chronic eye conditions. Furthermore, the integration of digital health technologies, such as telemedicine and mobile health applications, is likely to facilitate better patient adherence to treatment regimens, thereby further propelling the Germany ophthalmic drugs market.