Emergence of IoT Devices

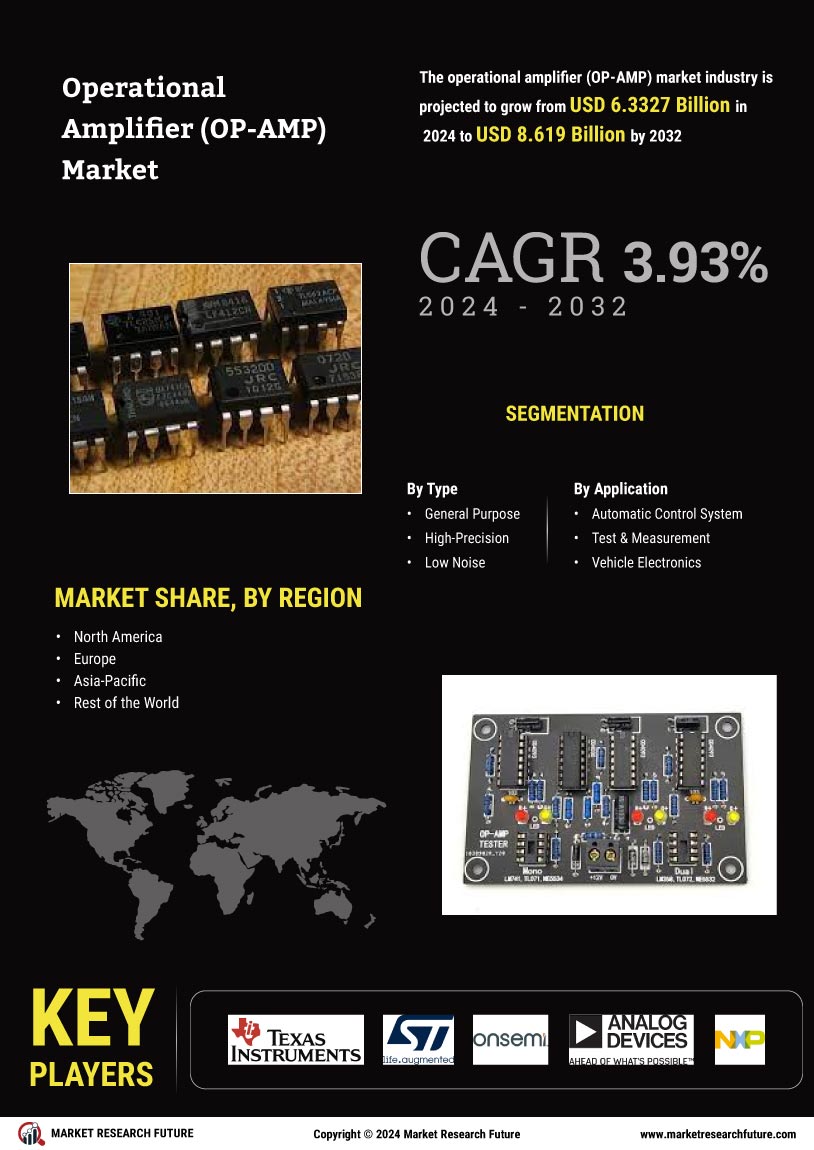

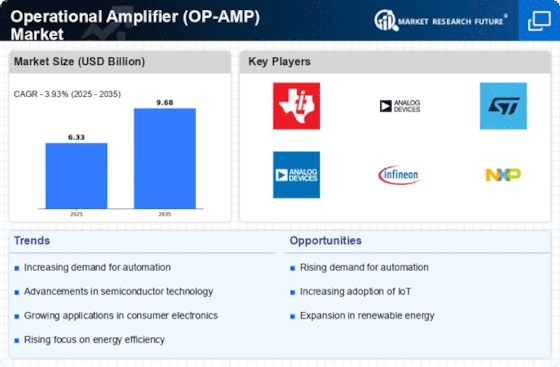

The Operational Amplifier Market (OP-AMP) Market is poised for growth due to the emergence of Internet of Things (IoT) devices. As IoT technology continues to evolve, the demand for efficient and reliable OP-AMPs is likely to increase. These components are essential for signal amplification and processing in various IoT applications, including smart home devices, industrial automation, and healthcare monitoring systems. Market forecasts suggest that the IoT market could reach a valuation of over 1 trillion dollars by 2025, which may drive the need for advanced OP-AMP solutions. This trend indicates that manufacturers will need to innovate and adapt their OP-AMP offerings to cater to the specific requirements of IoT applications, thereby shaping the future of the market.

Growth in Automotive Applications

The Operational Amplifier Market (OP-AMP) Market is significantly influenced by the expansion of automotive applications. With the automotive sector increasingly adopting advanced driver-assistance systems (ADAS) and electric vehicles (EVs), the demand for OP-AMPs is expected to rise. These components play a crucial role in various automotive functions, including sensor signal conditioning, motor control, and battery management systems. Recent market analyses suggest that the automotive electronics market is anticipated to grow at a CAGR of around 7% in the coming years, which could lead to a substantial increase in OP-AMP utilization. This growth indicates a shift towards more sophisticated electronic systems in vehicles, thereby enhancing the relevance of OP-AMPs in the automotive domain.

Advancements in Medical Technology

The Operational Amplifier Market (OP-AMP) Market is significantly impacted by advancements in medical technology. The healthcare sector is increasingly utilizing OP-AMPs in diagnostic equipment, imaging systems, and patient monitoring devices. These components are crucial for accurate signal processing and amplification in various medical applications. Market Research Future indicate that the medical device market is projected to grow at a CAGR of around 5% in the coming years, which could lead to heightened demand for OP-AMPs. This growth suggests that manufacturers may need to focus on developing specialized OP-AMP solutions that cater to the stringent requirements of medical applications, thereby enhancing their market position.

Increased Focus on Renewable Energy

The Operational Amplifier Market (OP-AMP) Market is also benefiting from the increased focus on renewable energy solutions. As countries strive to transition towards sustainable energy sources, the demand for OP-AMPs in solar inverters, wind turbine controllers, and energy management systems is likely to rise. These components are vital for efficient energy conversion and management, which are essential in renewable energy applications. Recent data indicates that the renewable energy market is expected to grow at a CAGR of approximately 8% over the next decade, suggesting a robust demand for OP-AMPs in this sector. This trend highlights the potential for OP-AMP manufacturers to align their products with the growing emphasis on sustainability and energy efficiency.

Rising Demand in Consumer Electronics

The Operational Amplifier Market (OP-AMP) Market is experiencing a notable surge in demand driven by the proliferation of consumer electronics. As devices such as smartphones, tablets, and wearables become increasingly sophisticated, the need for high-performance OP-AMPs is amplified. These components are integral in signal processing, audio amplification, and sensor interfacing, which are critical functionalities in modern electronics. Market data indicates that the consumer electronics sector is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, further propelling the demand for OP-AMPs. This trend suggests that manufacturers are likely to invest in advanced OP-AMP technologies to meet the evolving requirements of consumers, thereby enhancing the overall market landscape.