Operational Amplifier Size

Market Size Snapshot

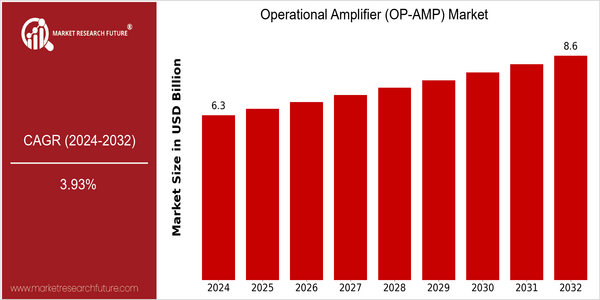

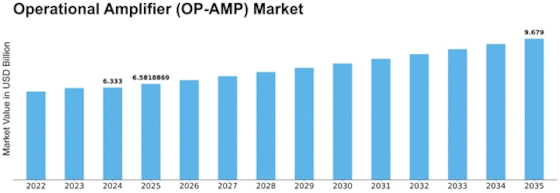

| Year | Value |

|---|---|

| 2024 | USD 6.3327 Billion |

| 2032 | USD 8.619 Billion |

| CAGR (2024-2032) | 3.93 % |

Note – Market size depicts the revenue generated over the financial year

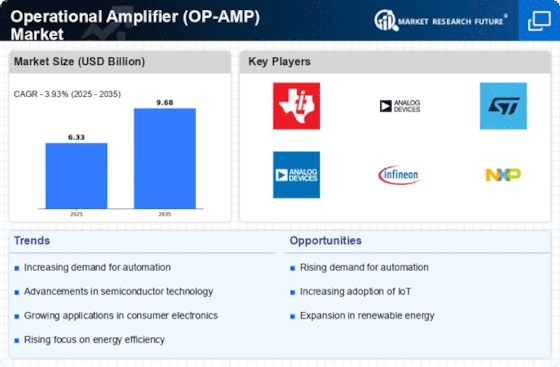

OP-AMPS OP-AMPS OP-AMPS are a type of operational amplifier, and the market for these is estimated to grow steadily from $6.3 billion in 2024 to $8.5 billion by 2032. This represents a CAGR of 3.93%. In general, the demand for OP-AMPS is growing in a number of fields, such as in the field of digital communications, in the field of industrial automation, and in the field of home appliances. In addition, as the level of sophistication of integrated circuits increases, the OP-AMPS are more and more incorporated in the complex equipment. Among the most important factors for this growth are the rapid spread of IoT devices, which require the ability to process signals, and the automation of the process of manufacturing. Moreover, the development of OP-AMPS that are low-power and high-speed is expected to further increase their application. Major players in the OP-AMP market, such as TI, Analog Devices, and STMicroelectronics, are actively involved in strategic initiatives such as forming a partnership and launching a product to strengthen their market position and respond to the changing needs of consumers. These efforts are expected to have a major impact on the future growth of the market.

Regional Market Size

Regional Deep Dive

Operational Amplifier (OP-AMP) Market is growing significantly across the globe, driven by technological advancements and increasing demand for electronic devices. In North America, the market is characterized by the presence of a strong player base and a robust manufacturing landscape. In Europe, innovations in the automotive and industrial applications are driving the market growth. Asia-Pacific is growing rapidly owing to the proliferation of smart devices and consumer electronics. The Middle East and Africa are slowly embracing the technology in the telecommunications and energy sectors. Latin America, though a small market, is showing tremendous growth potential, with industries in the region modernizing and investing in the component industry.

Europe

- Europe is witnessing a surge in the adoption of OP-AMPs in automotive applications, particularly with the rise of electric vehicles, as companies like STMicroelectronics and Infineon Technologies develop specialized components for these markets.

- The European Union's stringent regulations on electronic waste and energy consumption are pushing manufacturers to innovate and create more efficient OP-AMP solutions, fostering a competitive environment for technological advancements.

Asia Pacific

- The Asia-Pacific region is the largest consumer of OP-AMPs, driven by the booming consumer electronics market, with companies like NXP Semiconductors and ON Semiconductor leading the charge in product development.

- Government initiatives in countries like China and India to promote smart manufacturing and the Internet of Things (IoT) are significantly boosting the demand for OP-AMPs, as these technologies require advanced electronic components.

Latin America

- Latin America is gradually embracing OP-AMP technology, with local manufacturers beginning to invest in modernizing their production capabilities to meet the growing demand for electronic components.

- The region's economic recovery post-pandemic is leading to increased investments in technology and infrastructure, which is expected to drive the adoption of OP-AMPs in various sectors.

North America

- The North American OP-AMP market is heavily influenced by the presence of major semiconductor companies such as Texas Instruments and Analog Devices, which are continuously innovating to enhance performance and reduce power consumption.

- Recent regulatory changes aimed at promoting energy efficiency in electronic devices are driving demand for low-power OP-AMPs, aligning with the growing trend of sustainable technology in the region.

Middle East And Africa

- In the Middle East and Africa, the OP-AMP market is being shaped by increasing investments in telecommunications infrastructure, with companies like STMicroelectronics expanding their operations to cater to this demand.

- The region's focus on renewable energy projects is also creating opportunities for OP-AMP applications in energy management systems, as governments seek to diversify their energy sources.

Did You Know?

“Did you know that the first operational amplifier was invented in 1967 and was primarily used in analog computers? Today, OP-AMPs are integral to a wide range of applications, from audio equipment to medical devices.” — IEEE Spectrum

Segmental Market Size

Operational amplifiers (OP-AMPS) play a critical role in the market. They are the basic building blocks of all analog circuits. This market is currently experiencing a steady growth, mainly driven by increased demand from the areas of consumer electronics, automotive, and industrial automation. There are several reasons for this: the increasing demand for signal processing and the miniaturization of the equipment, which requires ever smaller and more efficient OP-AMPS. OP-AMPS are a mature technology, and the leaders, such as TI and Analog Devices, are in the process of developing new products and expanding their markets. These OP-AMPS are used in many applications, including in audio equipment, medical equipment, and sensors, where high accuracy and reliability are required. In addition, the trend towards smart technology and the integration of the Internet of Things, as well as the drive towards energy efficiency, will lead to a further increase in the market. OP-AMPS are evolving with the help of CMOS and BiCMOS technology. These OP-AMPS are becoming more and more powerful and their applications in next-generation equipment are expanding.

Future Outlook

Operational Amplifiers (OP-AMP) Market will be growing steadily from 2024 to 2032. The market is expected to rise from about $6.33 billion to $8.62 billion, at a compound annual growth rate (CAGR) of 3.93%. This is mainly due to the growing demand for OP-AMPs in various applications, such as consumer electronics, automotive systems and industrial automation. By 2032, the penetration rate of OP-AMPs into the Internet of Things (IoT) and smart sensors will exceed 60%. The miniaturization of electronic components and the complexity of the circuits will lead to a further increase in the demand for high-performance OP-AMPs. The trend towards energy efficiency and the growing importance of sustainable development in the electronics industry will also lead to innovation in OP-AMP design, resulting in the development of low-power and high-precision OP-AMPs. Artificial intelligence and machine learning are emerging trends that will also drive the OP-AMP market, as these applications require high-precision signal processing. The OP-AMP market will evolve significantly as a result of technological development and the diversification of applications. It will become a critical component in the future of the system.

Leave a Comment