Emergence of IoT Applications

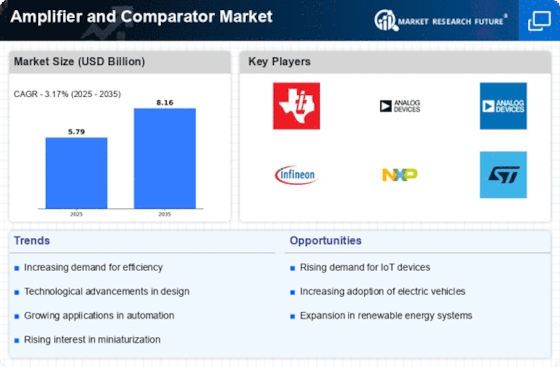

The Amplifier and Comparator Market is being propelled by the emergence of Internet of Things (IoT) applications across various sectors. As industries increasingly adopt IoT solutions, the demand for reliable and efficient amplifiers and comparators rises. These components play a crucial role in sensor data processing and communication between devices. The IoT market is anticipated to reach a valuation of approximately 1.5 trillion dollars by 2025, indicating a substantial opportunity for the Amplifier and Comparator Market. The integration of these technologies into IoT devices enhances their functionality and performance, thereby driving innovation and growth within the industry.

Focus on Renewable Energy Solutions

The Amplifier and Comparator Market is likely to benefit from the growing focus on renewable energy solutions. As countries strive to transition towards sustainable energy sources, the demand for efficient power management systems increases. Amplifiers and comparators are integral to the development of renewable energy technologies, such as solar inverters and wind turbine controllers. The renewable energy sector is projected to attract investments exceeding 2 trillion dollars by 2025, creating a favorable environment for the Amplifier and Comparator Market. This trend suggests that manufacturers will need to innovate and adapt their products to meet the specific requirements of renewable energy applications, thereby fostering growth in the industry.

Advancements in Automotive Technology

The Amplifier and Comparator Market is significantly influenced by advancements in automotive technology, particularly with the rise of electric vehicles (EVs) and autonomous driving systems. As vehicles become increasingly sophisticated, the demand for high-fidelity audio systems and precise signal processing components escalates. The automotive sector is expected to invest approximately 300 billion dollars in electric and autonomous technologies by 2025, creating a substantial market for amplifiers and comparators. These components are essential for enhancing the in-car experience and ensuring the reliability of various electronic systems. Thus, the Amplifier and Comparator Market stands to benefit from the ongoing transformation within the automotive landscape.

Rising Demand for Consumer Electronics

The Amplifier and Comparator Market is experiencing a notable surge in demand driven by the increasing consumption of consumer electronics. As devices such as smartphones, tablets, and smart home appliances proliferate, the need for high-performance amplifiers and comparators becomes paramount. In 2025, the consumer electronics sector is projected to reach a valuation of over 1 trillion dollars, indicating a robust growth trajectory. This trend necessitates the integration of advanced amplifier and comparator technologies to enhance audio quality and signal processing capabilities. Consequently, manufacturers are compelled to innovate and develop products that meet the evolving expectations of consumers, thereby propelling the Amplifier and Comparator Market forward.

Growth of Telecommunications Infrastructure

The Amplifier and Comparator Market is poised for growth due to the expansion of telecommunications infrastructure. With the rollout of 5G networks, there is an increasing requirement for high-performance amplifiers and comparators to support faster data transmission and improved signal integrity. The telecommunications sector is projected to invest over 1 trillion dollars in infrastructure development by 2025, which will likely drive demand for advanced components. These technologies are critical for ensuring efficient communication and connectivity, thereby enhancing the overall performance of telecommunication systems. As a result, the Amplifier and Comparator Market is expected to witness significant growth as it aligns with the evolving needs of the telecommunications sector.