Market Share

Introduction: Navigating the Competitive Landscape of Operational Amplifiers

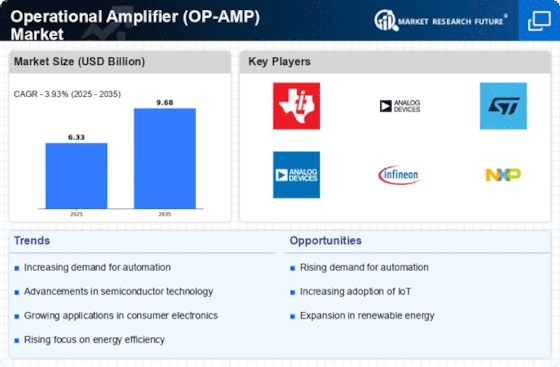

Operational Amplifier (OP-AMP) market is undergoing a transformational change, driven by a rapid change in technology and the rise in consumer expectations. In this market, there are many competitors: the original equipment manufacturer, the IT system integration company, and the special artificial intelligence company. Each of these three parties has its own advantages, and the original equipment manufacturer emphasizes the high performance of the product, and the IT system integration company emphasizes the integration with the Internet of Things (IoT). Artificial intelligence companies emphasize the application of artificial intelligence to the OP-AMP. The market is reshaping itself, and the OP-AMP is becoming more and more powerful. In addition, the green industry pushes the manufacturers to actively develop sustainable solutions, and the competition is getting more and more intense. The OP-AMP market is growing rapidly in Asia-Pacific, driven by the growing demand for consumer electronics and automobiles. The strategic deployment trend is to build a flexible and detachable solution, which can be used in 2024 and 2025.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across various applications, leveraging extensive portfolios to meet diverse customer needs.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Texas Instruments, Inc. (U.S.) | Broad product range and innovation | Analog and digital signal processing | Global |

| Analog Devices, Inc. (U.S.) | High-performance analog technology | Precision signal processing | Global |

| STMicroelectronics (Switzerland) | Diverse semiconductor solutions | Mixed-signal and analog ICs | Europe, Asia, North America |

| NXP Semiconductors N.V. (The Netherlands) | Strong automotive and IoT focus | Embedded processing and connectivity | Global |

Specialized Technology Vendors

These vendors focus on niche applications, providing specialized OP-AMP solutions tailored to specific market needs.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| ON Semiconductor (U.S.) | Expertise in energy-efficient solutions | Power management and signal processing | North America, Asia |

| Maxim Integrated (U.S.) | Integration of analog and digital functions | Mixed-signal solutions | Global |

| Cirrus Logic, Inc. (U.S.) | Audio and voice processing expertise | High-performance audio solutions | Global |

Infrastructure & Equipment Providers

These vendors provide essential components and technologies that support the broader operational amplifier ecosystem.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Renesas Electronics (Japan) | Strong in microcontroller integration | Embedded solutions and analog ICs | Asia, North America |

| Micrel (U.S.) | Focus on high-performance analog solutions | Analog and mixed-signal ICs | North America, Europe |

Emerging Players & Regional Champions

- Analog Devices (USA): high-performance analog, mixed-signal and digital signal-processing (DSP) integrated circuits. They are currently supplying the ADAS (Advanced Driver Assist System) to the major car manufacturers, competing with established suppliers such as Texas Instruments, with superior performance and lower power consumption.

- Maxim Integrated (USA): Focuses on low-power, high-precision OP-AMPs for portable devices. Their recent implementation in wearable health tech devices positions them as a competitor to larger firms, emphasizing energy efficiency and miniaturization.

- Offering a range of operational amplifiers for use in automotive and industrial applications. The company’s recent collaborations with European suppliers have boosted its market presence, enabling it to challenge the established players by focusing on reliability and cost-effectiveness.

- Known for a wide range of operational amplifiers designed for IoT applications. Recent contracts with manufacturers of smart-home devices give them the opportunity to compete with larger companies in the field of integration and interfacing.

- The Japanese manufacturer Rohm Semiconductor produces operational amplifiers for high-speed and low-noise applications. In recent years, the company has worked with leading consumer electronics manufacturers, putting them on a level with established suppliers, and putting performance and compactness first.

Regional Trends: In 2024, the use of operational amplifiers in the IoT and automotive industries is expected to grow, especially in North America and Europe. In order to meet the demand for low-power, high-performance products, companies are increasingly specializing in low-power and high-performance solutions. In addition, cooperation between companies is growing, which allows smaller players to compete against established vendors.

Collaborations & M&A Movements

- Texas Instruments and Analog Devices entered into a partnership to co-develop next-generation low-power OP-AMPs aimed at the IoT market, enhancing their competitive positioning in the growing smart device sector.

- Infineon Technologies acquired Cypress Semiconductor for $10 billion in early 2024, aiming to strengthen its portfolio in high-performance OP-AMPs and expand its market share in automotive applications.

- Maxim Integrated and NXP Semiconductors announced a collaboration to integrate OP-AMP technology into their automotive safety systems, positioning themselves as leaders in the automotive electronics market.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| High Precision | Texas Instruments, Analog Devices | OP-AMPs from Texas Instruments with low offset and drift are suitable for medical applications. Analog Devices has a large number of OP-AMPs with excellent performance, which are widely used in industrial automation and have proven their reliability in demanding applications. |

| Low Power Consumption | Maxim Integrated, Microchip Technology | In the OP-AMP line, Maxim specializes in low-power, battery-powered devices. It has a long history of success with medical equipment. Similarly, the Energy-Saving OP-AMPs from Microchip Technology show a commitment to a low-energy future. |

| High Speed | National Instruments, STMicroelectronics | High-speed operational amplifiers are essential for high-speed data acquisition systems. Using them to their full potential provides increased performance in real-time signal processing. ST has developed operational amplifiers that are used in telecommunications. |

| Integrated Solutions | Infineon Technologies, NXP Semiconductors | Infineon Technologies offers integrated op-amp solutions that combine multiple functions and simplify the development of car systems. NXP Semiconductors has a range of integrated op-amps that are aimed at the Internet of Things, which highlights their versatility in modern electronics. |

| Robustness in Harsh Environments | ON Semiconductor, Renesas Electronics | Op-amps from ON Semiconductor are designed for use in automotive and industrial applications, where they must operate reliably at high temperatures and in harsh conditions. These op-amps meet the strictest automotive standards to ensure the highest levels of reliability. |

Conclusion: Navigating the OP-AMP Market Landscape

In 2024, the market for operational amplifiers is characterised by a high degree of competition and a large degree of fragmentation. Both established and new players are competing for market share. Regionally, Asia-Pacific and North America are expected to grow most strongly, driven by the latest developments in consumer electronics and in the automobile. The market players must strategically position themselves to gain a competitive advantage, by deploying their capabilities in AI, automation, sustainability and flexibility. The established players are focusing on improving their product ranges and operational efficiency, while the newcomers are introducing disruptive innovations with the latest technology. In this changing landscape, the decision-makers must focus on investing in these key capabilities, to ensure that they are able to adapt to the fast-changing environment.

Leave a Comment