Market Analysis

Operational Amplifier (OP-AMP) Market (Global, 2024)

Introduction

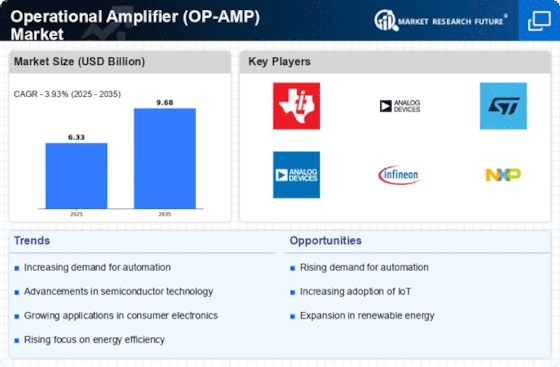

The market for operational amplifiers (OP-AMPs) is poised to experience significant growth, as the demand for high-performance electrical components continues to grow across industries. The OP-AMP, with its versatility and efficiency in signal processing, is used in many applications, from consumer electronics to automation and automobiles. Moreover, as technology continues to evolve, the use of OP-AMPs in new designs is becoming more commonplace, especially in the IoT, medical devices, and telecommunications industries. In addition, the need for miniaturization and energy efficiency is driving the development of next-generation OP-AMPs, which are able to meet the stringent requirements of modern applications. Furthermore, the burgeoning smart technology and automation industries will create new opportunities for OP-AMP manufacturers, as they seek to enhance functionality and reduce costs. These factors will create a challenging and dynamic environment for the OP-AMP market, and will require a deep understanding of the current and future trends.

PESTLE Analysis

- Political

- Operational Amplifier (OP-Amp) Market in 2024 is expected to be influenced by several political factors, including government policies on technology and manufacturing. In the United States, for instance, the government has allocated around $52 billion for the development of the semiconductor industry, which directly affects the production of electronic components such as operational amplifiers. Furthermore, trade tensions between China and the United States have imposed tariffs on the import of components, which has affected the supply chains and prices of companies in both regions.

- Economic

- In 2024, the economy is characterized by fluctuating inflation, which is expected to average about 3.5 percent worldwide. Inflation has a significant impact on the price of raw materials used in the manufacture of op amps, such as silicon and other semi-conductor materials. In addition, the market for electronics is expected to reach $1.2 billion, and a significant part of this growth is expected to come from the growing demand for consumer electronics, automobiles, and industrial automation, all of which are heavily dependent on op amps.

- Social

- In 2024 the growing inclination of consumers for automation and the smart devices will lead to a demand for op-amps in many fields. Surveys show that about 65% of consumers are willing to pay a premium for smart home appliances, which in many cases use op-amps for signal processing. In addition, the increase in remote work and distance learning has led to a growing demand for personal electronic devices and a greater need for op-amps in consumer electronics.

- Technological

- In 2024, OP-amps were still very much in the forefront of the market, owing to the technological developments in the design and manufacture of integrated circuits. The 5nm and 7nm process allowed the manufacture of more efficient and smaller OP-amps with increased performance and reduced power consumption. The estimated investment in R&D for the manufacture of semiconductors exceeded $100 billion, thereby increasing innovation and competition in the OP-amp sector.

- Legal

- In 2024, the regulations affecting the OP-AMP market are those relating to the disposal of electrical waste and the implementation of the environment-friendly policy. The Waste of Electric and Electronic Equipment (WEEE) directive requires that manufacturers take responsibility for the disposal and reuse of their products, including OP-AMPs. These regulations impose costs of approximately a billion francs on the electrical industry, and influence the operational strategies of the market.

- Environmental

- The environment is becoming an increasingly important topic in the OP-amp market, and a growing emphasis is being placed on sustainable production practices. By 2024, approximately one-third of all chip makers will have adopted “green” manufacturing practices, which reduce carbon emissions and waste. The shift is being driven by a combination of government regulations and customer demand for green products, which has led to a greater focus on developing processes that reduce the OP-amp industry’s carbon footprint.

Porter's Five Forces

- Threat of New Entrants

- The barriers to entry into the op-amp market are medium because of the need for significant investment in technology and manufacturing. Moreover, economies of scale and brand recognition provide a barrier to new entrants. The market is, however, expected to grow significantly, driven by technological advances and the growth of new applications.

- Bargaining Power of Suppliers

- Supplier power is relatively low in the OP-AMP market. There are numerous suppliers of raw materials and components. Suppliers of many components are standardized, which limits the power of individual suppliers. This allows manufacturers to negotiate better terms and to maintain a competitive price.

- Bargaining Power of Buyers

- The buyers in the OP-AMP market have high bargaining power, because they have many choices and switching costs are low. The buyers are also becoming more knowledgeable and demanding higher quality and lower prices. Therefore, in order to maintain their market share, manufacturers have to be more responsive to the buyers’ needs.

- Threat of Substitutes

- The threat of substitutes is medium in the op-amp market. Other technology is available that can perform similar functions, such as digital signal processing (DSP) and microcontrollers. But the specific applications and performance characteristics of op amps make them hard to replace in some situations, limiting the threat.

- Competitive Rivalry

- Competition is keen in the op-amp market, where numerous companies compete for market share. Price, quality, innovation, and service are the major differentiators. The rapid pace of technological change and the relentless demand for higher performance intensify the competition.

SWOT Analysis

Strengths

- High demand in consumer electronics and automotive applications.

- Versatile functionality in signal processing and amplification.

- Continuous technological advancements improving performance and efficiency.

- Strong presence of established manufacturers with brand loyalty.

Weaknesses

- High competition leading to price wars and reduced profit margins.

- Dependency on semiconductor supply chains which can be volatile.

- Complexity in design and integration may deter new entrants.

- Limited awareness of advanced OP-AMP features among end-users.

Opportunities

- Growing adoption of IoT devices requiring advanced signal processing.

- Expansion in renewable energy systems and electric vehicles.

- Emerging markets showing increased investment in electronics.

- Potential for innovation in low-power and high-speed OP-AMPs.

Threats

- Rapid technological changes leading to obsolescence of existing products.

- Economic fluctuations affecting consumer spending on electronics.

- Intense competition from alternative technologies and components.

- Regulatory challenges related to environmental standards and materials.

Summary

The op-amp market in 2024 will be characterized by a high demand, driven by the consumer electronics and automotive industries, as well as significant technological development. However, the market will also be characterized by high competition and supply chain dependence. Opportunities will be found in the growth of the Internet of Things and in the field of energy generation. Threats will include the rapid technological development and the economic fluctuations. Strategically, a focus on innovation and market expansion will help to minimize the risks and to exploit the growth potential.

Leave a Comment